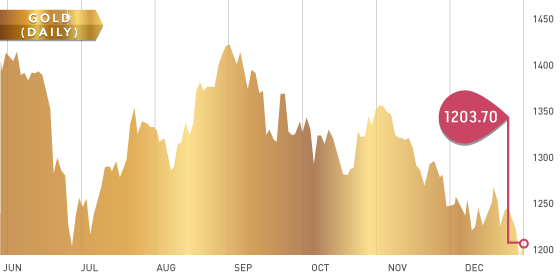

The precious metals had yet another tough week as positive economic news out of the U.S. combined with the U.S. Fed tapering $10 billion from its $85 billion QE program to push gold and silver towards lows of the year. While this has been a tough year for precious metals enthusiasts, investors must remember that precious metals are an investment, not a trade, and that the long-term fundamentals for precious metals and commodities have not changed.

Speculating into the New Year it looks like the economy will continue to slowly improve. While this lowers the demand for precious metals as a safe haven and guard against deflationary assets, it creates new reasons to own them as well. As the economy improves the demand for industrial and precious metals such as silver, platinum, and palladium will increase.

Gold Chart

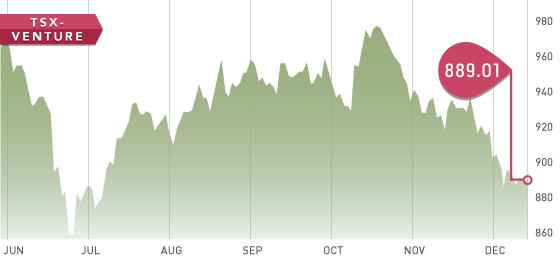

The U.S. markets continue to push to highs of the year. Fund managers can show high performance gains and lock in their yearly bonuses. Tax loss selling has been in full force this week on the TSX-Venture and there will likely be another day or two of small selling, but the worst is over for the year…hopefully!

TSX-V Chart

This week we’ll take a quick look at several gold stocks that we feel are “tax loss” selling candidates and could move upwards in the month of January.

Note: All of these are gold stocks so it is important to factor in the current market price and environment for gold.

The last day for tax loss selling for Canadian stocks is December 24th.

Premier Gold (PG.T) – $1.28

Premier Gold has a fantastic management team led by Ewan Downie. The company is trading near a 52-week low and insiders have purchased shares at higher levels in the open market recently. Financials at the end of September show ~$80 million in cash and investments.

Timmins Gold (TMM.T) – $1.00

Timmins has been profitable so far in every quarter of 2013 – something not many gold producers can say. The stock is cheap on several metrics compared to its peers. The all-in cash cost is around ~$1000, which is in the first quartile of producers. Management has been very active in the month of December buying shares in the open market.

Rio Alto Gold (RIO.T) – $1.49

Rio continues to deliver excellent numbers earning $15.9 million in the third quarter. The cash ratio is lower than we would like to see at 0.4955. Shareholders will be looking for management to increase the oxide resources because when they move into the porphyry section of the deposit costs will rise. A revised resource estimate is due in the first quarter of 2014.

Rubicon Minerals (RMX.T) – $0.78

We would not be surprised if majors are looking at Rubicon for a takeover bid. The stock is all the way back to 2008 levels. The economics of the project are fantastic, especially the grade of 8.1 g/t. Gold production is scheduled to commence in 2015.

Kirkland Lake Gold (KGI.T) – $2.21

Kirkland management in the past has over promised and under delivered, which is never a good thing. The company seems to be at an inflection point and may be turning the story around in 2014.

Romarco Minerals (R.T) – $0.36

Romarco owns the ‘Haile’ gold project in Carolina. The project has a CAPEX of only $320 million. Once in operation it will be one of the highest grade (2.06 g/t) open pit mines in the world. Romarco is expecting all permits by the end of 2014 with plans to begin construction in 2015.

Continental Gold (CNL.T) – $3.14

Continental has a strong balance sheet with $132 million in cash at the end of September. The goal at CNL is to prove up 10 million ounces of gold by 2015 and begin production in 2015. An updated 43-101 resource estimate is expected in the first quarter of 2014. The grade of the project is fantastic at about 9 grams per tonne.

DEC

If we think contrarian then the signs align to buy gold. One, there is total optimism in the stock market, valuations are high, everyone is excited. Is this not signs of the nearing the top?

Two, gold is hitting all time lows. Would not low interest in gold be associated with total optimism in stocks? Is this not a contrarian confirmation?

Just when everyone loves stocks and the Santa Claus rally is going well, would that not be just the right time to increase gold accumulation? It is total contrarian. Now is the time of bottom sentiment for gold and top sentiment for stocks.

According to what I am learning about research in investments – the Graham principle – undervalued assets both P/B and P/E do well in the future. Research, whether we like it or not, confirms Ben’s principles.

To my surprise Graham’s principles have been shown to produce something like 23% annual compound return. Guess who – WB are the initials – a student of Benjamin Graham has the same 23% annual return since his fund began? Of course, Warren Buffet.

All Warren Buffet had to do is follow Benjamin Graham’s principles religiously and he would get, yes, 23%. And he did just that.

Prices return to the mean. Gold MUST, therefore, bounce back. Now is the time to buy when the string on the arrow is fully sprung. Let us create a new term – The Gold Arrow effect. Don’t go claiming it now. I said it first.

Fill up your quiver now, the shooting is about to begin. Get ready to shoot gold arrows.