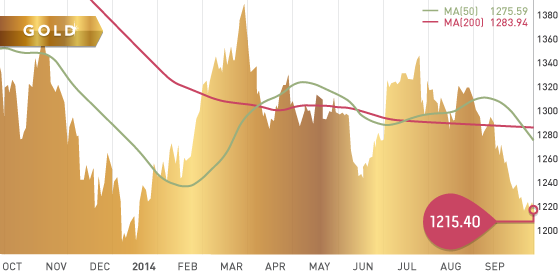

Gold

Gold finished almost flat on the week, closing at $1,215.40 per ounce. Gold is getting close to the key support level of $1,200. The US dollar continues to show strength as US economic data comes in as expected. On Friday, the US GDP came in as expected and is the fastest growth in 2.5 years. The US dollar continues to be the strongest currency worldwide which does not bode well for gold.

A research report from Barclays released last week estimates that 10% of worldwide production is cash negative when you factor in all-in cash costs. Meanwhile, gold smuggling in India has hit record highs ahead of the festival season.

Technicals:

- Support: $1,200

- Resistance:$1,237

- 50 day moving average: $1,275.59

- 200 day moving average: $1,283.94

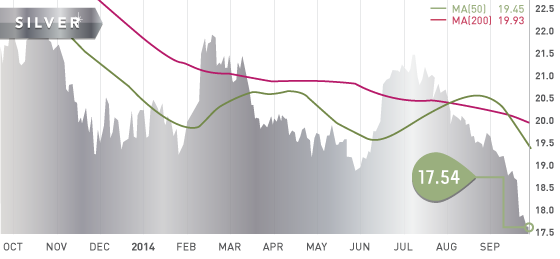

Silver

Silver closed at $17.54 per ounce. Silver is now down 10% in the last year.

Technicals:

- Support: $17

- Resistance:$18

- 50 day moving average: $19.45

- 200 day moving average: $19.93

Platinum

Platinum closed the week at $1,302 per ounce, down $35.30. The declining price comes as a bit of a surprise in the last week. Lonmin, the world’s third largest platinum miner, has been talking about closing a few unprofitable operations. The South African Chamber of Mines estimates 45% of the platinum mines in the country are breaking even or losing money at current prices.

Technicals:

- Support: $1,300

- Resistance: $1,342.70

- 50 day moving average: $1,423.12

- 200 day moving average: $1,433.14

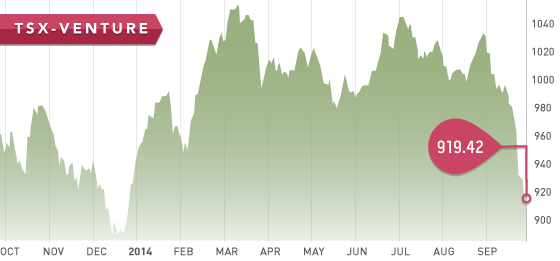

A very tough September continues for the TSX Venture, with a drop from last week’s close to 919.42. Friday was the first green day since September 12th, finishing up 8.15 points on the day. We continue to see lower levels for the TSX Venture as we enter the last quarter of the year. It is tough to watch the market continue to slide, but this will provide some fantastic buying opportunities in the near future. Valuations are already excellent for top-tier companies, and a further slide means that even better entry points still lie ahead.

A Look Ahead

The key items on the calendar this week are:

- September 30 Tuesday – Chicago PMI / Consumer Confidence

- October 1 Wednesday – ISM index

- October 2 Thursday – Employment Claims

- October 3 Friday – Unemployment Rate

Alaska/Yukon and Northwest Territories companies are complete. These companies tend to sell-off in the winter months as they cannot work due to the weather. It makes it tough when no catalysts are issued for 6-8 months for investors to buy these companies. Tax loss selling could provide an opportunity to get into the companies with solid cash positions and a decent project.

Colombia will be the next jurisdiction to be updated.

Top 10 Autumn update:

Eurasian Minerals (EMX.V) – Eurasian issued an in-depth press release on Tuesday summarizing the companies projects/current developments. A positive development is that Newmont will be building a new shaft in Nevada which should increase production. EMX owns a royalty on this land and will see increased cash flow in the future. We also noticed insider buying of 56,000 shares on Thursday.

Mart Resources (MMT.T) – Mart has stated the new pipeline would be ready for commissioning before the end of September. The stock has declined a little bit this week with the overall market. Keep your eyes on this stock next week as we should see a press release. The company has delayed the pipeline multiple times before so we will see.

- Symbol: III.T

- Price: $8.84

- Shares Outstanding: 74,967,768

- Market Cap: $661,216,000

- Cash: $6,967,000 (June 30th) + $115,000,000 (debenture closed on Sept 4th)

- Significant shareholders include Murray Edwards, Fairholme Capital, and Directors/Management

This week we feature Imperial Metals, a British Columbia company with production assets. Imperial Metals has been in the news often lately due to the unfortunate spill of tailings from the Mt. Polley mine. We believe the stock was oversold and in the next 6 to 12 months has potential for significant share price appreciation. The major catalyst will be the commencement of production at the Red Chris mine as well as the re-opening of Mt. Polley.

The next major mine in British Columbia will be the Red Chris copper/gold mine 80km south of Dease Lake in northwest British Columbia. Mine commissioning is expected in the fourth quarter of this year. Imperial has agreed with the first nations (Tahltan group) to have the tailings facility inspected by a third party engineering firm and this will address any concerns. The budget for the mine is $622 million. The project economics are very strong on this mine and will provide significant cash flow when in full operation.

Red Chris Mine

- 28 year mine life

- 30,000 tonnes per day

- 15.7% IRR at $2.20 copper, $900 gold, $12 silver

Mount Polley Mine on August 4th had the unfortunate event of a breach of the tailing storage facilities. At the moment, 450 people are currently working at the site on cleanup. Mount Polley will remain on care and maintenance for an indeterminate period of time. Statements have also been made that estimating the costs of remediation and reclamation are unknown at this time. The union of workers will be trying to push Imperial to re-open the mine as soon as possible.

The Huckleberry mine is an open pit copper-gold mine owned 50% by Imperial and 50% by a Japanese Group. 2014 forecasted production is 36 million lbs of copper, 2,900 ounces of gold, and 175,000 ounces of silver. The Huckleberry mine generated $1.4 million in net income in Q2 for Imperial. A replacement bull gear will be replaced later in the year.

Bottom line: Imperial will be an interesting stock to watch in the next several months. The stock has taken an almost 50% haircut since the spill at Mount Polley. We believe the return outweighs the risk. As Red Chris commences operations, the share price will move higher. No immediate rush to buy the stock but if it pulls back anymore it is definitely worth consideration.

Catalysts:

- Red Chris commissioning (Oct/Nov 2014)

- Mount Polley restart (?)

- Q3 results

Note: The stock was as high as $18 earlier this year.

SEP