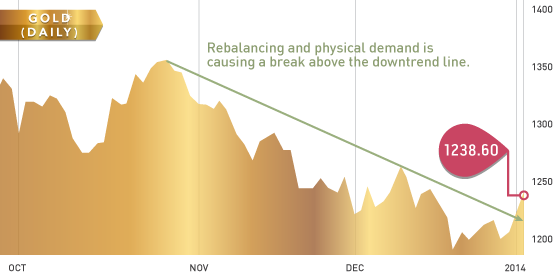

The precious metals began 2014 in the right direction up near highs of the week. Gold suffered its worst year since 1981, but demand for physical gold has noticeably increased recently. Physical gold premiums for immediate delivery in China were $20 an ounce this week while the average in late 2013 was $15 per ounce. Other developing nations such as Turkey had imports increase by as much as 64% in December.

Gold support levels: $1220, $1200, $1180

Gold resistance levels: $1240, $1250, $1275

Gold Chart

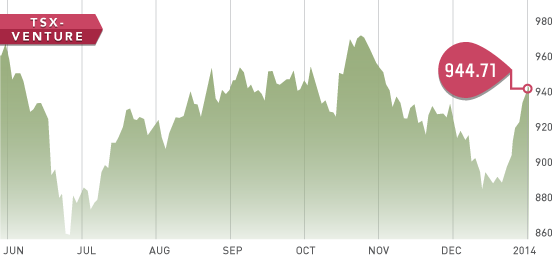

This week we finally saw some solid rotation out of the large cap names and into riskier assets such as the junior miners. Fund managers needed to cash in and take their profits after a record year in the DOW while tax loss selling had pushed virtually all the miners into drastically oversold conditions. It was a furious start to the year and while this is a good start, investors must remember one cannot just blindly throw darts at the dartboard.

TSX-V Chart

Price: $4.01

Market Cap: $1,012,561,000

Shares Outstanding: 247,569,811

The first Stock of the Week in 2014 belongs to AuRico Gold. Aurico has two gold mines in operation: Young Davidson in Canada and El Chante in Mexico. AuRico offers, in our opinion, good leverage to the gold price and pays a dividend while you wait. AuRico issued a press release this week stating a $0.04 dividend will be paid on January 29th. The all-in cash cost is around the $1,200 level at the moment for AuRico.

The company is in strong financial shape with $140 million in cash and a $150 million undrawn debt facility. The plan is to pay 20% of operating cash flow as a dividend so investors will receive exposure to the gold price. Sustaining CAPEX costs at the mines are declining significantly in the next two years, which will see higher operating and free cash flow.

JAN