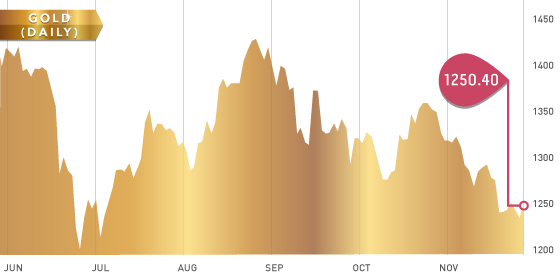

After pressing below the $1230 level, gold closed the week on a positive note finishing up at $1250. Platinum markets went opposite the gold and silver markets this week, moving down below $1380 and finishing the week down near $1360. A retest of the July low at $1300 looks quite likely in the near term. Overall, it was a weak month for gold and silver as USD strength in combination with the surprise ECB rate cut fueled lower prices. Next week, precious metals investors will need to watch the United States GDP Q3 second estimate and the Nonfarm Payrolls/Unemployment numbers that are due for release on December 6th.

On November 25th, gold and silver put in what technical traders call an “outside day”, which is when the high and the low for the day are higher and lower than the previous day’s highs and lows. This normally represents a period of uncertainty and usually leads to several days of choppy trading.

Gold Chart

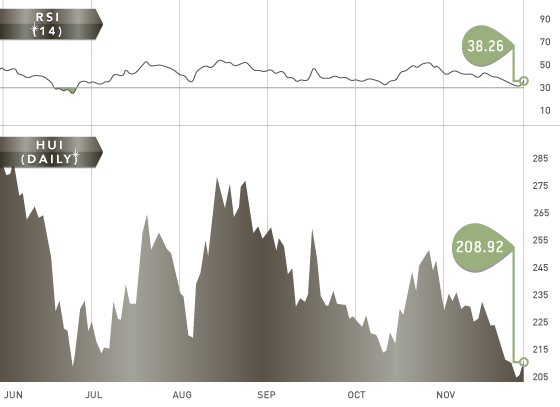

US markets continued to push to new highs as per the QE to infinity POMO. The TSX gold index spent most of the week below the 160 level, but the miners recaptured the 162 level on the uptick in the gold price on Friday. There are a multitude of names down around 52-week lows and in some cases multi-year lows, far too many to name but here are some interesting ones: SEA.T, RIO.T, EXN.T, NGD.T, YRI.T, EDV.T, SSL.T

Gold Bug Index 2013

Headline of the Week:

“Copper Creek completes $40,200 financing” This seemed pretty bizarre so we took a closer look at the books. We found $261 in cash as of Sept 30 2013 and $689,935 in current liabilities. Whoever subscribed to that financing should really take an accounting 101 course. Not to mention the financing was done at $0.06 and the stock is currently trading at $0.03 – just terrible.

Symbol: USA.T

Symbol: USA.T

Shares Outstanding: 69,674,763

Share Price: $0.345

Market Cap: $22,993,000

This week we’re taking a look at US Silver & Gold. This stock offers a little more risk and thus more reward than previously featured companies. If you expect the silver price to go higher in 2014, US Silver & Gold will offer plenty of upside potential. The company is on track to produce 2.1-2.2 million ounces of silver in 2013. All-in cash cost for the fourth quarter should be ~$20/oz.

The company has strong growth plans and is looking to more than double production to five million ounces a year by the end of 2015; however, we only see this happening if the silver price can get back above the $30 level. The balance sheet is not too bad with $11.3 million in working capital, but might not be for long if we see silver below $20 for an extended period of time.

NOV