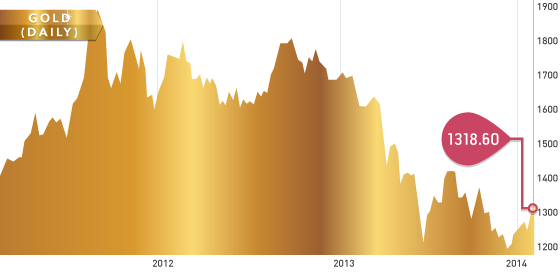

All precious metals were in the green this week and moved significantly higher. Gold ended the week at $1,318.60, up 4.4%. Friday was the highest close for gold since October 31, 2013. As we noted last week, a move above $1,280 would be the key to seeing gold move to the next level. The first catalyst for the gold price this week was when the China Gold Association released estimates for China’s gold consumption in 2013 at 1,176 tonnes, which was a surge of 41% over 2012 levels. China has overtaken India as the 800 lb. gorilla in the gold market and the strong demand is expected to continue. This is a very strong sign that a bottom has been put in the gold market and 2014 should see higher prices. Once gold was above $1,280 technical buying, a weak U.S. dollar, soft economic data, and short covering helped gold move through the 200-day moving average at $1,315.

Silver followed the move in gold as it usually does and ended the week at $21.42, up 7.5%. Silver also closed above the 200-day moving average of $21.24 and we would look for this momentum to continue next week.

Gold Chart

The TSX-V opened the week at 962.10 and posted five consecutive green days to close at 996. Tuesday was an interesting day on the Venture with 131,759,612 in volume, which was double Monday’s volume and the highest in quite some time. The TSX-V is a commodity driven exchange and, with a strong move in commodities this week, a positive Venture is no surprise. fund flows and exhibits relative weakness.

TSX-V Chart

Headline of the Week

Headline of the week belongs to Jet Gold (JAU.V). On February 12, 2014 Jet announced they closed a private placement of 15 million shares at $0.05 per share for proceeds of $750,000. We’re not sure what investors see here as Jet just completed a 1:10 rollback and has not released any plans that will create shareholder value.

A Look Ahead

Of note to investors and traders is U.S. and Canadian markets are closed on Monday Feb 17th (President’s Day and Family Day, respectively). On tap for next week are several economic reports and they will be a catalyst for the gold market one way or another. If economic data is weaker than expected the Fed is less likely to reduce the tapering program, which would be positive for the gold price.

Inside the Database

We continued to work on the ‘Great White North’ section of the database, which includes Alaska and the northern provinces of Canada (Yukon, Nunavut, and North West Territories).

Some of the companies that look interesting include Atac (ATC.V), Kaminak (KAM.V), Sabina (SBB.T), and Victoria Gold (VTT.V). Some of these names have already had significant moves off the December lows on fairly low volume; that is interesting to note as it shows this is a stock picker’s market and high quality names will do well.

Analyst portfolio performance: The analyst portfolio continues to do well. The average gain among our ten stocks in February is 17%. The race in the February challenge between James and Rob is close as they are within 1.5% of each other at the halfway point. Each of the ten stocks is positive in February and year to date.

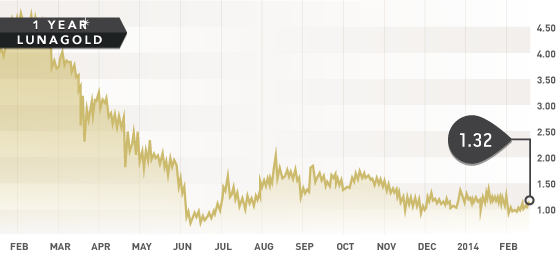

Symbol: LGC.T

Symbol: LGC.T

Share price: $1.32

Shares O/S: 105,028,566

Market Cap: $133,386,000

This week we take a look at junior gold producer Luna Gold. Luna owns and operates the Aurizona gold mine in Brazil. The mine produced 79,200 ounces in 2013 with production expected to increase to ~95,000 ounces in 2014. The goal is to eventually reach annual production at ~135,000 ounce per year, which represents excellent growth potential moving forward. All-in sustaining costs in 2014 are expected to be under $1,000 per ounce, which would be in the top quartile of the gold industry.

Luna is in the process of closing a $20 million dollar bought deal at $1.18, which is expected to close on February 25, 2014. The money raised will be used to complete the Phase 1 expansion at the mine, which was 42% complete at the end of January. An updated reserve and resource estimate as well as a PFS for expansion are catalysts expected in the third quarter of this year. Luna has $36 million in long-term debt, but we do not see this as much of a problem as cash flow generation should be strong. All in all Luna is a small, growing gold producer that is moving in the right direction to create shareholder value over the next few years.

Luna Gold 1 Year Chart

FEB