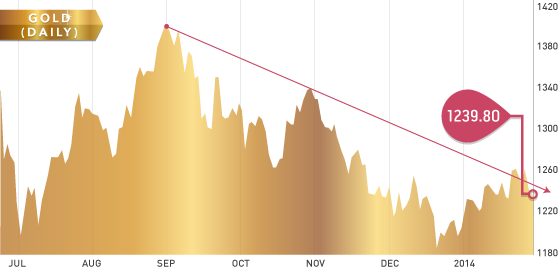

The precious metals recovered on Thursday and Friday from three initial weak days to close in positive territory for the week; silver led the charge finishing up over 1%. The 200-day moving average has worked well as a “catch play” near the $1,305-$1,310 level, while silver has spent several days consolidating in an upper flag patter near $22. Next week, $1,310/$1,290 and $20.50/$21.25 are support points for gold and silver, respectively. Gold ...

FEB