Gold

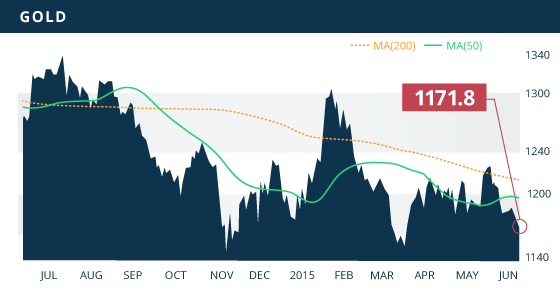

Last week, gold dropped $18.70 on the week as stronger labour market data out of the U.S. pushed the dollar higher and put further pressure on the already compromised gold price. The strong NFP numbers on Friday was the final push that had the metal dropping below support at the $1,175 level and out of the 2-month consolidation zone. The metal has shed $60 in the past three weeks, largely as a result of improved U.S. economic data; most recently the strong NFP numbers released on Friday. Gold is now down 5% since the highs reached in mid-May, as the improving U.S. data now has the market expecting a rate-hike by the Fed by September. This sentiment will continue to suppress the gold price.

With the selling pressure breaking through support at the $1,175 area, the next level of support is at the $1,162 area which is Friday’s low reinforced by a descending support line from the late-March low. If this area is breached, look for further support at the $1,150 level, which is reinforced by an ascending support line from the November low. Weak resistance is at the $1,197 area which marks the 50% retracement of the move from the mid-May high to Friday’s low. Solid resistance comes in at the $1,205 area which marks the 61.8% retracement of the same move, reinforced by the 100 and 200 day MA.

The metal closed last weeks session at $1,171.80, down 1.57% on the week. The HUI/Gold ratio hit a 5-month low as the Gold miners were sold off and hit a near 6-month low in the process.

Technicals:

- Support: $1,162.65

- Resistance: $1,197.50

- 50 day moving average: $1,196.66

- 200 day moving average: $1,212.38

- HUI/Gold Ratio: 0.136 (Last week 0.140)

Silver

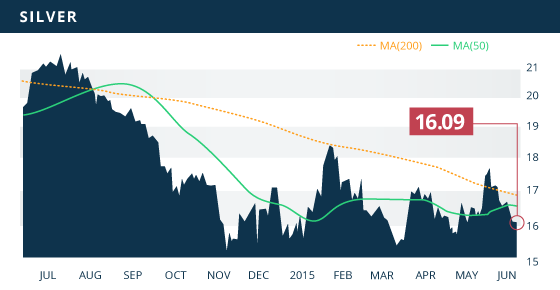

Silver also crippled under pressure this week and broke through support levels in the process. The metal closed the session at $16.09, down 3.71% on the week. Silver is now down close to 10% since the highs reached in mid-May. Near-term support is at the $15.90 area which is a level where the metal found support in early-May, and is further supported by an ascending trend line from the mid-March low. A break below this trend line would have the metal looking towards solid support, which will be found at the $15.05 area, although there are minor levels of support that may hold up on its way down. Near-term resistance is at the $16.64 level with solid resistance at the $16.85 level. Like gold, silver will need a turn of events in order to pull out of this 3-week collapse, as the strong U.S. data is currently weighing heavily on the precious metals. Until there is a change in sentiment regarding the strong U.S. dollar and imminent rate-hike by the Fed, the metals will continue to be subdued.

Technicals:

- Support: $15.90

- Resistance: $16.85

- 50 day moving average: $16.57

- 200 day moving average: $16.89

- Gold/Silver Ratio: 72.83

- XAU/Gold Ratio: 0.0578 (Last Week: 0.0585)

Platinum

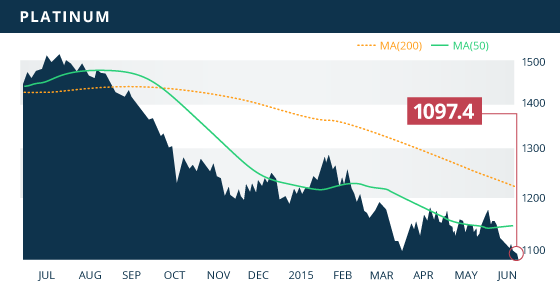

Platinum continued its descent this week and tested the mid-March low of $1,086 on Friday. The level held up to the test and the metal bounced off the mark to close the week at $1097.40, down 1.28% on the week and 6.8% since the mid-May high. Support continues to be at the multi-year low of $1,086, although if this level is broken a test of the $1,000 level should not be ruled out. Resistance is at the $1,122 level which marks the high of last week as well as a retracement mark of the move from the mid-May high to the low on Friday.

