IMPORTANT DATES:

March 3: China Non-manufacturing PMI, United States ISM Manufacturing PMI

March 5: Eurozone Q4 and annual GDP, Bank of Canada interest rate and monetary policy statement

March 7: United States Non-Farm Payrolls and Unemployment rate

March 9: China CPI

March 11: Bank of Japan interest rate and monetary policy decision

March 13: United States Retail Sales

March 17: Eurozone CPI

March 18: United States CPI

March 19: Federal Reserve interest rate and monetary policy statement

March 27: United States annualized GDP

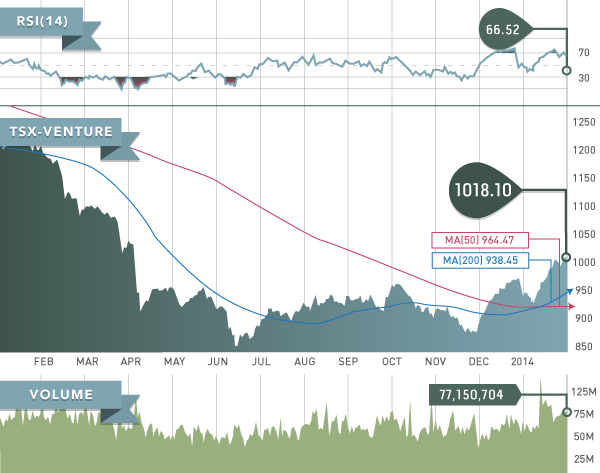

February was a very strong month for the TSX-Venture as the index only had six negative days and propelled itself above 1,000 for the first time since April 2013. There is not much to say here except that the trend is your friend until it is not. If the TSX-Venture can hold above 975-980 it would be very positive and constructive.

We have seen the 50-day moving average cross the 200-day moving average; both are now upward sloping. Known as a “golden cross”, this is normally a longer-term positive setup in the markets. Annual audited statements will continue to dominate TSX-V headlines for the month of March, watch your company’s cash positions, G&A ratios and all-in costs carefully.

How to use the Ukraine Crisis and Safe Haven Demand to Your Advantage

The situation across the pond in Europe continues to worsen as the Russian military continues to increase their presence in Crimea, Ukraine causing the Volatility Index, oil, and gold to jump dramatically.

As we have seen time and time again, as soon as there is a major macroeconomic event or headline we see two things happen: the Volatility Index (VIX) spikes and a flight to safe haven assets (gold) take place. Most notably the last two major international headlines pertained to the potential bankruptcies of Greece and Cyprus. Greek debt went to junk bond status in April 2010 causing the VIX to increase by 300% and fueled gold’s move to $1,400. During the Cypriot banking crisis from 2012-2013 we saw gold hit $1,800 and the VIX double.

Emerging market investors have been hitting the sell key hard. This has caused the Russian Central Bank to step in and raise their overnight lending rates from 5.5% to 7% in order to slow down the liquidation of the Russian Rouble, which has hit an all-time low. The Russian ETF (RSX) finished the first day of March down nearly 7%, while the Ukrainian Exchange (UX) finished down 11.73%.

Both these countries are crucial components to life in the European Union. Russia is a major supplier of natural gas and oil to Europe, while Ukraine is considered one of the most fertile countries to grow foodstuffs. Russia is also the largest producer of palladium as by-product of their nickel production.

Making The Best of a Bad Situation

For investors that are quick on the trigger there is no better way to trade short-term volatility than the VIX. Explosive moves can happen in the matter of hours or days and using the VIX as an investment vehicle and lead to some tremendous gains.

As advocates for investments in precious metals, this Ukraine-Russia crisis is a prime example of why safe haven assets such as gold should be an ample part of an investor’s portfolio. Detrimental economic events will always have an impact on the financial markets and investments in the precious metals space offer tremendous downside protection. Investments in physical or paper gold along with quality names that produce, or have large compliant resource estimates, provide safe haven risk-off value in times of market weakness.

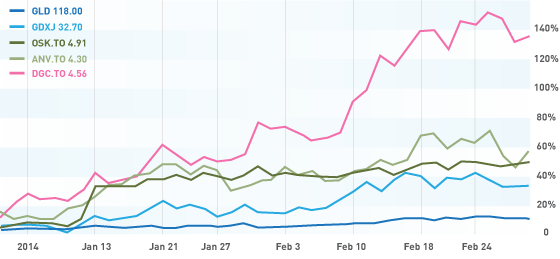

To generate alpha, a gold bug should look for companies that offer significant upside potential to an increase in the price of gold. Identifying companies that have high sensitivity to a rise in the gold price will outperform their peers and generate alpha.

Several companies that are in production, located in safe jurisdictions that have significant sensitivity to a sustained increase in the gold price based on their pipeline, and production guidance are Detour Gold (DGC.T), Allied Nevada (ANV.T), and Osisko Mining (OSK.T).

The Streaming Company Model

One of the most effective ways to reduce risk when investing in the mining industry is through royalty companies.

What is a royalty company?

A royalty company is a company that provides upfront capital and in exchange receives a stream on future production. The transaction allows the streaming company the right to purchase a percentage of future production at a fixed price.

Why invest in royalty companies?

- No risk of increased capital or operating costs overruns.

- The larger precious metal royalty companies have strong free cash flow and pay small dividends

- Royalty companies have outperformed ETFs, physical gold, and S/P TSX gold index over the last several years

- Optionality leverage potential for high returns. Example: Franco Nevada originally paid Barrick less than $3 million for the Gold Strike royalty, which has returned over $700 million to date for Franco shareholders

Royalty Companies:

Franco Nevada (FNV.T) – Franco is the 800lb gorilla in the streaming industry. Franco has an extremely strong balance sheet with $891 million in working capital and no debt. Shareholders also receive a monthly dividend – a fantastic way to play the gold market if you believe in a much higher gold price down the road.

Silver Wheaton (SLW.T) – The largest and only silver focused streaming company in the world. Many analysts believe the silver price will be like gold on steroids in the upcoming years. Silver Wheaton has a fantastic growth profile with production estimated to increase approximately 45% between 2012 and 2017.

Royal Gold (RGL.T) – Royal Gold is the smallest of the big three streaming companies, but has a market cap of $4.9 billion. Royal Gold offers the largest immediate growth as production is expected to double from fiscal 2013 this year. The big driver for this growth comes from Thompson Creek’s Mount Milligan project, which has just reached commercial production. Additionally, Royal Gold was named one the Fortune 100 fastest growing companies in 2013.

Sandstorm Gold (SSL.T) – Sandstorm is much smaller than the other competitors in the space with a market cap of ~$600 million. Sandstorm has several streams already in production and $100 million in cash to find new acquisitions. Production is expected to increase by 25% over the next several years. Sandstorm Gold is captained by Nolan Watson, who was CFO of Silver Wheaton before founding Sandstorm.

Gold Royalties Corp. (GRO.V) – Gold Royalties is by far the smallest company with a market cap of only ~$9 million. The company does have a portfolio of 15 NSR royalties with one in production. The main issue surrounding GRO is that their other 14 royalty streams are far from reaching commercial production. As such, there will be considerable lag time until these mines begin to generate cash flow for Gold Royalties.

MAR