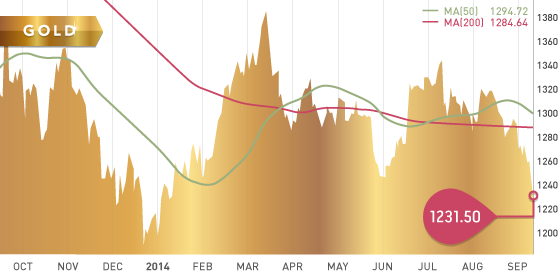

Gold

The yellow metal continues to struggle as the US dollar powers higher closing at $1231.50. The Fed meeting next week will be very important for gold. Investors will be looking for clues on when a potential interest rate hike may take place. Technical selling has also added to the decline in the gold price, but gold bulls argue that the USD has had too much of a run and needs to pullback.

The political situation between Russia and Ukraine seems to have taken a back seat to the US economy as far as gold catalysts go.

Technicals:

- Support: $1,225

- Resistance: $1,260

- 50 day moving average: $1,294.72

- 200 day moving average: $1,284.64

Silver

Silver closed $18.61 per ounce. It will be extremely tough for silver producers to make money at current levels.

Technicals:

- Support: $18.25

- Resistance: $19.00

- 50 day moving average: $20.07

- 200 day moving average: $20.01

Platinum

Platinum closed the week at $1,370.50 per ounce, down ~$40 on the week to hit a 10 month low. Looking at the charts, platinum broke through $1,400 level which was key support. At the current price,producers will be struggling to make money. The South African Rand is also near a seven month low which is not helping matters.

Technicals:

- Support: $1,350

- Resistance: $1,400

- 50 day moving average: $1,456.21

- 200 day moving average: $1,434.55

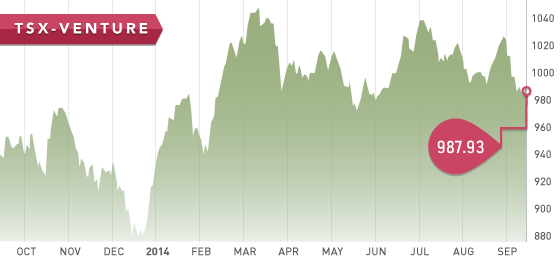

The TSX Venture closed the week at 987.93, which is down from the open of 994 on Monday. Commodity prices continue to remain low because of the strong USD. The Venture is back to early April levels and is close to support levels. We recommend being patient and waiting for bargains that we expect to see in the next couple months. Volume on the TSX Venture continues to remain low with two days having less than 55 million shares traded this week.

A Look Ahead

The key items on the calendar this week are:

- September 16 Tuesday – Producer Price Index

- September 17 Wednesday – Consumer Price Index, FOMC rate decision

- September 18 Thursday – Employment Claims, Housing Starts

- September 19 Friday – Leading Indicators

Quebec development companies are almost complete. Integra Gold jumps up and grabs the top spot after releasing a PEA and acquiring a mill in the last several months. Once Quebec is done we will be updating Alaska and Canadian North companies.

We continue to see a separation in the database between higher quality names and those who will probably not survive.

Top 10 Fall update:

Cayden Resources – CYD.T – Cayden received a takeover offer from Agnico Eagle on Monday after the bell. A nice 42.5% premium! Congrats to all shareholders of Cayden.

Mart Resources – MMT.T – Mart issued a production update for the month of August this week. The Umugini pipeline, which is a major upcoming catalyst for the company, continues to experience delays. This time it is related to weather and also local community issues. We continue to think MMT stock offers an attractive risk/reward scenario at these prices.

Marlin Gold (MLN.T) – Marlin issued a press release this week announcing the Mexican government has approved the El Compas permit. The La Trinidad mine continues to make progress and is ramping up.

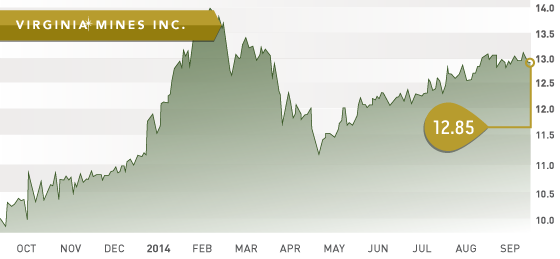

- Symbol: VGQ.T

- Price: $12.85

- Shares Outstanding: 33,753,780

- Market Cap: $433.4 million

- Cash: $6,678,145 + short term investments $42,110,645

This week we take a look at Virginia Gold Mines, a prospect generator and upcoming royalty company. Virginia has made the discovery of two new mining districts: Eleonore and Coulon in the past 10 years. The Eleonore deposit is over 8 million ounces with excellent potential for expansion. Goldcorp purchased the Eleonore depoist for ~$420 million in stock back in 2006.

Virginia held on to a 2.2% royalty NSR on the first 3 million ounces produced at Eleonore. The royalty increases at an increment of .25% for every additional million ounces produced up to a maximum of 3.5%. Goldcorp has forecasted production will average 600,000 ounces a year. Production this year is expected to be ~50,000 ounces. Virginia will start to receive royalty income in Q2 2015 as Goldcorp has already prepaid $5 million. Goldcorp will be drilling the project over the next couple years looking to increase the size.

The Coulon project is a VMS camp that is partnered with SODEMEX (part of the Quebec government). Diamond drilling is expected to commence in the fall consisting of 10,000 meters. The potential of this area (Coulon) looks promising but a fair amount of work is still needed to determine what/if the area holds an economic deposit.

Bottom line: Virginia owns a royalty on one of the best new mines in the world coming into production in the next quarter. I would not be surprised if the bigger royalty companies are watching this one closely with thoughts of a takeover offer. As investors wait for the royalty income to come in, Virginia sits with over $40 million in cash and is waiting for opportunities.

Catalysts:

- Eleonore initial production

- Results from any exploration project

- Possible takeover offer

AUG