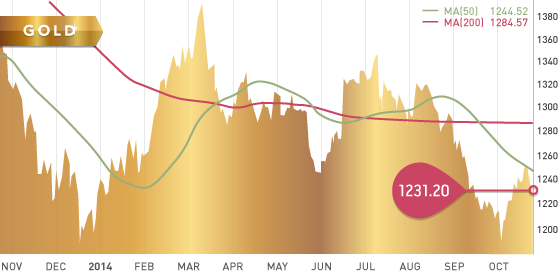

Gold

After breaking through resistance at $1,250 on Tuesday, gold pulled back the remainder of the week to close Friday at $1,231.20, down $7.30 on the week. The pullback was due to rebounding equity markets, resulting from better than expected economic data, as well as strong corporate earning results. Outflows from Gold ETFs continue to show softening interest in gold as investors shift back into equities and away from safe haven assets. However, gold demand attributed to the Diwali festival is up 30% from last year. Due in large part to the preparation for the festival, India imported $3.75 billion worth of gold in September, a 450% increase to the same period last year.

Technicals:

- Support: $1,222

- Resistance: $1,255.60

- 50 day moving average: $1,244.52

- 200 day moving average: $1,284.57

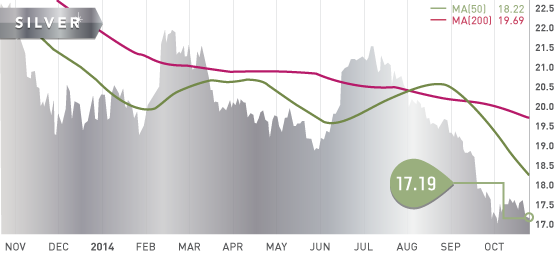

Silver

Silver again closed the week at $17.19, which is flat from the previous mark. The metal has traded flat the past two weeks, experiencing a mere decline of 20 cents over that time period. This may indicate silver is waiting for a decisive move by gold in either direction.

The latest report by CPM Group suggests silver demand is likely to remain strong. Investors were net buyers of silver ETPs during the first 7 months of the year, pushing the ETP holdings to a record high in July. It is anticipated by the report that investors will accumulate 1 billion ounces of silver over the next 10 years. This should be supportive of prices, as investment demand is the primary driver of silver prices. Near-term, CPM expects silver to trade between a base of $17 and a high of $21 an ounce, with the possibility of experiencing additional selling pressure over the next year. Over the long term, CPM believes investors will benefit from buying silver and silver equities.

The Gold:Silver ratio remains just under 1:72, a 5 year high with the 5 year average at 1:57.

Technicals:

- Support: $16.64

- Resistance: $17.82

- 50 day moving average: $18.22

- 200 day moving average: $19.69

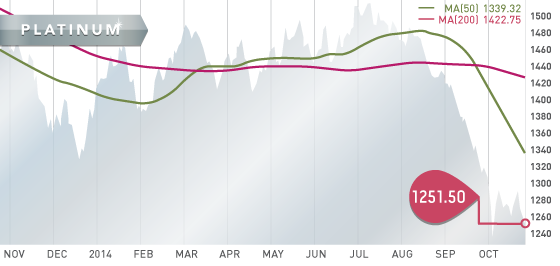

Platinum

Platinum, like it’s precious metals cousins, sold off after initial gains Monday and Tuesday. The metal closed Friday at $1251.50, down $10 on the week. The weakness over the past couple months has been attributed to concerns over a slowing Chinese economy, as well as an ending to the 5-month long platinum strike in South Africa. It was announced that operations at Anglo American’s platinum mines hit full production in September after following an ending to the strike. The ending of the strike removes the supply concerns priced into the platinum price earlier in the year.

