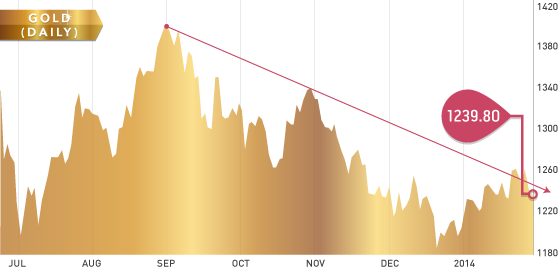

Precious metals were hit this week from all sides as U.S. dollar strength combined with another round of tapering to force short-term investors to hit the sell key. After opening the week near the highs, the metals managed a bounce on Wednesday only to be hit hard Thursday. The oversold bounce at $1,240 was also met with forceful selling at $1,250-$1,255.

Gold Chart 2014

Continue Reading →JAN