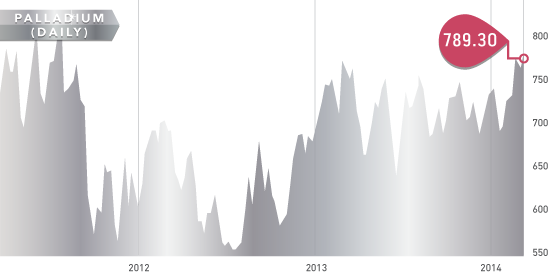

This week the metals suffered a case of buy the rumour, sell the news as the metals wavered in the face of the Crimea vote and the U.S. federal reserve tapering decision. Several new palladium ETFs launched on Friday, giving the metal a nice push up to $800 per ounce. Palladium has been quite range bounce for over a year, fluctuating between $700-$800, but these ETFs can potentially jumpstart a breakout for the metal.

Support for gold next week is at $1,320, $1,300 (200-day moving average) and $1,280.

Palladium Chart

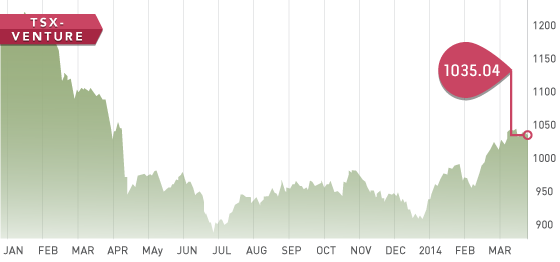

The broad markets put in a positive week finishing up over 1%. The TSX-V finished the week relatively flat, while the gold index pulled in several percent, closing at 198. Janet Yellen might have surprised the markets with her comments regarding raising interest rates as soon as this year. The markets recovered, but the USD appreciation hurt precious metals. The Commitment of Traders (COT) report this week showed very high levels of commercial short selling, the most since last March.

TSX-V Chart

A Look Ahead

Next week is a quiet week on the economic headline front. Audited annual financial statements will continue to trickle in so keep watching those cash positions and all-in costs. Unsurprisingly, the Kitco gold survey had a weak response rate and a fairly mixed view; that’s what happens when you buy an interim top. If gold can stay in the $1,330 range next week and consolidate that would be beneficial down the road.

Analyst portfolio performance: The analyst portfolio continues to outperform the TSX-V and GDXJ benchmarks by a considerable margin. The portfolio is up 32% YTD and the top five are up 44%.

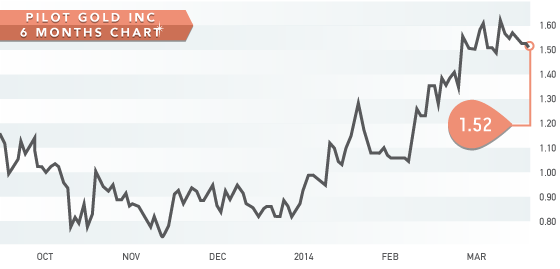

Symbol: PLG.T

Symbol: PLG.T

Price: $1.52

Shares Outstanding: 89,940,333

Market Cap: $138,508,000

Pilot Gold is a development company with a portfolio of excellent projects in Turkey and Nevada. Management is one of the most important things to look at when investing in mining stocks and PLG gets a big checkmark here being led by CEO Mark O’Dea. Members of the management team have one of the best track records in the junior mining space and have sold a project to Newmont for $2.3 billion.A new exciting discovery was recently made in Nevada at the 79% owned Kinsley Mountain project. Drill assays have recently been reported from the project and include high-grade holes including drill hole PK131C, which intercepted 10.5 g/t over 42 metres. Geochemical anomalies over 7km show discovery potential with several priority targets outlined by Pilot’s geologists. A $4.5 million dollar budget has been set for the project, which includes 17,000m of drilling. Expect plenty of news out of this project in the next couple months. An interesting way to invest in this project might be by investing in the JV partner Nevada Sunrise (NEV.V) that owns 21%.

Pilot has two joint-venture projects with Teck in Turkey. The Halilaga Property is a copper-gold porphyry deposit that had a PEA completed in 2012. The economics on the project do look good with a $675 million NPV, 26% IRR, and 2.1 year payback period. The CAPEX is steep at $968 million and both partners are currently looking at ways to optimize the project economics. The TV Tower project is a district-sized project that encompasses 90 square kilometres. The KCD zone has been drilled and moved to an initial resource in 15 months. Plans are underway for drilling to commence in Q2 at this project.

Excellent management with solid projects make Pilot Gold a stock to keep on your watch list.

MAR