Technicals:

- Support: $1,239.70

- Resistance: $1,300

- 50 day moving average: $1,339.32

- 200 day moving average: $1,422.75

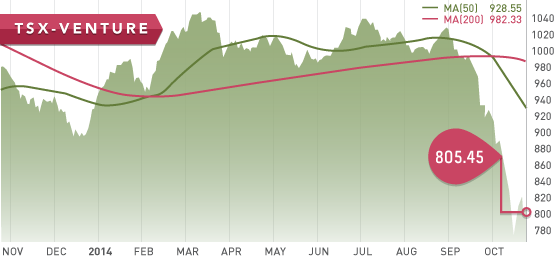

The Venture benefitted slightly from a broad market rally on Thursday. The rally was a result of better economic news coming out of the US and the Euro Area, accompanied by strong earnings reports announced this week. The TSX closed the week up over 300 points. However, the TSX-V closed Friday at 805.45, down slightly at a half percent change on the week.

The positive PPI report out of the Euro Area eased fears about a looming recession for the region. The TSX was also lifted by Caterpillar reporting strong third quarter profits, as well as a strong move up by Agrium. As Caterpillar is an important indicator of economic activity, it has a strong influence on the TSX when it has large moves, such as the 5% gain Caterpillar had on Thursday.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, key economic items on the calendar this upcoming week are:

Monday October 27

- Bank Stress Tests (EU)

Tuesday October 28

- Consumer Confidence (US)

Wednesday October 29

- Fed Rate Decision (US)

- QE Treasuries and MBS (US)

Thursday October 30

- Unemployment Rate (GER)

- Inflation Rate (GER)

- Inflation Rate (JPN)

- GDP Growth (US)

Friday October 31 –

- Unemployment Rate (EU)

- Manufacturing PMI (CHN)

It is expected that this week will mark the end of QE3. Also, the markets will keep a close eye on the Fed’s rate decision on Wednesday, as well as the EU bank stress tests early in the week.

Last Week: Chinas GDP growth exceeded expectations last week, although it continues to decelerate. Inflation in the US was in line with expectations, and new home sales surprisingly increased month over month opposed to an expected decline. The Bank of Canada kept it’s interest rate at 1%.

This past week, the Tickerscores team attended the Silver Summit conference in Spokane, Washington. Tickerscores was both an exhibitor as well as a presenter. We received a lot of positive feedback about Tickerscores from both investors as well as companies.

As result of the declining market sentiment and silver price, the conference was very quiet this year. This scenario however, generated a better opportunity to speak with the companies and analysts present. Jeffrey Christian of CPM Group was a valuable speaker to listen to. The CPM Group predicts that silver will trade between a $17-$21 short-term, and remain strong going forward. Mr. Christian is concerned about the Fed’s balance sheet, and believes it will continue to be supportive of gold and silver.

Some companies that impressed us at the show were Rockhaven Resources (Pick of the Week), Fortuna Silver Mines, MAG Silver, Silvercrest Mines, and Santacruz Silver. Some miners such as Endeavour Silver have been completing expansion and development programs that will significantly increase and ensure future revenue generation from their projects. This downturn in silver prices may present a timely opportunity to take advantage of companies that are completing capital intensive expansion and development projects such as Endeavour.

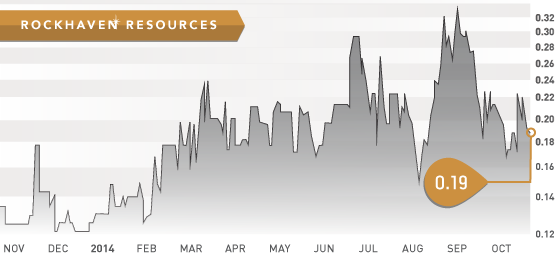

- Symbol: RK.V

- Price: $0.19

- Shares Outstanding: 83,783,334

- Market Cap: $15,918,834

- Cash: $1.2 million in working capital

- Significant shareholders: Management and Insiders (18%), Tocqueville 8%, Strategic Metals (32%)

Note: Rockhaven was rated #1 in Tickerscores most recent Alaska and Canadian North Exploration update.

