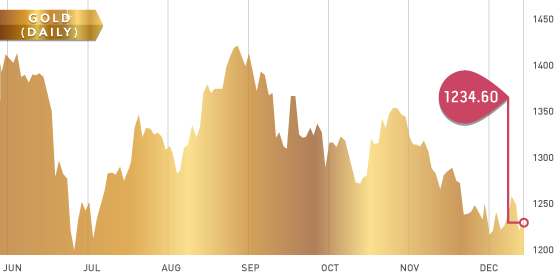

It was a seesaw week for the precious metals. Gold finished the week off on a positive note closing up $9.70 to settle at $1,234. Next week will be another volatile one as the Federal Reserve interest rate and tapering decisions will be on the forefront of traders’ screens. Platinum and palladium exhibited relative weakness this week; however, palladium is the only precious metal that is close to positive on the year.

Gold support levels: $1220, $1210, $1180

Gold resistance levels: $1250, $1260, $1295

Gold Chart

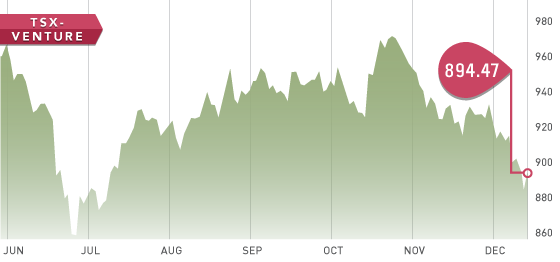

What we saw this week in the TSX-Venture was textbook tax loss selling across the board. The Venture broke 900 for the first time since early July and the chart in the short term looks like we are heading for a retest of the summer lows. The key to noticing the tax loss selling was the early week performance in the GDX / GDXJ compared to the relative weakness and selling all day in the Venture.

TSX-V Chart

Brigus Gold (BRD.T)

Brigus Gold (BRD.T)

Price: $0.63

Market Cap: 143,902,000

Shares Outstanding: 232,099,513

This week we take a look at mid-tier producer Brigus Gold. Brigus produces a little over 100,000 ounces per year in Ontario at the Black Fox Mine. They have a high quality deposit that is over 2.6 million ounces, the open pit grade is 3.1 g/t, and the underground grade is 6.1 g/t. In Q3 they produced 27,000 ounces at an all-in cost of $1173. Their all-in costs dropped from $1512 in Q2 2013, which is a 14% reduction.

On the exploration side, Brigus is drilling the Grey Fox Property, which is also in Ontario. So far, Grey Fox is approximately 725,000 ounces, but the grade is excellent – 2.6 g/t in the open pit and 6.2 g/t underground. On December 12, 2013 Brigus drilled 20m of 8.87 g/t at a very shallow depth. If Brigus can expand the deposit at that type of grade and shallowness the project economics will be fantastic.

DEC