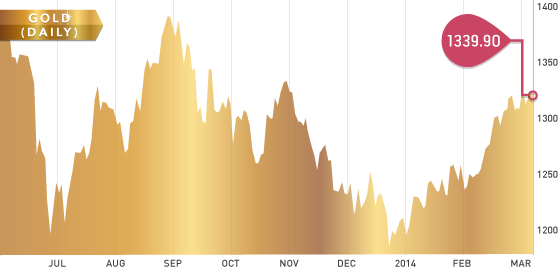

The precious metals had a seesaw week as gold, platinum, and palladium pushed higher on Russia-Ukraine tensions and worker strikes in South Africa. Gold tried several times to break through the $1350-$1355 zone, but failed after U.S. employment numbers came in better than expected. Platinum and Palladium pushed higher throughout the week on speculation of lost metal production due to the union worker strikes in South Africa. Silver was the weakest of the precious metals this week finishing off 1.5%.

Gold Chart

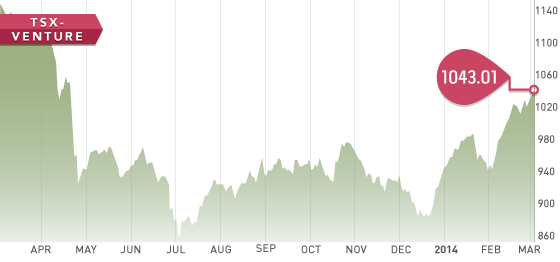

The TSX-Venture climbed steadily higher all week as both the junior oil and gold markets moved higher. We saw a number of significant capital raisings this week from Kinross, Pretium, Detour Gold, Virginia Mines, U.S. Silver & Gold, and Cayden Resources to name a few. It would be a big positive for the junior markets this year if access to capital for the quality names becomes more available. In February 2014, there was $520 million raised on the TSX-V through 128 financings; in February 2013, there were 146 financings raising a total of $388 million.

The Fraser Institute Mining Survey came out earlier this week. The survey is considered an excellent educational tool to compare jurisdictions using data that is difficult to discuss quantitatively, such as political risk, tax regimes and labour unions. The survey is sent to 4,100 mining related companies at all stages across the globe. They have included another 18 jurisdictions this year bringing the total to 112. If you have not seen the document before, we encourage you to take a look at it. You can access a copy here: http://bit.ly/1n1DSzT

TSX-V Chart

Headline of the Week

This week we are going to compare two different headlines. “New Carolin arranges $50,000 private placement” and “Cayden Resources arranges $7.3 million bought deal”. Which one do you think has the better chance to create shareholder value? Well the chances of $50,000 doing more than $7.3 million are extremely slim, so door number two is a better bet. Opening up the New Carolin financial statement we see they have $23,000 in cash and $1.9 million in debt – ouch. Opening up Cayden Resources’ financials we see they have $2 million in cash, plus $7.87 million from a property sale to Goldcorp, and $2.6 million in debt (most of it a warrant liability) – definitely more liquid and solvent.

The takeaway from this rant is to have you imagine yourself as the CEO of the mining company doing the capital raise. Does the amount of money they are raising make sense for the company’s ultimate goal of making money?

A Look Ahead

Next week is a rather quiet week on the economic front. The only major market movers come Sunday evening; they are Chinese CPI and Japanese Q4 and annual GDP.

We completed updates for African exploration and development companies; this should be available next week. We have also completed analysis on the region of Manitoba-Saskatchewan in Canada. We are currently working on the rest of South and Latin American exploration and development companies. The current adjusted cash position is hovering around $570,000 for 220+ exploration companies, while the G&A ratio has jumped considerably to 70% on average.

Analyst portfolio performance: The analyst picks for the year started off the first week of March on a positive note, finishing up 1.8%. The overall return YTD is 40.7%, while the top five are up 55.6%.

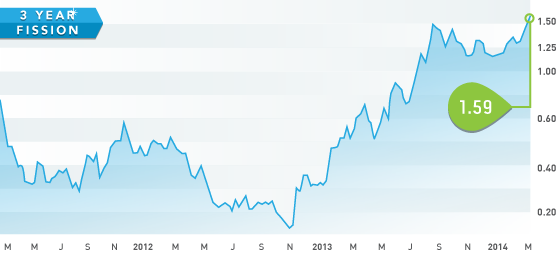

Symbol: FIS.V

Symbol: FIS.V

Price: $1.59

Shares outstanding: 328,803,815

Market Cap: $476,766,000

This week we feature uranium junior exploration stock Fission Uranium. Fission has the most exciting uranium discovery in the last couple years and is a legitimate takeover candidate. Fission at the PLS project is on to a high-grade discovery at less than 300m depth. It appears the uranium market has bottomed here and the supply/demand fundamentals look very positive in the next several years. Likely candidates to make a takeover bid are Cameco, Areva, or Rio Tinto.

Fission is in the midst of a $12 million winter work program that will involve 30,000m of drilling in 85 holes. The goal is to then continue with an $8 million summer program and complete a 43-101 by the end of 2014. Five diamond drill rigs are currently active on the property and investors can expect a steady news flow. Management interests are well aligned with shareholders and we would expect them to try and maximize any takeover bid. CEO and Chairman Dev Randhawa owns ~3.6 million shares and COO Ross McElroy owns ~1.75 million shares. Keep Fission on your watch list as the uranium sector begins to heat up in the second half of 2014.

MAR