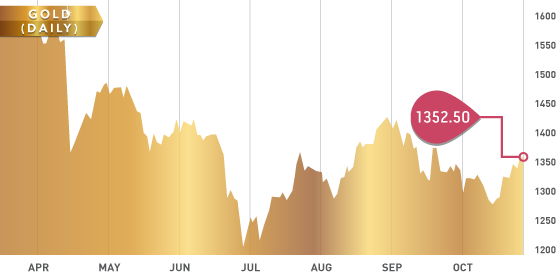

The precious metals held higher all week since rebounding from the spike low of $1251, which formed a hammer candlestick pattern on October 15th that we highlighted in last week’s Weekly Trends. The US dollar softened all week, which helped the precious metals move higher. Next week’s Federal Open Market Committee (FOMC) meeting will likely be more of the same as recent economic data has been less than stellar coupled with the debt ceiling issues.

Gold Resistance levels: $1357, $1375, $1395

Gold Support levels: $1328, $1312, $1300

Platinum follow up: Platinum had a constructive week holding in an upper flag type pattern, which is quite bullish. The $1460 area is a small level of resistance, but the chart looks quite healthy and appears to have broken the last six weeks of down trending. A break below $1430 would likely lead to a retest of $1410-$1400, but buyers will definitely come in around that area and protect the downtrend breakout attempt.

Gold Chart

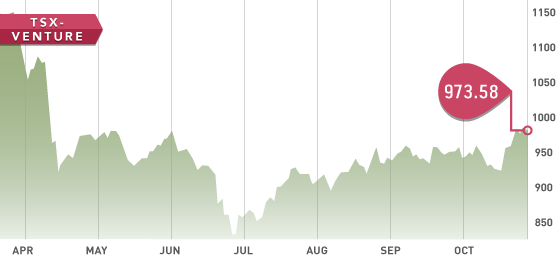

The TSX-V put together a very constructive week moving up to the 970 level for the first time since the spring, stopping just below the resistance of 975 that we have mentioned several times as an important area for the market as a whole. With precious metals stocks down on average 35%-40% any rebound in the price of gold should be met with considerable rebounding of the precious metals stocks. A lot hinges on what the FOMC plans to do with regards to tapering and its outlook for the rest of the year and Q1 2014.

TSX-V Chart

Symbol: BTO.T

Symbol: BTO.T

Share price: $2.81

Shares outstanding: 651,380,950

Market Cap: $1,784,784,000

This week we take a look at B2Gold; an intermediate gold producer operating three mines worldwide. One of the things we like most about B2Gold is production is expected to double from 380,000 ounces this year to 760,000 ounces in 2018. The company is profitable at current gold prices and estimates an “all in” cash cost of $1063 per ounce, which provides good leverage on the gold price.

B2Gold is led by a terrific management team, which has a proven track record for building and operating mines. The management team owns 36.3 million shares, which is 5.6% of the float so they are aligned with shareholder interests. In our opinion, B2Gold is a stock that should be on the radar of every gold investor.

OCT