Rockhaven Resources is exploring their 100% owned Klaza Project located in Southwestern Yukon. The Klaza project, hosted in the Dawson Range Gold Belt, was acquired from ATAC Resources in late 2009. With Archer Cathro on board providing project management, Rockhaven immediately commenced drilling in the 2010 exploration season, and received positive results from their initial drill program. A successful program was completed in 2011, consisting of approximately 16,500 meters. In 2012 the company completed a “Phase 1” drill program totalling 22,000 meters, which consisted of large step-outs . This program identified 9 mineralized zones contained within a 4km by 2 km mineralized area, with a aggregate vein strike length of 9.4 km. By completing an extensive trenching program during the 2013 exploration season, Rockhaven was able to link the mineralized zones within this area. With a better understanding of the structures at Klaza, Rockhaven conducted a drill program this year that concentrated on the Western BRX and Western Klaza zones. With the exercising of amended warrants, Rockhaven was able to raise the capital to expand the drill program from 12,000 meters to 21,000 meters. The results from this years program met expectations and in some cases exceeded them, especially the recently announced hole KL-15-238. There has been 238 holes for close to 60,000 meters drilled on the Klaza Property since Rockhaven started drilling in 2010, with room for expansion. Rockhaven is debating whether to produce an initial resource calculation, or wait until more drilling has been completed and markets improve.

With Klaza core viewed by two separate CBM (Carbonate Base Metal) specialists, the company now believes that Klaza is host to a CBM epithermal system. This has further been supported by drill results this year, namely the recently released hole KL-14-238. This was the last hole of the 2014 program and was somewhat of an aggressive step out, but proved to be well worth it. The hole encountered 16.29 g/t gold, 1,435 g/t silver, 5.57% lead, and 6.23% zinc over 1.37 meters. This 1.37 meter interval amounts to 45 g/t gold equivalent, and is contained within a broader 18.5 meter mineralized complex. This hole substantially extended the known depth of mineralization to approximately 400 meters below surface. This is an approximate 150 meter increase from the previous known depth intersected by hole 229 in that area. We expect this extension will be in-filled in the subsequent drill program, and should add significantly to the size of the resource.

In addition to hole 238, impressive results over the past 4 years of drilling have displayed high-grade mineralization, such as hole 137 returning 62.76 g/t AuEq over 1.31 meters, hole 154 returning 74.26 g/t AuEq over 1 meter, and hole 143 returning 42.28 g/t AuEq over 1.65 meters.

Preliminary metallurgical test have shown exceptional recovery using a combination of gravity and floatation. Results from Western BRX showed recoveries of 97.6% and 98.3% for gold and silver respectively. The Western and Central Klaza zone showed similar recoveries of 97.3% and 99% respectively. Although very encouraging at this point, further metallurgical test should improve the confidence in the processing and recoveries of Klaza ore.

The project is in a good location, having well established dirt road access to the property, and is only 50 km from a major highway. The Klaza project is fully permitted for advanced exploration, and the company also has strong support from local First Nations. However, the 2013 report by the Fraser Institute knocked the Yukon to 19th from 8th most attractive jurisdiction to mine. This drop in rating was due to concerns over regulation, land claims, and taxation. These are alll items that investors should keep a close eye on if investing in projects in the Yukon. In light of this, a top 20 rating out of 112 jurisdictions around the world is something that should give investors some confidence in the Yukon.

Another item that may need addressing is the capacity of the transmission lines that will supply future projects in the Yukon with power.

Bottom line:

Of course with any company at early stage exploration, there are numerous risk hurdles to overcome, and Rockhaven is no exception. However despite the conventional risks associated with junior exploration companies, there are a number of factors about Rockhaven that should make the company attractive to investors. The grades are excellent, with positive metallurgy. Mineralization occurs within 9 separate parallel zones over substantial strike lengths, potentially amenable to bulk underground mining. There is plenty of room for expansion, as well as the potential for discovery at multiple untested targets on the property. The project is located in a politically safe jurisdiction, with good road access and infrastructure near by.

This strong management team has extensive experience in the area, and is an obvious believer in their project, holding 18% of the shares. Strategic Metals, also part of the Archer Cathro family, holds 32%. In addition to the strong hands holding stock, there has been numerous insider purchases over the past year, including the exercising of amended warrants in July.

Potential Catalysts and Events to Monitor:

- Potential maiden resource estimate in 2015 (Board decision)

- Potential 2015 drill program (Summer 2015)

- Yukon Policy Risks (regulations, land claims, taxation)

- Further Metallurgical Tests

OCT