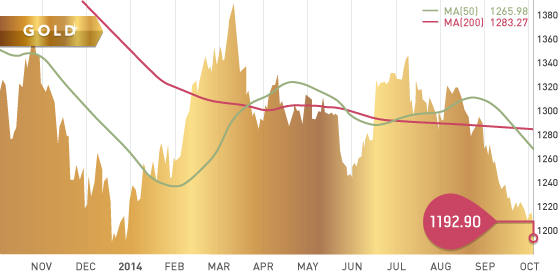

Gold

As a result of Friday morning’s release of better than expected US Jobs numbers, gold fell $27.10 (2.2%) to close the week at $1,192.90 per ounce. The US added 248,000 jobs in September with the unemployment rate dropping below 6% for the first time since pre-recession.

After holding its ground for the past 2 weeks, gold broke key psychological support at $1,200, and is now looking to test long-term support of $1,180. Gold has found support at this level twice in the past year and a half, and has not traded below the $1,180 level since early 2010.

This may be the final stand for gold, as a move in either direction may be a signal of whether the bears or the bulls are in control. Regardless, in the short term, rosy economic data and a strong US dollar will continue to exert pressure on the yellow metal.

Technicals:

- Support: $1,180

- Resistance: $1,225

- 50-day moving average: $1,265.98

- 200-day moving average: $1,283.27

Silver

Silver closed the week at $16.83 an ounce, down $0.82 (4.6%) on the week. Silver is now down over 20% year to date. The metal continues to put in new multi-year lows as it follows gold’s descent in addition to more sluggish industrial demand. The gold/silver ratio is currently 1:70, the highest in 4 years.

Technicals:

- Support: $16.50

- Resistance: $17.64

- 50-day moving average: $19.08

- 200-day moving average: $19.87

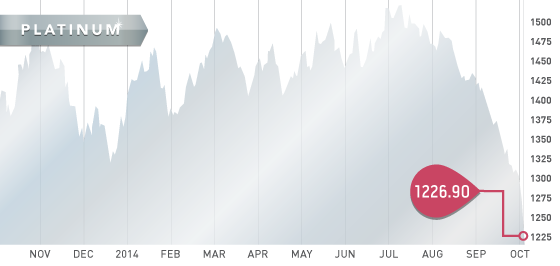

Platinum

Platinum closed the week at $1226.90 per ounce, down $75.10 or 5.7% on the week, shedding the most out of the precious metals group. The slowing growth of China and Europe has raised concerns about demand for platinum.

Technicals:

- Support: $1,225

- Resistance: $1,280

- 50-day moving average: $1,402.25

- 200-day moving average: $1,431.01

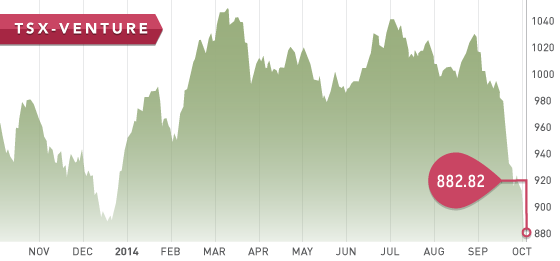

The strength of the US dollar continues to impact the prices of precious metals as well as oil. Both commodities are prevalent on the TSX and TSX-V, and have both felt pressure.

The TSX recorded its 5th weekly decline, including a 4 month low on Thursday. The TSX Venture was down as well, closing the week at 882.82.

Precious metals and copper both dropped below important levels on Friday. Although the Venture closed up slightly on Friday, the start of October has displayed a continuation of the September sell off, with a 4% drop from last week’s close of 919.42, and over 13% decline in just the past month.

A Look Ahead

The key items on the calendar this week are:

- October 7 Tuesday – Consumer Credit

- October 8 Wednesday – Crude Inventories

- October 8 Wednesday – FOMC Minutes

- October 9 Thursday – Initial Unemployment Claims

Alaska/Yukon and Northwest Territories development companies will be posted early this week. We are also nearing completion of the Colombian exploration and development companies, with the region experiencing a significant trimming as a result of these challenging market conditions.

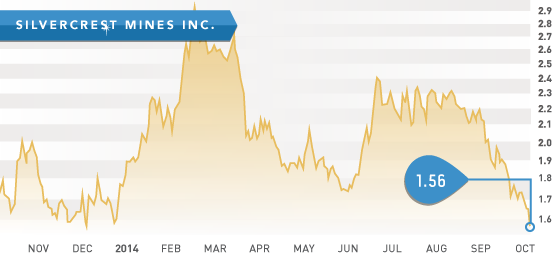

- Symbol: SVL.T

- Price: $1.56

- Shares Outstanding: 118,728,205

- Market Cap: $185,216,000

- Cash: $40,856,666 (June 30th)

- Significant shareholders include Sprott Inc (6.6%), AGF Investments (5.5%), and Directors/Management (5%)

SilverCrest is run by a successful management team with experience in Mexico and various other Latin American countries. SVL is in a healthy financial position with a producing mine in Mexico, which has been in production since 2011. The Santa Elena silver/gold mine is currently in the final stages of a transition phase from open-pit to underground mining and milling operations. Now that the capital-extensive expenditures of the expansion have been completed, the mine should be generating free cash flow starting in the fourth quarter.

