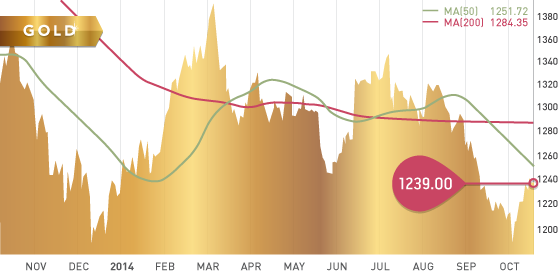

Gold

Gold continued its rally this week, although it was slightly tepid. The price met sharp resistance at $1,250 on Wednesday, which immediately drove the price down below $1,240. Since that event, gold traded sideways in the $1,240 range for the remainder of the week closing at $1,239, up 1.3% from its close last week.

Gold benefited early this week from a broad sell off in North American and world markets. The concern about global growth and the language from some FOMC members are supporting gold at the moment.

Technicals:

- Support: $1,222

- Resistance: $1,250.50

- 50 day moving average: $1,251.72

- 200 day moving average: $1,284.35

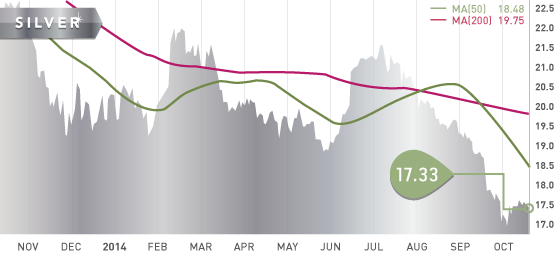

Silver

Silver closed the week at $17.33, basically ending flat for the week. The supply deficit is still a concern, but silver seems to be waiting for a stronger move up by gold before it appreciates itself. The Gold:Silver ratio is now just under 1:72, the highest in 5 years.

Technicals:

- Support: $16.64

- Resistance: $17.82

- 50 day moving average: $18.48

- 200 day moving average: $19.75

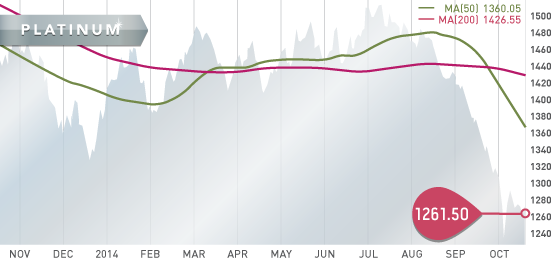

Platinum

Platinum closed the week at $1,261.50 ending the week relatively flat after positive gains on Friday. On Thursday, Platinum actually closed lower than gold for the first time since April of 2013. Ongoing concerns about a slowing Chinese economy continue to weigh down the metal.

Technicals:

- Support: $1,220

- Resistance: $1,300

- 50 day moving average: $1,360.05

- 200 day moving average: $1,426.55

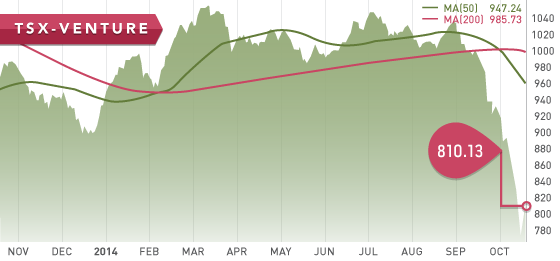

The TSX and the TSX-V ended a tumultuous week on a positive note, as investors poured money back into North American equities. The TSX and the TSX-V benefited from this late week market rally, although the TSX ended the week flat and the TSX-V still managed to loose 2% on the week.

Concerns about Germany and Greece, as well as reaction to the IMF cutting their global growth forecast, all contributed to the markets strong reactions early in the week. The sell-off was reversed Thursday and Friday as investors poured back into North American equities. This was a reaction in part to an oversold market, but also because of a surprise comment by a hawkish Fed official that QE should continue past October due to inflation concerns.

Comments from another Fed official Kocherlakota, also questioned the rate of tapering as well as the US being below maximum employment. Kocherlakota also stated that a rate hike in 2015 would be “inappropriate”. He believes the Fed should cut rates to combat unemployment. There is also concern that the strong US dollar will hurt US exports, which is counteractive to a country that is still trying to stimulate its economy and pull itself out of a recession.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, key economic items on the calendar this upcoming week are:

Monday October 20

- GDP (China)

Tuesday October 21

- Existing Home Sales (US)

Wednesday October 22

- Inflation Rate (US)

- PPI, Core PPI (US)

- BoC Rate Announcement (CAN)

- BoC Monetary Policy Report (CAN)

- Retail sales (CAN)

- BoE Meeting Minutes (UK)

Thurday October 23

- Consumer Confidence (EU)

Friday October 24 –

- PMI (China)

- New Home Sales (US)

It will be a busy Wednesday for global economic data this week which could impact the markets.

Last Week: Although lower than consensus estimates, Chinas balance of trade surplus is still increasing substantially. Export growth out of China grew 15.3% year over year, largely driven by exports to the US. This is most likely a result of the stronger US dollar. However, despite the recent strength the dollar has shown, it has actually been weakening against the yuan over the past couple of months.

US initial jobless claims for the second week of October fell last to their lowest levels since April 2000. This beat the consensus, indicating a recovering labour market. Industrial Production and Manufacturing were up in September beating estimates. US Retail sales were down more than expected, creating worries about the US economy. This may foreshadow lower growth for Q3. Building permits came in below consensus as well, although up slightly from last month.

