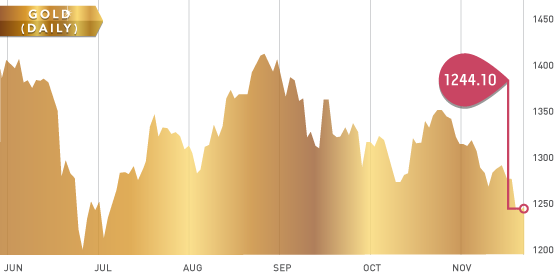

Gold had a tough week after a $30 down day on Wednesday on potential tapering headlines. From a technical perspective, the charts for the precious metals do not look great. A small rebound off $1260 was no match for the sell side and it seems like we will be seeing $1200 gold in the coming weeks. It is important for readers to remember there are two kinds of trades in gold: the investment trade, which requires a long-term thesis and the short-term tactical trade. Investors should not confuse the two. The market will continue to whip around over the coming weeks and requires a serious catalyst to really propel the metals in either direction, so the long-term thesis has not changed. On the short-term tactical side, the price action remains considerably bearish on all time frames with $1180-$1200 gold a likely downside target.

Gold Chart

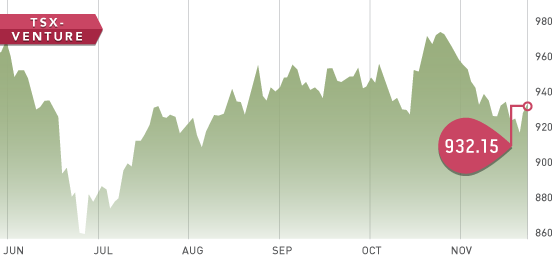

The TSX-Venture had three up days to two down days to finish roughly unchanged on the week. The gold index was crushed on Wednesday and went out near the lows of the week on Friday, which is never a good sign. It is a little scary to think about how ugly it can get if we get sub $1200 gold in combination with tax loss selling. As Rick Rule says though, you have to love bear markets because that’s when the investor has the opportunity to really capitalize on high quality names and buy them at substantial discounts.

TSX-V Chart

Headline of the Week:

Pretium Resources (PVG.T) “Pretium produces 4,215 oz Au from Valley sample”

Pretium is looking to silence a lot of critics with the results from the bulk sample that is about 80% complete. The stock had a massive day, up 79.5%. Pretium expected a total of 4000 ounces from the 10-ton bulk sample and after completing 80% of it they have already matched their goal. A definite positive for the stock.

Symbol: OGC.T

Symbol: OGC.T

Share Price: $1.68

Shares Outstanding: 293,587,920

Market Cap: $484,420,000

This week we look at OceanaGold, a multinational gold producer with four operating mines. Oceana caught our eye with impressive Q3 results and a net income of $43.7 million. An all-in cash cost between $900-$1000 per ounce places Oceana in the top quartile of all gold producers. The fourth quarter is looking to be a strong one with production ramping up and mining of higher-grade ore. Production for the year is guided to come in between 285,000-325,000 ounces.

Looking forward to 2014, production is expected to increase as the ‘Didipio’ mine continues to ramp up. At the current share price of $1.68, the price to cash flow per share for 2014 is ~2.5X, which is very cheap compared to other gold producers.

NOV