Technicals:

- Support: $1,086.50

- Resistance: $1,121.80

- 50 day moving average: $1,143.37

- 200 day moving average: $1,219.91

The TSX and the TSX-VENTURE were both down 0.38% on the week. The VENTURE hit a 2-month low during intraday trading on Friday, although the index managed to surge to end the day and pare some of the losses. However it still shed 2.6 points on the week to close at 689.85, thanks in large part to the slumping miners. The mining sector was down another 2% on the week with gold miners the hardest hit this week, dropping 3.62%. The base metal sector showed a modest loss of 0.22% as the copper price continues to fall. Copper hit a 6-week low of $2.70 a pound, and broke through a 4-month trend line to the downside. The energy sector shed another 1.57% as WTI crude was down on the week as it continues to consolidate along the $60 level.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Tuesday June 9

- CPI YoY (CHN) – Consensus: 1.3%

Thursday June 11

- Industrial Production YoY (CHN) – Consensus: 6.0%

- Core Retail Sales MoM (US) – Consensus: 0.7%

- Initial Jobless Claims (US) – Consensus: 277K

Friday June 12

- PPI MoM (US) – Consensus: 0.4%

- Consumer Sentiment (US) – Consensus: 91.5

- Consumer Expectations (US) – Consensus: 85.0

This is a very quiet week for economic data, with only a few items of significance out Thursday and Friday. The key items will be the retail sales and the PPI, as the market looks for improvements in the consumer and inflation data respectively. Both are areas that have been sluggish as the Fed looks for improving data to warrant the anticipated rate hike.

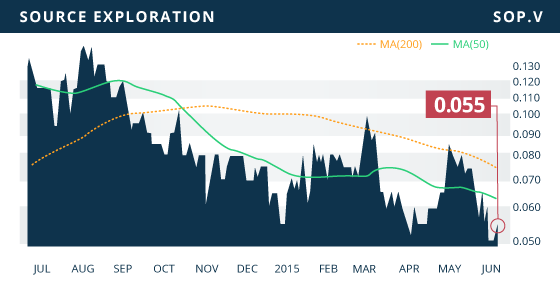

Our Tickerscores analyst was at the Canvest Conference in Vancouver last week to speak with a handful of junior exploration companies exhibiting. The conference traffic was notably down, and the number of mining companies exhibiting had dropped significantly from last year. However, there were still a couple of good stories at the conference, including Rockhaven Resources (RK.V), a company previously covered by Tickerscores. On the second day of the conference, Rockhaven announced that a 15,000 meter drill program had commenced at their Klaza Project, which will be accompanied by engineering and permitting studies. Another good story was Source Exploration (SOP.V), which we have chosen to cover as “stock of the week” below.

- Symbol: SOP.V

- Price: $0.05

- Shares Outstanding: 86,858,401

- Market Cap: $4.5 Million

- Cash: $778,309 (As of March 31st)

- Significant Shareholders: Management and Directors (6%), U.S. Global Investors (6%), Sterling Mining (4.4%)

Source Exploration (TSX.V:SOP) is a Canadian-based junior exploration company advancing their Las Minas Project located in the Veracruz state of eastern Mexico. The 1,616 hectare property is part of a mineral district that has seen significant historical mining, although the Las Minas area itself is largely underexplored. Source holds 5 concessions that make up the Las Minas Project, as well as a separate 6th concession to the south of the project which was acquired through staking. The company has the option to acquire a 100% interest in the other 5 concessions by making cash payments to the vendors. Source has an upcoming final payment of $1.3 million due in December for 100% ownership of the main three concessions. The company will need to come up with those funds in order to secure this project, or possibly extend the purchase option to another date. This is a situation that will need to be monitored by investors, as until Source obtains 100% of the project, there remains a risk. The project is road accessible, and is located close to a hydroelectric plant with water readily available to the property.

