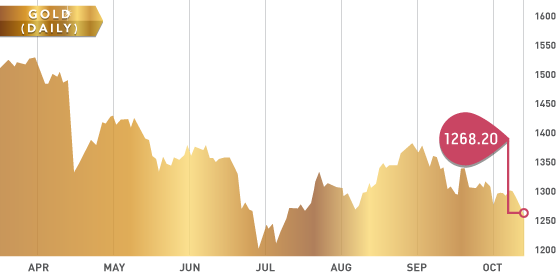

The precious metals had a whirlwind of a week. Debt ceiling and government shutdown headlines caused serious volatility, which was felt though all precious metals markets. Several things stood out earlier in the week that hinted on bearish action. Firstly, the weakness of the USD has a tendency to move gold higher; this was not the case this week. Secondly, with all the headlines one would have thought we would have seen some safe haven buying; this was also not the case.

What we saw later in the week was a typical “sell the news” type of move that occurred after the Democrats and Republicans went back to the table to negotiate. This then triggered stops, moving gold down into its last short-term support point at $1270. If gold cannot reclaim the $1270-$1275 level, then we can expect another rough week for precious metals.

Gold Chart

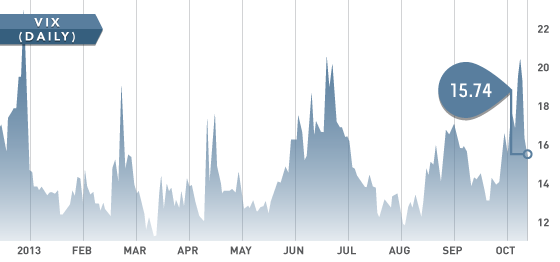

Uncertainty in Washington has weighed on the markets all week. The Volatility Index (VIX) shot up to 21, which is one of the highest levels we have seen all year. The market remains extremely headline driven as the politicians in Washington continue to argue and fight yet achieve very little. A temporary relaxation of the debt ceiling would definitely cause a “relief rally”, but will not fix the problem.

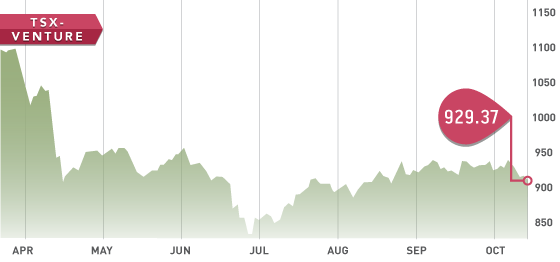

The TSX-Venture suffered this week moving down to 930, which is the lowest the market has been since August. Current conditions generate fantastic short-term trading opportunities such as Pretium Resources (PVG.T) below $5 for a trade back to $5.30 for 10%, but in this type of volatile environment it is very difficult to put on long-term trades.

Volatility Index

TSX-V Chart

Headline of the Week

Headline of the week goes to Conway Resources. “Conway Resources borrows $500,000.”

You know times are tough when companies are taking loans with 11% per month interest rates. As a bonus, the loan comes with one million shares. Too bad they are trading at $0.005 per share.

Hold Cash

With the current volatility surrounding the junior mining markets we like the idea of holding some cash and not featuring a particular company. Precious metal prices have had a roller coaster week. At this time it is a smart move to hold some cash and wait for opportunities. Remember, tax-loss selling is not far off and precious metals stocks could get hit hard this year.

We will leave you with a few tips for investing/trading in the current market environment:

1. Cash position – It is crucial to check each company’s cash position before investing. It is a must for exploration companies as it is extremely tough to close a financing.

2. Volume – Make sure any company you are looking at is trading at least 500,000 shares a day if not more. Volume gives an investor the ability to get in or out efficiently and quickly if required.

3. Catalysts – The next news release is likely what will move the stock up or down. Always know the next several catalysts for each company you are invested in and then approximate when news is expected. If you do not know, pick up the phone and call the CEO. For example, it is probably a good idea to stay away from Yukon gold exploration companies since they will not be doing any property work for the next eight months.

Update: As expected, last week’s Stock of the Week, North American Nickel, released assays. The assays came in at a fairly good grade of nickel, but the stock sold off. This shows the current junior mining market weakness. North American Nickel does have more assays to release, but will not be back drilling again until April at the earliest next year.

OCT