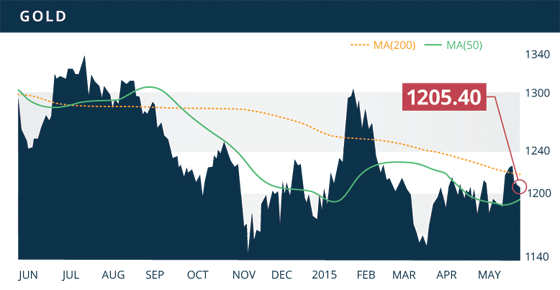

Gold

Gold shed $17.60 last week to close at $1,205.40, down 1.4%. The week started off on a positive note with the metal pushing above $1,230 during intraday trading on Monday. However the metal plunged $20 the following day after strong housing numbers were released out of the U.S. on Tuesday morning. The solid housing numbers set the tone for the week, and had the U.S. dollar bouncing off of a 4-month low to rally 3.1% on the week. The U.S. dollar strength naturally applied significant downward pressure to the gold price and held the price in check for the rest of the week. Near-term support was broken last week, although buyers showed up at the $1,200 level to support the price. Solid support is at the $1,175 area, which has proven to be a stable area of support over the past 2 months. Near-term resistance is at $1,214.78, which coincides with last Friday’s high as well as the 200 day MA. A move back above the trend line will have the metal eyeing solid resistance around the $1232 area. The sensitive economic data due out on Tuesday and Friday may lead to high volatility for the U.S. dollar, and therefore the gold price as well.

Technicals:

- Support: $1,176.71

- Resistance: $1,232.30

- 50 day moving average: $1,194.35

- 200 day moving average: $1,217.89

- HUI/Gold Ratio: 0.142 (Last week 0.148)

Silver

Silver was also under pressure last week, falling $0.42 to close the week at $17.10, down 2.4%. The metal spent the entire week above the descending 200 day MA, which is a good sign. It is worth noting that silver has not traded above the 200 day MA since July of last year, and has spent little time above the trend line since the metals collapse in 2011 from the $40 level. This week we will look for continued support along the 200 day trend line, which currently sits around the $17 area. The $16.85 support level held up to the penny last week when buyers stepped in when the metal plunged $1.10 to an intraday low of $16.85 on Tuesday. We should see the metal retest the $16.85 level once again if the price breaks back below the $17 level. Resistance is now at last weeks high of $17.75, which also coincides with a 21-month descending trend line. A break above this area should have the metal looking to test the highs around $18.50 reached in late January.

Technicals:

- Support: $16.85

- Resistance: $17.75

- 50 day moving average: $16.52

- 200 day moving average: $17.04

- Gold/Silver Ratio: 70.49

- XAU/Gold Ratio: 0.0591 (Last Week: 0.0614)

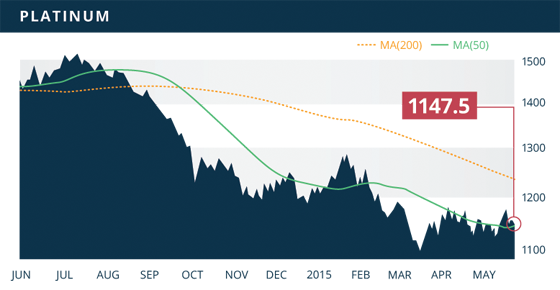

Platinum

Platinum shed $20.20 last week to close at $1,147.50, down 1.77%. Like gold and silver, platinum was also a victim of U.S. dollar strength that began with Tuesdays surge. Platinum was down close to $30 on Tuesday alone, although the metal remained above the $1,140 level during week as buyers held the line in that area. Support continues to be at the $1,136 area, with resistance remaining at the early-April high of $1,186.

Technicals:

- Support: $1,136.10

- Resistance: $1,186.00

- 50 day moving average: $1,146.11

- 200 day moving average: $1,235.89

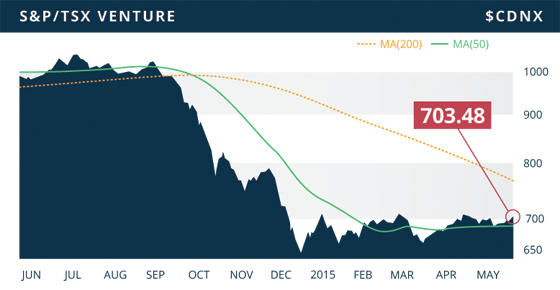

The TSX and the TSX VENTURE were both in positive territory to end the week, with the VENTURE at a 3-month high of 703.48. However, this was not due to the performance of the mining sector as it was down 2.24% on the week. Contributing to these losses was a 2.4% decline by the gold miners, and a 3.2% drop in the base metal sector. The energy sector was up 1.64% on the week after posting 4 consecutive weeks of losses, with these gains the main driver of the gains in the TSX and TSX-V during the week.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Tuesday May 26

