The precious metals had a volatile week as the US Federal Reserve surprised investors by keeping the $85 billion per month asset purchasing plan going. Expectations were low heading into the announcement that the Fed was going to continue to prop up the market. The ongoing stimulus is a positive for the precious metals markets, and one of the main drivers for those who believe precious metals should be valued considerably higher.

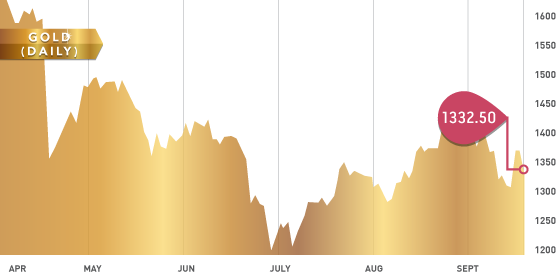

We highlighted last week that $1300 and $1275 were areas to watch from a technical perspective. These levels remained unbroken and so it appears that gold has tried to put in a short-term bottom at $1291 after the Fed announcement. Several days of consolidation should be expected for gold and is considered healthy.

Gold support levels: Short term: $1310, Medium term: $1291, $1275

Gold resistance levels: Short term: $1360, Medium term: $1375, $1395

Line in the sand: $1350

Gold

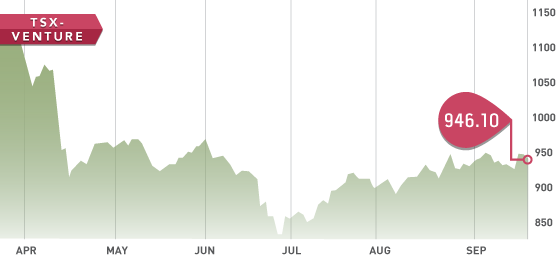

Investors braced for impact this week as expectations surrounding the FOMC asset purchasing program were supposed to begin to taper. When this was not the case and Ben Bernanke stated interest rates might not rise until 2015, this fueled a rally felt all the way from the TSX-V to the S&P 500.

The Kinross Gold short position, which we took note of over a month ago, has started to unwind. The other major producer short positions are still on to their full extent, but the Kinross position has been reduced from 79 million to 33 million.

The TSX-V continues to be a stock picker’s market as more and more companies chose to sit idle and hope for better times rather than putting shareholder money to work.

Ginguro Exploration (GEG.V) is a high risk / high reward gold exploration stock in Ontario. The stock has had a tremendous run going up 7 fold since the middle of August. This is a unique exploration company as they are exploring for a paleo-placer type deposit similar to the gold fields in South Africa. The paleo-placer deposits in South Africa are responsible for 40% of the gold production in world history.

Initial samples have been promising and the company has just closed a $2.3 million dollar placement. Rob McEwen has taken notice of what is going on and his company Evanachan Ltd. holds 18.5% of the stock. This is definitely a stock to follow as they continue to explore and understand the geology.

For an excellent video that explains Ginguro take a look at their website.

*Of note, Ginguro owns 55% of this project and is earning a higher % as exploration expenditures occur. Endurance Gold (EDG.V) owns the other 45%.

Disclaimer: Visual Capitalist is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Site users should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Visual Capitalist will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our material special reports, email correspondence, or on our web site. Our readers are solely responsible for their own investment decisions.

SEP