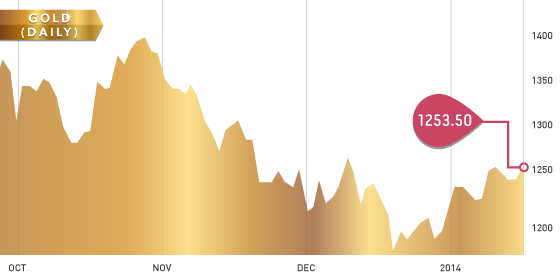

Gold futures closed the week near the unchanged level while platinum, palladium and silver finished the week negative. Gold was poised for a small breakout above the $1267 level, but was shot down on Friday after emerging market currencies fell hard causing the U.S. dollar to appreciate and gold to move lower. Additional sell pressure can be attributed to the U.S. Federal Reserve meeting next week where there is a strong potential for additional tapering in the asset purchase program. The platinum worker’s strike continues in South Africa with the union demanding a double in wages. In day one of the strike it is estimated that there was $13 million in lost revenue. Negotiations are set to continue on Monday.

Upper support levels for gold for next week are $1255, $1230 and $1200 while resistance points are $1275 and $1290.

Silver continues to consolidate and is range bound between $19.40 and $20.50.

Gold Chart 2013

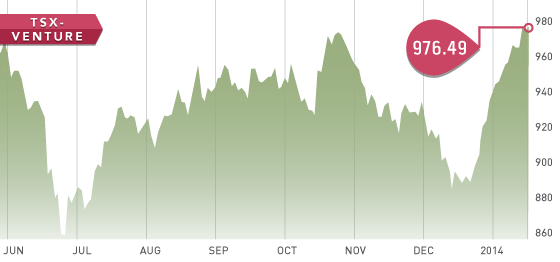

Equity markets were hit hard across the board on Friday including the TSX-V, which was down over 20 points at one point, closing in the mid-960s. The TSX-V has enjoyed a nice low volume bounce from oversold levels over the past week and is likely due for some short-term profit taking, which is what we saw today in the market. What we as investors in the junior space would like to see is the stronger names begin to outperform on a relative basis moving forward. Meaning even on down weeks, high quality names will be down less than low quality stocks.

The analyst portfolio is still up 20% YTD, which is a solid start and we look to build on this moving forward.

A Look Ahead

Wednesday is the big day for investors next week as it will bring the U.S. Fed interest rate decision along with any tapering decision. While the December jobs number may have been a slight cause for concern, it is suspect as to whether that sole number is enough to change the pace of asset tapering. Friday has the U.S. fourth quarter GDP numbers as well as the US personal consumption expenditures for Q4, which is similar to the CPI.

Headline of the Week

Headline of the week goes out to Dynasty Metals & Mining for “Dynasty replaces out-of-date content.” It’s unbelievable on so many levels that it is tough to know where to start. Just to send this press release costs at least $100 (don’t worry, we’ll tack it on to their G&A ratio). The news release then goes on to discuss how the company has been posting non-compliant 43-101 information, but has now removed such content from the website. Previously, they were misrepresenting grades as well as economic analysis by using “independent” reports, which is illegal and immoral on so many fronts there too many misreporting violations to count. Chalk one up for the BCSC.

Symbol: CTT.V

Symbol: CTT.V

Price: $.065

Market Cap: $1,951,000

Shares outstanding: 39,019,287

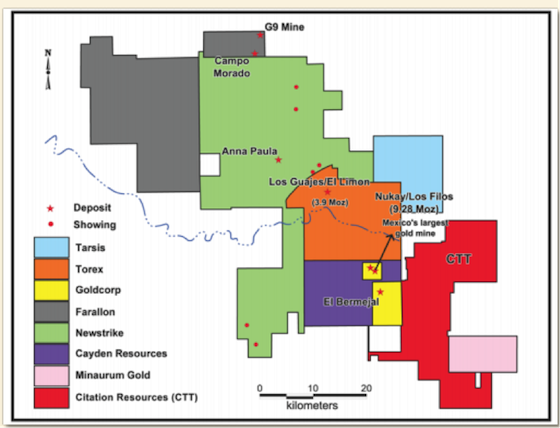

This week we take a look at junior exploration company Citation Resources. The stock is trading at $0.065 and is extremely risky, but with this risk comes the opportunity for huge gains. A press release issued on January 16th caught our eye: Citation Resources finalizes Biricu access agreement. This is a very important development as it allows management to start a drill program, which they hope to begin by the end of March. The Biricu Property is located in the prolific GGB belt in Mexico, which hosts multiple discoveries including the neighbouring Torex and Goldcorp properties.

Management has been waiting for this permit for almost a year now and was hoping to drill the four targets they have found last year. Citation reported $371,949 in cash as of September 30, 2013 so we expect a financing will needed for the drill program. It is noteworthy that as of March 31, 2013 Citation reported $500,289 in cash, so they have not been very prudent while waiting for this permit. This will be an interesting exploration stock to watch when drilling starts.

JAN