Precious metals remained range bound this week with few disturbances from economic headlines. Platinum led the precious metals higher finishing the week up 1.3%; gold was the weakest performer yet finished slightly positive up 0.4%. Year to date performance has been on par with our January Market Intelligence – the combination precious and industrial metals (platinum, palladium, silver), as we like to call them, have been the outperformers and we expect to see this continue.

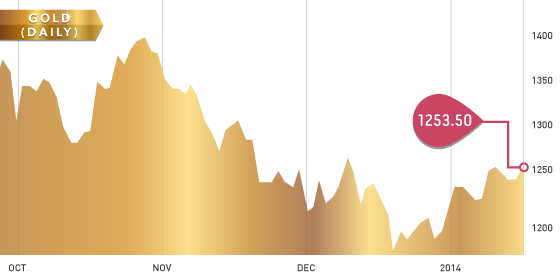

On the technical side, gold is consolidating in the top part of an ascending triangle, which as far as chart patterns go, yields the highest percentage chance for a continuation move. The December 2013 high of $1267 is the level to watch.

Silver continues to be range bound from mid-November. The $19.00 – $19.50 zone continues to act as support and $20.50 as resistance.

Platinum and palladium continue to act strong on a relative basis. $760 is resistance for palladium while $1475-$1500 is resistance for platinum.

Gold Chart 2013

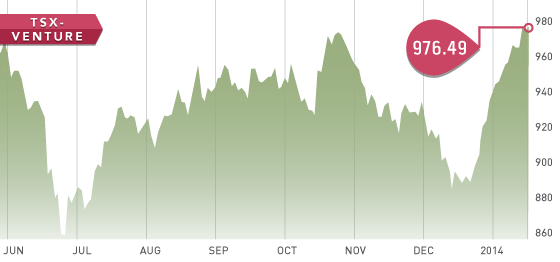

For three weeks in a row now we have seen a strong inverse relationship between the large cap American indexes and the junior markets. The TSX-V 975 level has been resistance since April, yet this week the market paid little heed to it as juniors continue to bounce from oversold conditions.

Our analyst picks for 2014 are off to an excellent start with James’ portfolio averaging 21.5% (RMX.T, TMM.T, USA.T, RGL.T, BTO.T) and Rob’s averaging 17.5% (THO.T, RIO.T, EXN.T, ORG.V, BYV.V).

The major M&A news of the week was Goldcorp’s bid for Osisko; however, Osisko quickly called the bid “opportunistic” and said come back with a real offer. The Malartic project generates approximately 120,000 ounces per quarter for Osisko, so we agree when the Osisko management team says, “we appreciate the offer, but come back with a real one.”

Headline of the Week

This week’s Headline of the Week is also on the M&A front and comes from Allied Nevada and China Gold Stone. Apparently, China Gold Stone commenced a tender offer for ANV that was quickly shutdown as no one could find any credibility that this Chinese company could put together $10 let alone the hundreds millions required for this takeover. If nothing else it woke the stock up, which we featured as our Stock of the Week back in December. So, lucky you if you bought it back then – take the money, and run!

A Look Ahead

Next week will be a quiet week on the North American economic front, but Wednesday brings the Bank of Japan interest rate decision and monetary policy statement. The Japanese have been aggressive on the monetary and fiscal easing fronts, which ends up devaluing the Yen relative to its peers. A big downside move in the Yen would come from additional easing measures and would likely spark a rally in the USD, which has a strong tendency to move gold lower.

TSX-V Chart 2013

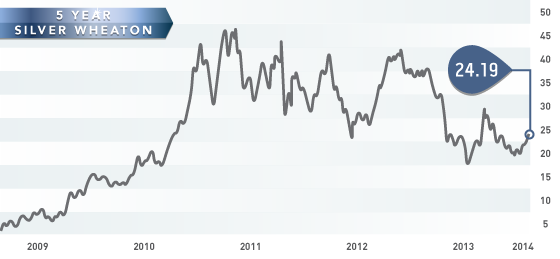

Symbol: SLW.T

Symbol: SLW.T

Price: $24.49

Market Cap: 8,523,913,000

Shares Outstanding: 357,396,778

This week we take a look at Silver Wheaton – the world’s top silver streaming company. We believe that the silver price is at a point where the upside potential outweighs the downside risk. If silver moves upwards, Silver Wheaton will be a go to stock for investors.

The best part about Silver Wheaton is the growth expected in the next three to five years. Estimated production in 2013 is ~33.5 million ounces and is projected to grow to ~42.5 million ounces by 2017. The asset base is well diversified with 19 producing mines worldwide. Management has done a tremendous job acquiring streams, as 88% of deals involve mines that produce in the lowest cost quartile. A dividend is paid quarterly linked to 20% of operating cash flows.

JAN