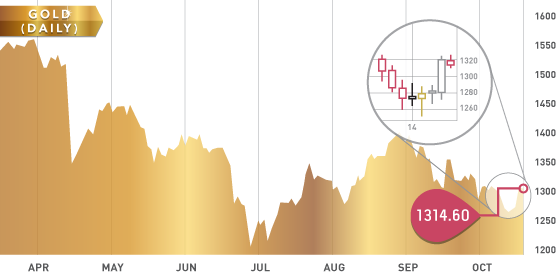

Metal prices continued to whip around this week as fear levels rose on the government shutdown and potential debt ceiling crisis. Tuesday was the turn for gold as it broke below our $1270 level moving all the way down to $1250 before rebounding and closing green on the day. This is extremely bullish for the short-term and is evidenced by a solid performance on Wednesday and Thursday. Gold has been in a longer-term downtrend all year, and a short-term one since peaking above $1425 in late August. The $1275 area for gold will remain a crucial support point, with another support point above that at $1290.

Platinum looks to close out the week with five positive days in a row. Having both intrinsic value as well as major industrial uses, platinum is an excellent place to put money to work. It too has been in a short-term downtrend since August, but looks to have broken that trend this week. Holding above $1400 and $1420 are several key areas of support. The 50-day moving average at $1460 is likely the next resistance point followed by $1500.

Gold Chart

The TSX-V regained the 950-level on Thursday after spending most the week in the 930 area. On the Top 20 Short List provided by the TSX, the only notable change was an additional 10 million shares of Kinross Gold Corp put on the short side. This represents roughly a 59% increase in the short position. With the debt ceiling and government shutdown now out of the way, investors can at least temporarily refocus on the fundamentals. Earnings season will be coming up in early November and with the average gold and silver prices coming in lower in Q2 than in Q1, we should expect to see some weak numbers coming in across the board.

Headline of the Week

“Africa Oil arranges a $450,000,000 private placement”. Precious metals CEOs have to cringe seeing that headline. Most of them are running around trying to arrange sub $500,000 placements to keep the lights on. Not to mention that $450 million is roughly the same as the market caps of all BC, Ontario and Mexican exploration companies combined.

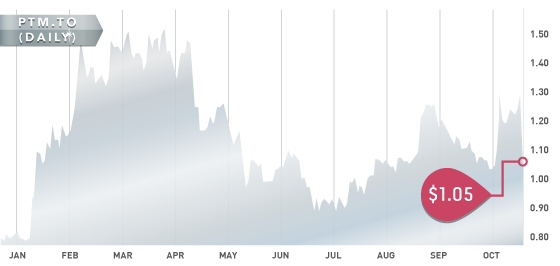

Symbol: PTM.T

Symbol: PTM.T

Share price: $1.05

Shares outstanding: 402,759,542

Market Cap: $519,560,000

On October 18th, Platinum Group Metals put out a press release stating that one of their major partners will not be participating in their share of the 6-month forward budget. The portion of the budget that Africa Wide was supposed to cover is approximately $21.8 million USD. As of the last financials, Platinum Group Metals had $90 million in cash, which would cover this $21.8 million easily. This is a 6-month forward budget, which indicates how capital is going to be strategically allocated over the next 6 months.

This definitely throws a wrench into the short-term picture for Platinum Group Metals, but this should be treated as a potential entry point into a company that hasn’t seen its share price below $1.00 for more than a short time all year. The entry window was extremely short as the stock traded down to $0.97 before rallying back to $1.18 – a phenomenal opportunity.

The assets that PTM has are just as good today as they were yesterday and perhaps more valuable if a deal is worked out where PTM can obtain a higher percentage of the overall revenue.

We will continue to update subscribers as PTM makes some short-term decisions.

OCT