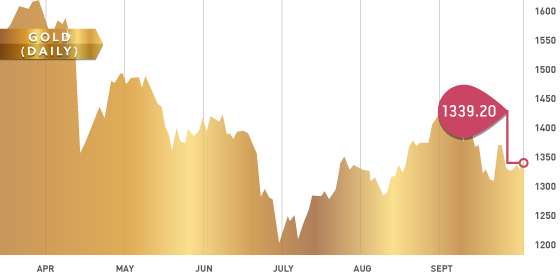

It was a quiet week for the precious metals as the majority of the week was spent digesting last week’s move; gold prices rose slightly overall for the week. The US Federal Reserve’s decision not to taper should create a floor for gold around these levels. Next week, look for gold to try to break the mini downtrend it has been in since September. Silver will follow the gold price action, but as per usual will be more volatile than its yellow counterpart.

Gold Support: $1316, $1300, $1271

Gold Resistance: $1345, $1350, $1375

Gold

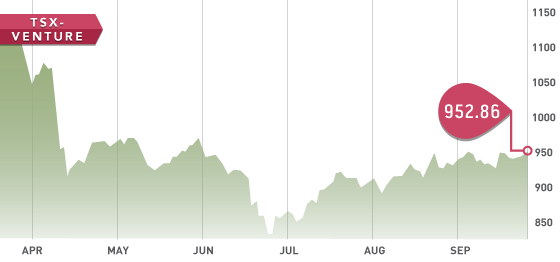

The equity markets also had lacklustre action this week; however, next week will be more volatile with the monthly jobs report coming out as well as congress’ debate over government debt taking place. In theory, the government will shutdown if a resolution is not passed, which it did previously in December 1995. The TSX-Venture closed above 950 again this week, which is a good sign for the market. The volume attached with the move was decent, which is another positive.

Timmins Gold (TMM.T) is a profitable gold producer in Mexico. We decided to feature Timmins as Stock of the Week because it is trading close to a 52-week low. Timmins earned $14.29 million in Q1 and was still profitable despite the dip in gold prices in Q2, earning $972,000. One thing we really like about Timmins is they have one of the lowest all-in sustaining cash costs for gold producers. Production for 2013 is expected to be ~125,000 ounces. Management owns 4% of the stock, with institutions holding approximately 60%. One thing to note is Timmins does have a loan payable to Sprott for $18 million due by year-end.

Disclaimer: Visual Capitalist is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Site users should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Visual Capitalist will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our material special reports, email correspondence, or on our web site. Our readers are solely responsible for their own investment decisions.

SEP