IMPORTANT DATES:

February 6: European Central Bank (ECB) Interest Rate and policy statement

February 7: US employment data: nonfarm payrolls, unemployment rate, US debt ceiling deadline

February 13: European Central Bank Monthly Report, US retail sales

February 14: Chinese CPI, European Q4 GDP

February 18: Bank of Japan Interest Rate and policy statement

February 20: US CPI, US FOMC minutes

February 28: European CPI

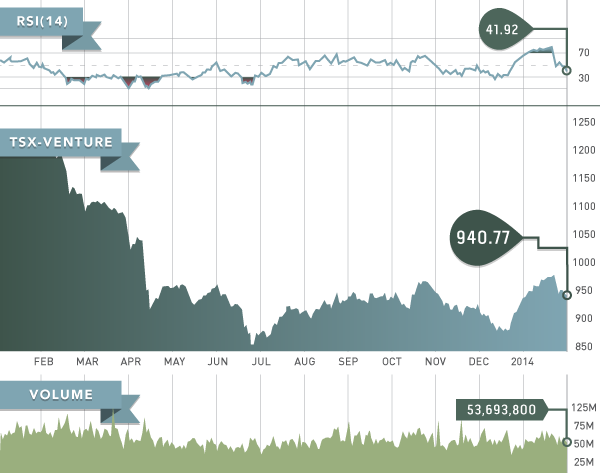

The TSX-V had a great start to the year, putting in 13 positive days out of the first 16 and closed the month at 951 up from 931, which was the December close. The oversold bounce had already gotten started by January as investors flocked to many of the oversold juniors that had been hit hard by tax loss selling. Reality set in however in late January and the market pulled back from the 975-980 levels that we have highlighted several times as key resistance levels.

There are many companies that are doing financings for minimal amounts ($50,000-$250,000); we remain extremely skeptical on these as it is very difficult to create shareholder value with these small raises. It is likely this type of financing goes entirely to general and administrative expenses, which do very little for investors.

Investors will begin to turn to audited annual financials; earnings will start to trickle in starting in the second week of February all the way through until the end of April and May. Investors should pay close attention to the guidance and all-in costs for producers and the cash positions of explorers and developers to get a feel for how to proceed.

We have recently started to see potential signs of the M&A market coming back, which is good news. Not only are investors seeing high quality names at ultra-cheap valuations, but also the mid-tiers and majors. The attempted Osisko takeover by Goldcorp is an excellent sign that things may be slowly improving. The financing climate is still very tough, but those companies that have significant cash hordes can put money to work picking up projects for pennies on the dollar.

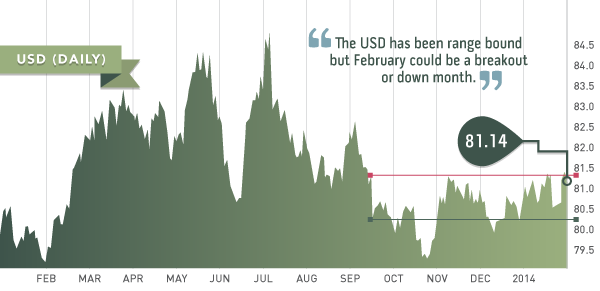

The U.S. dollar has remained range bound since breaking through the 81 on the U.S. dollar index back in September 2013. Within that time period there has been considerable whipsaw from both domestic and global headlines. February will be an interesting month for the U.S. dollar with several important items on the calendar: the ECB monetary policy statement and interest rate decision, U.S. debt ceiling followed by the Bank of Japan interest rate and monetary policy decision.

Investors should take note of these dates because of the significant impact the U.S. dollar has in relation to precious metals. A strengthening of the U.S. dollar can occur because of weakness in other currencies and economies, not just because of the strength of the United States. A move in the U.S. dollar index above 81.50 can potentially lead to a very quick move up to 82.50-83.

We saw some very volatile moves in the U.S. dollar in the days leading up to the debt ceiling deadline as many investors sold their U.S. dollars in fear, only to rush back into the U.S. dollar once the deadline had been moved. If we see significant volatility and fear creep into the U.S. dollar this time around from similar worries, it definitely has the ability to act as a catalyst and push gold significantly in either direction.

The Prospect Generator (PG) model is one way to reduce risk when investing in junior mining companies. A PG company is focused on very early stage property exploration: staking, sampling and induced polarization.

A prospect generator options off projects to joint venture partners and keeps an ownership percentage.

The model reduces risk, as the partner usually finances the exploration costs. It is said that one in every couple thousand anomalies becomes a mine. Prospect generators increase the odds of making a discovery because they usually have several projects being worked on simultaneously.

With JV partners funding the cost, shareholders benefit from not having new shares issued for financings.

ADVANTAGES

- Larger portfolio of assets

- Financing to pursue multiple exploration projects

- Less shareholder dilution

- Less financial risk, as exploration is limited to sampling, mapping, induced polarization etc. less capital intensive

- Rick Rule calls it “the more balls in the hopper approach”

DISADVANTAGES

- If you can’t find a JV partner, it becomes more expensive and difficult to explore.

- Investors potentially give up a large percentage of the project’s value upon signing a joint-venture agreement

EXAMPLE:

PG stakes a claim and commences initial exploration work

- Initial sampling / IP looks promising and the project is offered up as a joint-venture

- Joint-venture partner obtains 51%-80% of the claim via an earn in agreement and becomes the operator

- As the operator they are responsible for funding the majority of the exploration work

PROSPECT GENERATORS:

Millrock Resources

Virginia Mines

Riverside Resources

Eurasian Minerals

Almaden Minerals

Avrupa Minerals

Globex Mining

Aurion Resources

Evrim Resources

Midland Exploration

Miranda Gold Corp

Altius Minerals

Lara Exploration

Tarsis Resources

Transition Metals

FEB