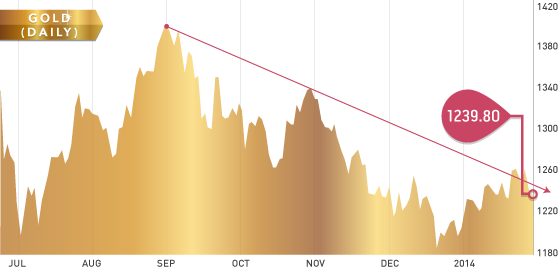

Precious metals were hit this week from all sides as U.S. dollar strength combined with another round of tapering to force short-term investors to hit the sell key. After opening the week near the highs, the metals managed a bounce on Wednesday only to be hit hard Thursday. The oversold bounce at $1,240 was also met with forceful selling at $1,250-$1,255.

Gold Chart 2014

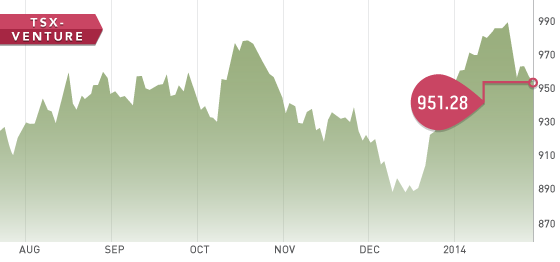

It was a nasty week for the markets and there wasn’t really a good place to hide as selling came from all directions. The U.S. Fed continued to ease their asset purchases by $10 billion, which should not come as a big surprise. The DOW looked to put in an ugly day on Friday opening down close to -200, but regained close a third of that and looks to be trying to hold the 15,500 level; likewise the S&P 500 looks to be trying to hold above 1,750. The TSX-V briefly rose above 975, but was hammered back down below 950 this week. Earnings season will be a big test for many of the Venture companies.

TSX-V Chart 2014

Veris Gold (VG.T): “Veris gets notice of default, plans refinancing” Oh boy, the participants in the $6.2 million financing in December have to be pretty fired up about this news release. Two months in and they are already down 50%+ on their investment. After producing 42,000 ounces in the previous quarter, Veris has defaulted on their monthly gold purchase agreement with Deutsche Bank.

A Look Ahead

With the first month of the new year out of the way, the relief rally looks like it has checked up for the time being. We saw large, across the board moves in virtually all precious metals stocks over the past several weeks, many undeservedly so. Investors should now move to focus on investing in catalyst driven stocks. The beginning of February means it is nearly time for earnings season with many of the majors releasing their numbers and guidance for 2014 over the next several weeks.

Inside the Database

The average cash position for exploration companies was around $625,000 (adjusted for outliers). We are also seeing a lot of companies with negative working capital. The difference between cash and working capital is that working capital includes receivables, prepaid expenses, and other short-term assets. Both are important, but one must remember that you cannot pay new bills with receivables or other prepaid expenses: Cash is King. The average general and administrative expense ratio was around 65%; this represents that on average $65 out of every $100 is going to management, not to exploration.

Analyst portfolio performance: All 10 Picks: +20% YTD; Top 5 Picks: +32% YTD

Symbol: CFB.T

Symbol: CFB.T

Share Price: $0.31

Shares O/S: 16,751,875

Market Cap: $5,361,000

Chieftain Metals is an advanced stage development company in northwest British Columbia. We watched Chieftain present at the Vancouver Resource Investment Conference as part of the panel on British Columbia’s Emerging Projects. At the current share price we think Chieftain stock is undervalued and the reward potential greatly outweighs the risk.

The main focus for Chieftain is the Tulsequah Chief project, which covers two previously operated underground mines by Teck Resources in the 1950’s. The Tulsequah Chief project is a VMS deposit that hosts five different metals at good grades: zinc (5.59%), copper (1.12%), lead (1.04%), silver (81.3 g/t), and gold (2.3g/t). A feasibility study was issued on January 28, 2013 with project economics including a 16.5% IRR and NPV (8%) of $200 million.

Major shareholders include West Face Capital, a Toronto based investment fund led by CEO Greg Boland. The fund is well known for its activist approach and manages over $2 billion in assets. Insiders also have skin in the game with CEO Victor Wyprysky owning 631,076 shares and James Ross buying 150,000 shares in the open market last week (January 21, 2014).

Chieftain Metals 1 Year Chart

As you can see from the chart, Chieftain stock has been going downhill from $2.85 all the way down to a low of $0.105. With only 16 million shares outstanding the sell-off has been on low volume and it appears Chieftain has started to move back up.

Advantages:

- Low float – only 16 million shares outstanding giving Chieftain a market cap of $5,361,000

- Analysts forecast a rise in zinc prices in the next couple years, which would be perfect timing for Chieftain with the mine opening

- A VMS deposit with exposure to five different metals, which are high-grade

- Royal Gold has done due diligence and acquired a $50 million dollar stream of which $10 million has been advanced. The other $40 million will be advanced as construction milestones are hit.

- Strong shareholder base including West Face Capital (24.9%) and Procon Holdings (17%)

- Strong exploration potential with the possibility of new VMS district with a 43km long strike length

Issues:

- An estimated $495 million CAPEX presents an extreme challenge for a company with a market cap of $5,361,000

- The PEA used slightly higher metals prices

- The Taku River Tlingut have filed a suit in Supreme Court to challenge the mines environmental permit

- There have been unsuccessful attempts to put the mine back into production in the past

For more info on Chieftain Metals:

Cheiftain Metal’s presentation can be found here

Video interview with CEO Victor Wyprysky can be viewed here

JAN