- Core Durable Goods Orders MoM (US) – Consensus: 0.4%

- CB Consumer Confidence (US) – Consensus: 95.0

- New Home Sales (US) – Consensus: 510K

Wednesday May 27

- Interest Rate Decision (CAN) – Consensus: 0.75%

Thursday May 28

- Initial Jobless Claims (US) – Consensus: 274K

- Pending Home Sales MoM (US) – Consensus: 1.0%

Friday May 29

- Q1 GDP QoQ (US) – Consensus: (-0.8%)

- Q1 GDP QoQ (CAN) – Consensus: 0.2%

- MI Consumer Sentiment (US) – Consensus: 89.9

It’s a shortened week in the U.S with the Memorial Day holiday on the Monday. There is not a tremendous amount of data on deck, but the most sensitive days for data will be Tuesday and Friday; with Core Durable Goods, CB Consumer Confidence and Q1 GDP the top items on the week. The market will also look for further evidence of a strengthening housing market with New Home and Pending Home Sales data.

Last Week: The week started off with strong data out of the U.S. which showed Building Permits and Housing Starts for the month of April well above expectations. Building Permits were at a 7-year high, and Housing Starts jumped 20% in April, although it should be kept in mind that there was a build up of delayed housing starts during the months of February and March which most likely contributed to the higher housing starts. This had the U.S. dollar rallying for the rest of the week, as the market viewed the data as strongly supportive of the U.S. growth and imminent rate-hike narrative.

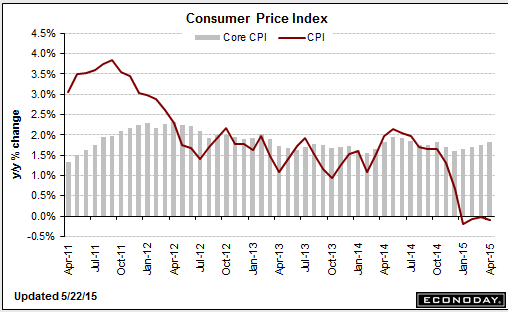

There was little in the FOMC March meeting Minutes that was not already known by the market and priced in. The Philly Fed Index came in below estimates, with a reading below 10 for the fifth straight month. Year over year Inflation dropped below expectations, although Core Inflation showed a slight uptick, enough to give the U.S. dollar another short burst to end the week. In the chart below you can see the divergence of U.S. Inflation and Core Inflation in response to lower oil prices over the past few months. I would suspect the lower energy prices will start to show up in the Core Inflation data in the coming months.

Due to certain circumstances we have had to postpone the recent jurisdiction updates. However, we will have a stream of updates to start the month of June as things will be back to normal at the end of this week. We will have Quebec Developers, Mexico Producers, and Nevada Producers ready to release. We also continue to work away at British Columbia Developers in the background while progressing with our TOP10 report.

Prompted by a subscriber question last week, we also have an update on Midway Gold and the recent developments of the company. This update will be sent out on Tuesday.

- Symbol: REX.V

- Price: $0.23

- Shares Outstanding: 101,890,199

- Market Cap: $23.4 Million

- Cash: $1 million (as of January 31st)

- Significant Shareholders: Management & Board (13.2%), Robert L. Gipson of Ingalls & Snyder (11.8%), U.S. Global Investors Inc. (8%), Fresnillo PLC (4.4%)

Orex Minerals Inc. (TSX-V:REX) is a Canadian-based junior mineral exploration company holding four exploration projects in three of the top jurisdictions in the world for mining and mineral exploration. The company is exploring the Barsele Project in Sweden, the Coneto and Los Crestones Projects in Mexico, and the Jumping Josephine Gold Project located in the West Kootenay region of southern British Columbia, Canada. The company has a stable cash position of $1 million and no debt, yet the potential to add US$6 million through the pending signing of the earn-in option on their Barsele Project. There are 13 million warrants out with an average exercise price of $0.30, with 7.5 million of these warrants expiring by November 21, 2015. It is possible these 7.5 million warrants may provide a near-term cap to the share price in the low $0.30’s until they are exercised in November. The share price has traded in a range between a low of $0.205 and a high of $0.43 over the past year.

Barsele

The 32,709 hectare Barsele Gold Project is located in the Västerbottens Län district of northern Sweden. The Barsele Project contains an indicated resource of 14.1 million tonnes grading 1.21 g/t gold for 547,000 ounces, and an inferred resource of 20.2 million tonnes grading 0.97 g/t of gold for 627,000 ounces. Agnico Eagle has recently signed a letter of intent (LOI) to earn 55% in the Barsele Project. Under the terms of the agreement, Agnico will pay US$10 million to Orex (US$6 million upon signing), and will also spend US$7 million on exploration over 3 years. Agnico also has the right to increase their option to 70% by taking the project to pre-feasibility.