Source began drilling the property in 2011 and has defined a near-surface gold-silver-copper skarn mineralized system. The company has been drawing comparisons to the Los Filos and Morelos skarn deposits located in the Guerrero gold belt of Mexico, owned by Torrex Gold (TXG.TO) and Goldcorp (G.TO) respectively. If Las Minas is in fact similar to those two deposits, then Source will be an exciting story to watch unfold. However, with the continuous aid of the drill rig, only time will tell.

The Las Minas deposit is composed of 3 zones; El Dorado-Juan Bran, Santa Cruz, and the newly discovered Nopaltepec zone. El Dorado-Juan Bran is the main mineralized zone, which is a near surface flat lying mineralized body that dips to the south. The Santa Cruz zone and the Nopaltepec zone appear to be a separate higher-grade mineralizing system that overlies the El Dorado-Juan Bran zone. Approximately 16,500 meters has been drilled by the company to date, which has defined a mineralized body 420 meters in width and 840 meters on strike. Highlights of the drilling include hole LM-14-SC-08 which was drilled in the Santa Cruz zone and intercepted 99 meters of 1.64 g/t gold, 7.63 g/t silver, and 1.05% copper. Hole LM-11-SC-45 also drilled in the Santa Cruz zone returned 10 meters grading 8.33 g/t Au, 7.4 g/t Ag, and 1.29% Cu.

The company recently completed a 2,000 meter drill program, which was aimed to better define the zones for a maiden resource calculation expected in Q4. The recent drilling program also resulted in a new discovery of the Nopaltepec zone. This zone lies 100-150 meters above the downward projection of the El Dorado-Juan Bran zone and is situated roughly 300 meters to the southwest of the Santa Cruz zone. Hole LM-15-NP-01 at Nopaltepec intersected multiple mineralized intercepts awhile ending in mineralization at a depth of 203 meters. The company believes Nopaltepec is part of the same mineralizing system as the high-grade Santa Cruz zone. If these mineralized zones are connected, it would greatly aid in supporting the upcoming resource estimate, and help add additional ounces.

At this point the property clearly hosts encouraging high-grade mineralization. The market will want to see positive metallurgical recoveries displayed from the pending results of the metallurgical study. Also, due to the orientation of the deposit, and the steep topography overlying it, it is unlikely that there is any possibility of any significant surface mining, despite the deposit being near-surface. However, one exception may be the Santa Cruz zone. Therefore underground mining would be the most logical method used on this deposit, which is much more costly than surface mining, and therefore requires high-grade mineralization in order to become feasible. In addition, the flat lying nature of the mineralization would require a more expensive underground mining method such as room and pillar. Room and pillar can also have a higher degree of loss due to a percentage of the mineralized pillars remaining in place after mining. Therefore, Source will need to define a optimal deposit of size, high-grade, with high metallurgical recoveries. These are three areas to monitor closely going forward. For each of the three areas that Source is able to check off, it will make Las Minas that much more valuable and attractive.

Bottom line

With the impressive drill results encountered so far from the Las Minas Project, the upcoming maiden resource estimate could provide a boost to the share price. As mentioned above, there are a few areas that should be monitored going forward. One is will the company raise the funds necessary for the final $1.3 million option payment in December, or potentially extend the purchase option agreement like they have with their other two concessions. The second area is the metallurgical studies. From what was gathered while speaking with the company, there is no indication that the mineralization is refractory or that metallurgical recoveries will be difficult. The current metallurgical studies underway will help confirm this or not, and if positive, help de-risk the deposit somewhat. Lastly, as the company continues to advance the project, the proposed mining method will be an important factor influencing the economics of the deposit. However, at this early stage of development with the impressive drill results, and with a market cap under $5 million, we think this promising story is worth looking at.

Potential Catalysts and Events to Monitor:

- Metallurgical Studies (mid-2015)

- Maiden Resource Estimate (Q4 2015)

- $1.3M Final Purchase Option Payment (December 2015)

JUN