Dear Subscribers,

This week I’d like to announce the launch of two new features that are available to our annual subscribers: “Ask Our Analysts” and “Personal Stock List Review”.

Essentially a Q&A feature, “Ask Our Analysts” lets you ask our analysts any questions about the Tickerscores system or companies we cover. The “Personal Stock List Review” is a value-added feature that allows you to submit up to 10 stocks that you own (or are watching). We’ll review and submit back to you a formal report with the relevant metrics, catalysts, and our thoughts. You can find both of these on the Features page of the VC+ website.

We are currently building out VC+ to be something very special. In the last few days we added Colombia as a jurisdiction, and we will soon add Brazil. We are aiming to cover almost every significant jurisdiction and company on the TSX and TSX-V by Christmas.

Sincerely,

Jeff Desjardins

President, Visual Capitalist

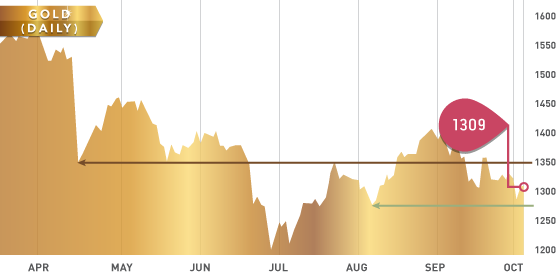

Gold and silver finished the week off on a weak note, closing lower on the day and negative on the week. Gold seems to be in a tough spot as it has been unable to rally in the face of the debt ceiling debacle and weaker USD. The $1350 area still is a short-term line in the sand. Important support is at the $1270-$1275 zone, where gold has rebounded twice from since the summer. A break below this area; however, will be met with significant selling and we could easily see a move back towards $1200.

Gold support levels: $1300, $1290, $1270

Gold resistance levels: $1320, $1340, $1360

Gold Chart

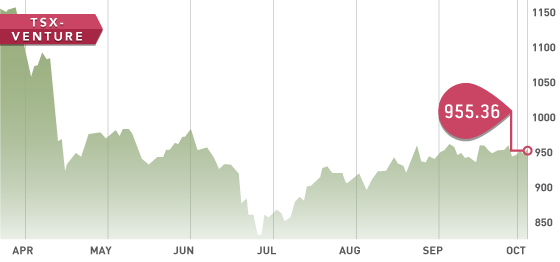

The TSX-V hovered near 950 for most of the week. Trading activity was normal, near the 3-month average at 60 million shares and the new highs new lows indicator fluttered between 0 and -10. Ivanhoe Mines completed a $108 million private placement, which just goes to show that real companies with strong management have the ability to get things done even in a tough market. Nothing overly exciting on the top 20 TMX short positions, except another 10 million shares were added to the short side of Barrick bringing the total to 32 million or 3.1%.

Headline of the Week

Robex Resources halted their stock, only to put out a press release saying they were moving offices. Putting out that release probably cost them $150 and we’ll be sure to add that into their G&A expenses when we rate them in Tickerscores.

TSX-V Chart

North American Nickel is an exciting exploration play in Greenland. The stock has immediate near term catalysts. We attended a presentation by the team at North American Nickel last week in Vancouver. Drill results from the Maniitsoq project are expected in the next 10 business days. The core has showed intersections of sulphide mineralization, which gives investors a clue that nickel is likely present. Investors will want to be watching the nickel grade when the assays come in. We caution potential investors that you never know what grade you have until the results come back from the lab, but this one looks promising.

Another option to play North American Nickel comes through investing in VMS Ventures. VMS is trading in the $0.25 range and owns 27.5% of the shares outstanding in NAN. You could argue VMS is worth the $0.25 on its own, as they own 30% of a copper mine in Manitoba that is commencing production.

OCT