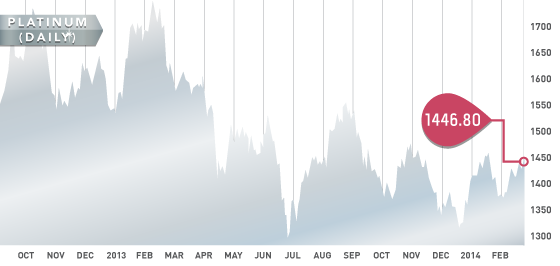

Gold and silver rose to start the week, but weakened on Friday as the U.S. GDP number came in around the consensus of 2.4%. Platinum had a stellar week, outperforming the rest of the metals after Impala Platinum stated that strikes were going to continue. It would be better if platinum had a solid week based on a big bump in catalytic converter sales, but instead it comes from underpaid miners working on their hands and knees in 120-degree heat.

Platinum Chart

The TSX-V pulled in nearly 20 points to start the week, but found support at 1005 and rallied back up into the 1020 area. The TSX-Gold index under-performed the broad index finishing the week down roughly 2%, but still within striking distance of year-to-date highs.

TSX-V Chart

Headline of the Week

This week’s headline comes from north of the border: “Northern Dynasty’s Pebble Project faces more delays from EPA.” It is no secret that the Pebble Project has its fair share of permitting issues (one of the major reasons Anglo dropped out) and this setback certainly does not help. We talked about the issues of the project in our Northern Development podcast – the risk/reward factor definitely increased on both sides of the coin. The potential for the project to be a no-go or at least prolonged on the permitting front has increased significantly; however, NDM just lost 30% of their market cap in a day and still have 100 million ounces of gold and 81 billion pounds of copper. The multi-billion dollar question is whether the biggest undeveloped mine in the world is put into production at some point.

A Look Ahead

Next week there are a few things on the economic front to keep on the radar. On Wednesday, we have Eurozone Q4 and annual GDP numbers, the Bank of Canada interest rate and policy statement, and U.S. ISM numbers. On Thursday, we have U.S. initial jobless claims followed by the U.S. nonfarm Payrolls and the Canadian unemployment rate on Friday.

Gold bugs will be looking for soft employment data out of the U.S. later in the week, as weak employment data could slow down fed tapering. Economic data out of Europe is a bit of a coin flip; bad GDP numbers mean the economy is struggling, which devalues the Euro against the U.S. dollar (bad for gold), while a struggling economy increases demand for safe haven assets (positive for gold).

A continuation of the platinum strikes would be a positive for the producers and development companies in the PGM realm. Companies such as Ivanhoe (IVN.V), Platinum Metals Group (PTM.T), and Stillwater Mining (SWC) should be kept on the radar.

We completed our analysis on the Manitoba-Saskatchewan jurisdiction of Canada this week. It is a small jurisdiction, but we have now completed analysis of all precious metals companies in Canada. There are only two exploration companies, neither of which scored over 50 and should be avoided. Likewise, on the development front there is nothing to get overly excited about. There are six development stage companies and the only one with a decent sized project was Carlisle Goldfields (CGJ.V). At first glance the economics look excellent, but a closer look revealed a “slightly hidden” substantial CAPEX of $1.5 billion.

Analyst portfolio performance: Year to date the analyst portfolio is up 38% and the top 5 picks are up 53%. For February, the portfolio finished up 14.2%.

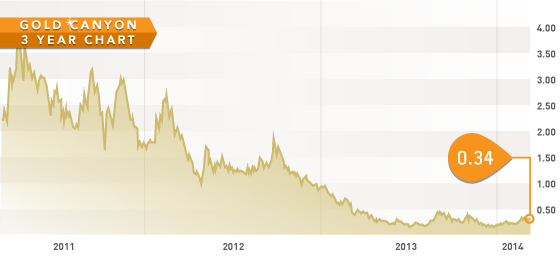

Symbol: GCU.T

Symbol: GCU.T

Price: $0.34

Shares Outstanding: 148,549,539

Market Cap: $51,992,000

This week we’re featuring Gold Canyon Resources as stock of the week. Gold Canyon is a gold development company in the Red Lake area of Ontario. At current valuations we believe Gold Canyon is a legitimate takeover candidate. The Spingpole project has a NI 43-101 resource estimate of ~5 million ounces of gold and 25 million ounces of silver. A very robust PEA was completed that shows a $438 million dollar CAPEX, 25.4% IRR, and a payback period of 1.7 years. The project is being moved towards pre-feasibility. CEO Akiko Levinson owns 3,107,201 shares, which is some serious skin in the game.

FEB