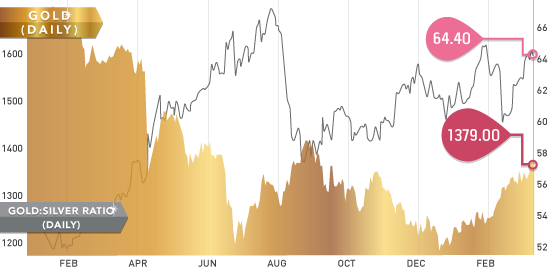

The precious metals got a nice lift this week as all the metals pushed to new 2014 highs. After basing in the mid $1,300s, gold pushed hard this week climbing above $1,385 and closing at $1,378. Impressively, the GLD has had several weeks of positive flow, meaning more money is entering the fund then exiting. This corresponds nicely to the move we have seen so far year to date in the metal. Silver has underperformed gold rather considerably this month. This has allowed the gold-silver ratio to move up to 64.7, just a tick from the closing high of the year, which is 64.86. Silver has struggled to close above $21.50 in recent days; a close above this would exhibit strength.

The strikes continue in South Africa putting a dampener on PGM production coming out of the region. Impala, Anglo-Platinum, and Lonmin have to be quite frustrated with the situation as the hours and money lost continues to climb. Apparently, workers have lost in the neighborhood of three billion Rand, while the producers have lost nearly eight billion Rand. Meanwhile, in snowy Montana there are no strikes at the Stillwater Mine (SWC) – food for thought on that one. SWC probably hopes these strikes continue for some time as they benefit from the bump in PGM prices because they can still keep production and recycling going at full speed.

Gold Chart

The big indices were flat for the week before moving considerably lower on Thursday. Weak production data out of China was the big headline for the weak, spurring a sharp selloff in copper down below key $3 support. The U.S. producer price index came in surprisingly negative as the actual change in primary markets missed estimates by 0.3%.

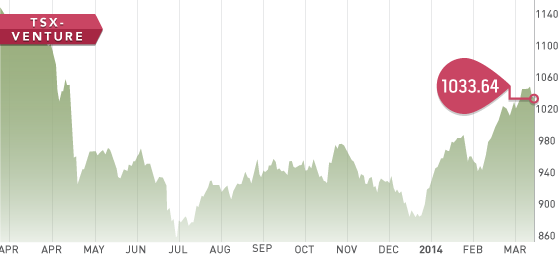

The resource heavy TSX-V trucked higher before being hit hard on Thursday and finished off the week around 1,035. The rising tide continues to lift all boats it seems these days; however, we do not expect this to last forever. We are seeing companies that have substantial leverage to the increase in gold price doing very well; Detour Gold and Allied Nevada are two names that immediately come to mind.

TSX-V Chart

Headline of the Week

This week the honour goes out to Carpathian Gold. The initial headline was “Carpathian Gold to be tardy filing 2013 financials” Until these financials are filed, they will be under a MCTO (management cease trade order). While this may have something to do with late financials, it is more likely that Macquarie Bank is getting pretty grumpy about the $140 million CPN owes them and continues to extend the debt deal.

A Look Ahead

Next week is a big economic week for the markets. Early in the week brings Eurozone and U.S. CPI data. Wednesday is the big day with U.S. Federal Reserve interest rate decisions, tapering, and FOMC economic projections. Ending the week we have Canadian CPI data. Sunday March 16th brings a vote to bring Crimea back to Russia, which will likely be met with a number of sanctions from the U.S. and EU.

Not that we place a lot of a value on the Kitco gold survey, but the survey was overwhelming bullish both in the number of responses and the expected positive price movement coming next week. We like to be a bit contrarian in our strategies and with the amount of economic data coming out lately that has been bearish on gold, it is hard to be all that positive about next week. We’re not saying sell your vault, but it’s likely not the week to add to it either.

Analyst portfolio performance: The analyst portfolio continues to outperform the GDXJ and others. The portfolio YTD return is 47.5%, while the top five are up 61%. In March, the portfolio is up 6.7%.

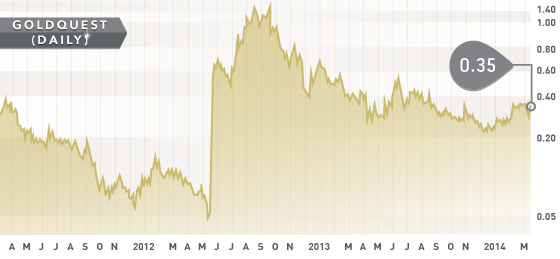

Symbol: GQC.V

Symbol: GQC.V

Price: $0.35

Shares outstanding: 145,680,044

Market Cap: $45,161,000

This week we take a look at a development company in the Dominican Republic called GoldQuest. GoldQuest stock is a great example of the volatility in the mining stocks going from a low of $0.04, to a high of $2.03, and currently sitting at $0.34. It is an interesting story as GoldQuest was down to its last few dollars in the bank account when deciding to drill the Romero target. The discovery hole at Romero was exceptional with 235m of 7.9g/t gold and 1.4% copper. This sent the stock into a frenzy eventually hitting over $2 per share. The stock has pulled back considerably as GoldQuest continues to develop the project. A Resource Estimate has been released and a PEA is due in early Q2.

Resource Estimate (Oct 29, 2012)

| Project: Romero | Gold equivalent ounces | Grade (Au equivalent) |

| Indicated | 2.38 million | 3.81 |

| Inferred | .79 million | 2.49 |

GoldQuest controls a 60 km long trend called the Tireo project, which they plan to aggressively explore in 2014. With $11 million in the treasury, GoldQuest is well funded to explore this project and an Airborne ZTEM survey is underway. Drilling of targets will commence in Q2 until the end of the year with 10,000m expected to be completed. GoldQuest will have plenty of catalysts out in the next couple of quarters so keep it on your watch list.

MAR