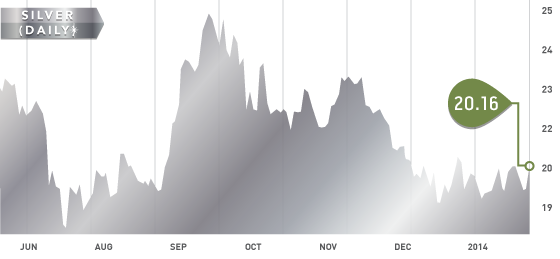

The precious metals markets pushed higher on Friday thanks to lacklustre U.S. non-farm payrolls. Overall, the metals are positive for the year, but remain range bound in the grand scheme of things. A close above $1,250 in gold and $20.50 in silver would break the shorter-term downtrend and could definitely trigger a new wave of short term buying.

Silver Support Points: $19.90, $19.65, $19.40

Silver Resistance Points: $20.40, $20.50, $20.75

Silver Chart

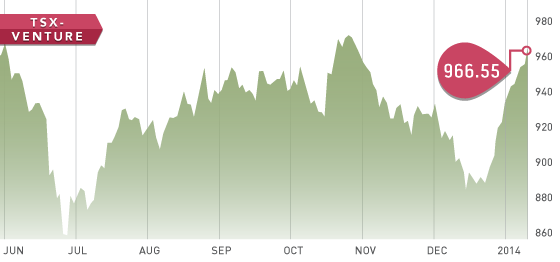

After two consecutive weeks of gains for the TSX-V, it seems like a round of high-fives would be appropriate. The last time there were twelve consecutive positive days in the Venture was February 2007. This low volume melt up will likely meet resistance at 975, which has been a tough hurdle to get over. Sell-side pressure is still quite evident in the U.S. markets as fund managers lock in profits and we expect this to continue throughout the first month of the year.

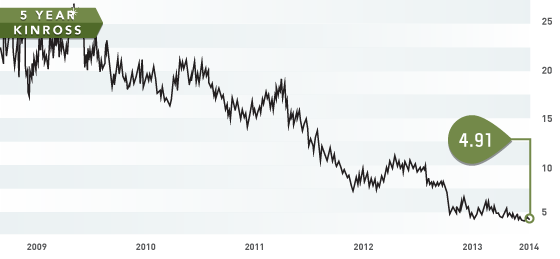

Symbol: K

Symbol: K

Share price: $4.91

Market Cap: 5,488,455,000

Shares Outstanding: 1,143,428,055

Today we take a step up the food chain and look at Kinross Gold. Kinross is one of the world’s top gold producers producing ~2.6 million ounces a year. The third quarter for Kinross was excellent with net earnings of $54.4 million ($0.05 per share). Kinross is headed in the right direction on all aspects of operation. CEO Paul Rollinson had this to say on Q3 results, “As we have all year, we remain focused on strong, consistent operational performance, reducing costs, capital discipline and ensuring balance sheet strength.” 2013 all-in sustaining cash cost guidance is $1100-$1200 per ounce.

JAN