The underground expansion adds 8 years to the life of mine (LOM) of Santa Elena, with pre-tax NPV5% of $128.7 million and an IRR of 49% using $1250/oz gold and $19.50/oz silver. The CAPEX for the expansion is $99 million of which SVL has funded with cash flow from the mine as well as financings. The expansion has come in on budget, and is only slightly behind schedule due to a couple of minor delays.

Although underground mining requires higher operating costs compared to open-pit, these will be offset by increased production and higher recovery from the new mill and processing plant. The expansion at Santa Elena will increase the throughput from 2500 tonnes/day to 3000 tonnes/day, while the all-in cash costs are expected to remain between the $11-$12 range. The company is looking at the potential to increase the silver recovered by using lead nitrate in the processing circuit. Lab tests so far on the Santa Elena ore show a 5%-15% increase in recovery. Whether this translates to commercial production remains to be seen. SilverCrest is continuing to test this during mill optimization and could potentially increase the silver produced over the LOM if current testing is successful.

Through expansionary and exploratory drilling at Santa Elena, the deposit has the potential to grow further and add more years to the LOM plan. SilverCrest has recently completed 24 holes of definition drilling to delineate and better define the reserves and first stope mine designs. These 24 holes covered the portion of the reserves to be produced in 2015. The results displayed good grade reconciliation with current SilverCrest models at Santa Elena. Drilling to date will be included in an updated resource and reserve estimate expected in early 2015. SilverCrest has grown their production 30% over the past two years, and could grow that number even further with the ongoing optimization measures currently being performed.

Also of note, the current mine plan will be using 2 different mining methods during the LOM; long hole stoping (approximately 70% of ore reserve) and the more capital intensive cut and fill method (30%). A couple of the holes recently drilled during the infill program have indicated that the percentage of reserves amenable to long-hole stoping may have the potential to increase. If this is confirmed with future infill drilling, this outcome would result in lower average operating costs over the LOM.

The recently acquired (Jan. 2014) Ermitano target sits 3.5 km from Santa Elena and will be a priority focus of exploration going forward due to its proximity to Santa Elena and the potential to possess similar mineralogy. Of note, the leach-pad could provide future heap-leach material, either from Ermitano or other properties in the vicinity.

SilverCrest also has a healthy pipeline of projects, including the aforementioned Ermitano property, as well as the La Joya Project located in Durango Mexico. A PEA of the La Joya deposit was released in October of last year. Using $1200/oz gold and $22/oz silver the pre-tax NPV5% is $133 million with an IRR of 30.5% and a 9 year LOM plan. A 30% drop in these Base Case metal values still generates healthy economics of the project. Looking ahead, the profits generated at Santa Elena could help fund the potential development of both Ermitano and/or La Joya. At this point it looks as though SilverCrest will prioritize Ermitano in attempts to define and procure future mill feed.

Sandstorm Gold has a gold streaming agreement in regards to 20% of the gold produced at Santa Elena (Note: not applicable to Ermitano). In February Sandstorm elected to exercise its underground option by making an additional $10 million upfront payment.

Bottom line: It may be difficult to fight the trend of declining gold and silver prices that we have experienced over the past couple of years. However, amid these challenging market conditions, there are some well managed companies that are generating cash and developing promising assets with strong growth potential. SilverCrest is one of these companies, as it is one of the lowest cost silver producers in the sector and is therefore able to remain competitive, even with lower gold and silver prices. Management has done a great job starting small and using that success to fund further growth. The extreme fall in gold and silver in the past month has presented an opportunity to pick up undervalued companies with low cost production. This collapse in gold and silver prices also coincides with this period of transition to full underground production at Santa Elena. In time, the market may wake up to the strong balance sheet and the near-term generation of free cash flow, so long as the underground transition proceeds without disappointments.

Potential Catalysts and Events to Monitor:

- Mill optimization and achievement of nameplate throughput.

- Potential Q4 decision to reopen the Santa Elena open-pit, which contains approximately 4500 oz gold and 280,000 oz of silver.

- Initial drilling of Ermitano target. An economic deposit defined here would provide future heap-leach and mill feed at Santa Elena.

- Santa Elena Resource and Reserve update expected by early 2015

- La Joya Pre-Feasibility Study

- Potential Acquisitions: Properties or Development/Producing Companies

- Positive Lead Nitrate test results and further infill drilling could both provide potential increase in recovery, and lowered operating costs (increased Long Hole stoping percentage) respectively.

Note: SVL is trading at its 52 week low. If SVL does not recover some ground during October and early November then it may experience some tax-loss selling in late November – late December.

OCT