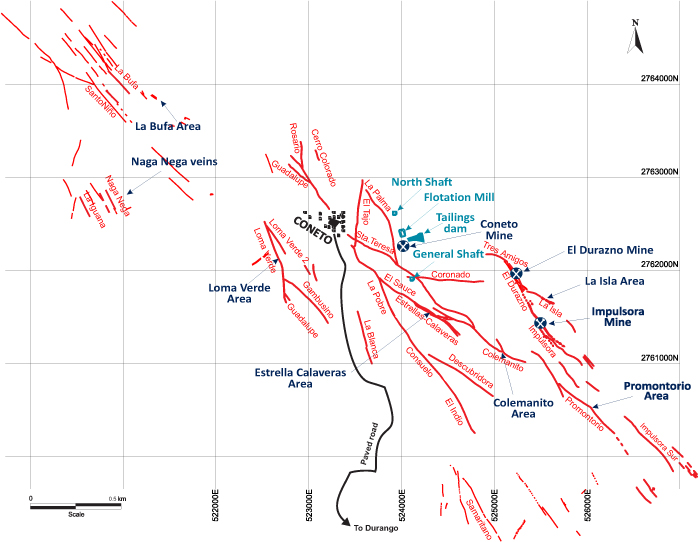

Coneto

The 15,700 hectare Coneto Silver-Gold Project is located in central Durango, Mexico. In 2011 Orex signed an agreement with Fresnillo Plc in which Fresnillo will spend $6 million over three years at which point it will trigger a merger of the Coneto properties held by each company and the formation of a new company (NewCo) to hold and manage the amalgamated Coneto land package. Fresnillo will own 55% of the NewCo, and Orex will hold 45%. Fresnillo has the right to increase its ownership in the NewCo to 70% by advancing the project to pre-feasibility or spending US$21 million. To date, Fresnillo has spent US$4 million on Phase-II and III drilling, with US$2 million committed for 2015. Fresnillo commenced a 4,500 meter Phase-IV drill program last month, which will target the multiple mineralized structures on the property, and aim to extend mineralization along strike and down dip with 100-meter step-outs. The first three phases of drilling totalled 28,700 meters in 82 holes. Drill holes such as hole BCO-02 from the Loma Verde Area, which intercepted 10.27 meters (true width) averaging 3.08 g/t gold and 138 g/t silver, display the high-grade nature of the Coneto Project.

Los Crestones

The 100% owned Los Crestones Gold-Silver-Copper Project is located in the state of Sinaloa, Mexico, 100 km north of the city of Culiacan. The 4,168 hectare property has seen no modern exploration, and aside from a few historical workings, is relatively untouched. The first phase of drilling on the property was conducted in 2011 by Astral Mining, a company subsequently absorbed by Orex in 2013. The Phase-I program consisted of 18 holes totalling 2,619 meters. This first phase of drilling returned encouraging results, with the best hole (11LD011) returning an intercept of 5 meters (3.53m true width) averaging 39.1g/t Au, 93.3 g/t Ag, and 2.13% Cu; a very impressive hole. Orex commenced a 5,000 meter Phase-II drill program in December, with results expected at any time. With a better understanding of the mineralization and structural controls at Los Crestones, the company will be able to better zone in on the trend of the subsurface mineralization. Judging by the high-grade intercepts of the first pass, the company may be in for further surprises at Los Crestones.

McEwen Mining’s El Gallo mine complex is located 30km west of the Los Crestones Project. The El Gallo mine stared commercial production in 2013 and produced 38,212 ounces of gold and 25,912 ounces of silver during 2014. However, once the El Gallo 2 deposit is in production, the company expects to add 5-7 million ounces of silver to annual production at El Gallo. With the El Gallo complex so close to Los Crestones, any significant discovery made by Orex will certainly demand the attention of their neighbour to the west.

Bottom line

The company is in a stable cash position with $1 million in the bank, although the potential closing of the Agnico Eagle’s option agreement will add US$6 million to the company’s cash position. This cash infusion, plus the additional US$4 million over the next two years, will position the company well to continue advancing their other early-stage projects without share dilutive financings. Orex has positioned itself well by engaging two major mining companies, Fresnillo and Agnico, to share the costs and risks of developing their Coneto and Barsele Projects respectively. With both Agnico and Fresnillo holding the option to earn 70% interest in the respective properties, this positions OREX for potential increase shareholder value in the event that the remaining 30% interest is monetized to their larger JV partners.

Potential Catalysts and Events to Monitor:

- Los Crestones Phase II Drill Results (Q2 2015)

- Finalization of Agnico Eagle Option Agreement

- Fresnillo Phase-IV Drill Results (Q3 2015)

MAY