Colombian exploration companies will be released early this week. We are currently working on Colombian developers, and Red Eagle gaining some attention with their recent Feasibility report showing robust economics for their Santa Rosa gold project. Construction is anticipated to commence in the second quarter of 2015.

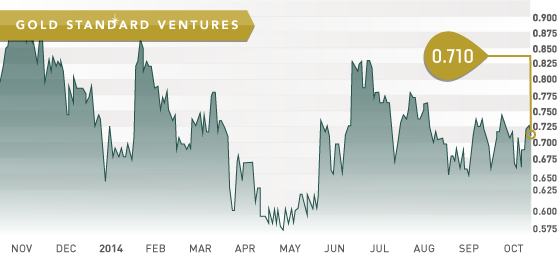

- Symbol: GSV.V

- Price: $0.71

- Shares Outstanding: 122,295,106

- Market Cap: $86,829,525

- Cash: $630,670 (June 30th) + $6.3 million raise in August.

- Significant shareholders: Insiders and Associates (15%), 50% Institutional Ownership including 13.1% held by FCMI (Albert Friedberg)

Note: Gold Standard Resources has been consistently a high scoring company in our Tickerscores database, though it dropped in our last update to only 51 due to a large decline in cash position. This was because they were making a strategic consolidation by purchasing the Pinion Project, which gives them a very large land package in the Carlin Trend.

Overview

Gold Standard Resources is exploring their Railroad-Pinion Property, a 45 square mile land package located in the prolific Carlin Trend. GSV has been busy over the past few years acquiring properties, and now within this newly consolidated underexplored land package are three priority targets GSV is focusing on: Pinion, North Bullion, and Bald Mountain. All three targets are open to expansion.

Pinion had a historical resource prior to the acquisition by GSV. Upon acquiring 100% of Pinion in March of this year, GSV immediately commenced a drill program as well as a re-logging program of the historical drill core. This led to a 43-101 compliant resource released in September. Contained in this resource is 423,000 indicated ounces of gold, and 1,022,000 and 9,43,000 inferred ounces of gold and silver respectively. Mineralization at Pinion is open in all directions, with drilling currently underway to expand and further delineate the deposit. Pinion is a shallow oxide deposit, with oxide deposits generally requiring much lower CAPEX to put into production.

The Bald Mountain gold-copper oxide target is one that is of high interest for GSV. Last year hole RRB13-1 returned three horizons of mineralization, all oxidized. The first horizon at about 200 meters below surface returned 56.1 meters of 1.47g/t gold. The second horizon returned 23.3 meters of 0.4% copper, roughly 270 meters below surface. The third horizon contained small intervals of gold, copper, silver, lead, and zinc. GSV was excited about this hole, but downplayed their enthusiasm as they still needed to gain control of a portion of land in the vicinity of the discovery. With GSV now in control of that chunk of property, they are drilling 5 holes at Bald Mountain to follow up on hole RRB13-01. Results should be out soon. This is an exciting target which is all oxide, with preliminary metallurgical tests showing an 82.2% un-weighted average recovery after one hour of cyanide agitation leach.

The North Bullion deposit is an impressive discovery, and one that GSV has been focusing on since 2012. This deposit is a classic Carlin sedimentary-hosted system. The mineralization at North Bullion is different then the other two targets, in that the mineralization is refractory as opposed to oxide. This would require different processing and therefore more CAPEX for the project. However as an alternative, GSV could send any potential ore from Gold Bullion to a mill in the vicinity with established recovery techniques for the refractory ore.

With the phase 2 drilling under way, currently 3 drills turning, there should be lots of news going forward for GSV. The characteristics of oxide deposits allows GSV to use RC drilling, which is cheaper than diamond drilling, hence allowing GSV to drill more holes with their budget. The Emigrant Mine is right next door to the Railroad-Pinion Property, and is one of Newmont’s most profitable mines, at lower grades then found at Pinion. During exploration, the resource at Emigrant grew quickly to 2-3 million ounces. GSV hope to achieve similar growth at Railroad-Pinion.

Bottom line:

Gold Standard has a strong management team that is clearly able to raise the necessary funding when needed. At three separate occasions over the past year, they have raised over $22 million, mostly without warrants attached. GSV has been one of the few junior companies able to raise over $10 million in this challenging market. We think that fact, coupled with the 65% institutional and insider combined ownership, indicates the expectations and enthusiasm the market has with this project.

GSV has a very experienced technical team that have contributed to a number of discoveries in the Carlin Trend with Newmont. Nevada is one of the best regions in the world for mining, having been ranked 8th in the world by the Fraser Institute. Although one situation to monitor is the upcoming vote on Nevada’s mining tax, as it could potentially open the door for higher taxes for mining companies.

With the downturn in the market, and the punishment the majors have received as a result of pursuing large, low-grade deposits with massive CAPEX, mining companies are now shifting their focus to smaller, higher-grade deposits with low CAPEX and simple metallurgy. GSV is showing signs that they may be able to demonstrate those such qualities at their Railroad-Pinion deposit.

Potential Catalysts and Events to Monitor:

- Current Drilling at Pinion, Bald Mountain, and a third target recently discovered at South Pinion.

- Bald Mountain and results pending.

- Updated Pinion resource estimate – Q1 2015

- North Bullion maiden resource estimate – 2015

- Pinion PEA mid-2015

- Nevada vote on current mining tax cap in November

OCT