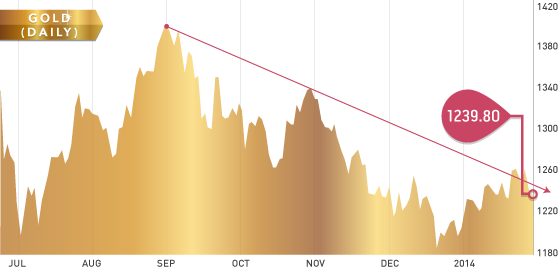

This week the metals suffered a case of buy the rumour, sell the news as the metals wavered in the face of the Crimea vote and the U.S. federal reserve tapering decision. Several new palladium ETFs launched on Friday, giving the metal a nice push up to $800 per ounce. Palladium has been quite range bounce for over a year, ...

MAR