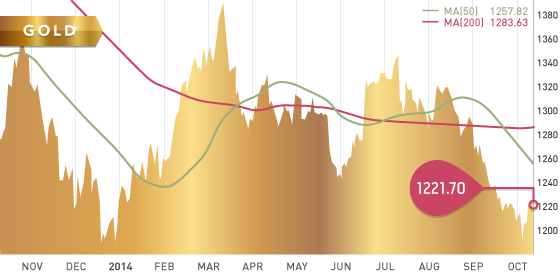

Gold

After its descent to the $1,190 level last Friday, gold managed to rally this week following a brief low of $1,183.30 Monday morning. The price of gold jumped after the FOMC minutes released Wednesday indicated that interest rates will probably stay close to zero longer than expected. The committee is also concerned about weakening economies around the globe. Gold finished the week at $1,221.70 up $28.80 (2.4%) from the $1,192.90 close last Friday. The bounce this week was important for gold as it showed support was present once again sub-$1,200. This formed a triple bottom with each bottom being slightly higher then the one previous.

Technicals:

- Support: $1,200

- Resistance: $1,242

- 50-day moving average: $1,257.82

- 200-day moving average: $1,283.63

Silver

Silver closed the week at $17.30, which is up from last weeks $16.83 close. It moved up $0.47 or 2.8% on the week. Despite silver’s poor performance lately, the metal’s supply deficit coupled with strong silver coin sales is encouraging. The Gold/Silver ratio remains at 1:70, the highest in over 4 years.

Technicals:

- Support: $16.64

- Resistance: $18.00

- 50 day moving average: $18.75

- 200 day moving average: $19.81

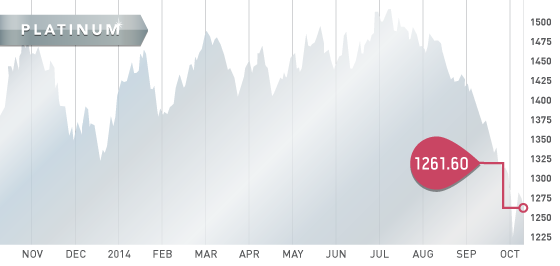

Platinum

Platinum closed the week at $1,261.60, which is up from last week’s $1,226.90 per ounce. That’s good for a $34.70 gain or 2.8% on the week. Russia’s Natural Resource Minister said that Russia and South Africa will meet in November to discuss supporting platinum and palladium prices. South Africa and Russia combined possess 80% of the worlds PGM reserves.

Technicals:

- Support: $1,220

- Resistance: $1,300

- 50 day moving average: $1,380.65

- 200 day moving average: $1,429.40

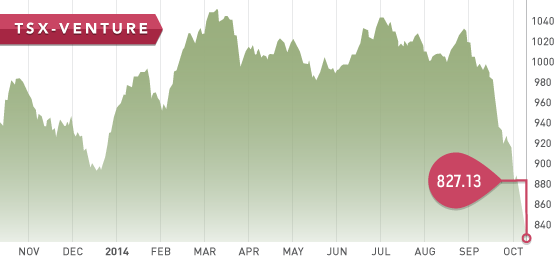

The US dollar continues to weigh on the resource-heavy TSX. The TSX recorded its 6th weekly decline, down 3.8%. The TSX closed at a six month low Friday while recording three days of triple digit losses on the week. The TSX Venture was down for the 5th straight day Friday closing at 827.13, down 6.3% on the week. In fact, the TSX-V has only experienced positive gains in just 4 out of 29 trading days since the beginning of September. The Venture is heavily oversold and that may indicate that tax-loss selling is occurring early this year. Precious metals rallied back this week and copper found support at $3.02 closing the week at $3.07. This rally however did not translate to the TSX-V partially because of oil prices continuing to fall. The TSX-V is now down 19% since the start of September.

Other markets around the world are also experiencing upheaval. US stocks are having a pullback (and as we write this, futures show the selloff may continue into this week). Also worth noting is stocks in Dubai crashed on Sunday 6.5% (market days in Middle East are Sunday through Thursday). Volatility according to the VIX index is also at its highest in about two years.

A Look Ahead

The key items on the calendar this week are:

- October 13 Monday – China Balance of Trade

- October 15 Wednesday – US Retail Sales

- October 15 Wednesday – US PPI, Core PPI

- October 16 Thursday – US Industrial Production, Capacity Utilization

- October 17 Friday – US Housing Starts, Building Permits

It will be interesting to watch if the Industrial Production and Manufacturing data for September is similar to the August report, which showed the first drop since January. Retail sales increased in August – however, it will be interesting to see if the lowered August consumer credit report released last week will impact the upcoming September retail sales report.

Colombian exploration companies will be released this upcoming week, with the majority of the companies scoring low. Cordoba, Solvista, and CB Gold are the three companies that seem to stand out from the pack. Cordoba is currently drilling their San Matias target and we should be seeing results from them in the very near future. This could present a potential near-term catalyst for the stock if they continue to receive similar results to the ones released last year. Solvista’s Caramanta Project is currently being explored by IAMGold under a $36 million 70% earn-in agreement. This agreement positions Solvista well, as they can develop their flagship project without the need to raise money in this difficult market.

- Symbol: PGM.v

- Price: $0.31

- Shares Outstanding: 107,753,375

- Market Cap: $33,403,546

- Cash: $4.7 million (June 30th)

- Significant shareholders include Rob McEwen (11.6%), AngloGold Ashanti (11.8%), and Management and Directors (7%)

Having last week picked a low-cost producer in Mexico, this week we feature an exploration company with a large consolidated land package in a proven mining camp in Ontario. Pure Gold Mining has recently put together a significant land package in the prolific Red Lake district. The Madsen property contains three past producing mines, as well as established mining infrastructure. Included is an operational head frame, 500 tonne per day mill, tailings management facility, and a CIP gold recovery circuit (installed in the late 1990s). This infrastructure, currently on care and maintenance, is all fully permitted.

The consolidated land package is strategically placed along the Madsen Mine Trend, a geological contact between two distinct rock packages. This contact has shown to be a favourable host for gold mineralization, most notably the Madsen mine deposit. The Madsen Gold Project contains a high-grade resource of 928,000 (indicated) ounces of gold, and 297,000 (inferred) ounces, with impressive average grades of 8.93 g/t au and 11.74 g/t au respectively. It is worth noting that this resource was compiled using $1000/oz gold price.

There is no question there is gold on this property. The Madsen Gold mine has produced 2,452,388 oz (1938-74, and 1997-1999), and the entire Red Lake camp has produced over 28 million ounces of gold. It will just be a matter of whether or not it has been geologically emplaced in economic concentrations. There have been recent discoveries in the Red Lake District over the past 15 years uncovering additional high-grade deposits, such as Goldcorp’s HGZ discovery. Pure Gold hopes to mimic this success at Madsen.

The geology of this district is becoming better understood which provides the potential to unlock additional resources in the area. Pure Gold is targeting two different geological settings. The first is the 12 km Madsen Mine Trend, which is an unconformity contact between the Balmer Assemblage and the Confederation Assemblage. This contact is host to the Madsen mine and two smaller mines on the property. This contact is also on trend with the Campbell and Red Lake mines to the northeast.

The second geological setting is the contact between the ultramafic rock unit hosted within the Balmer assemblage. The 8 Zone deposit is hosted along an ultramafic contact and Pure Gold is looking to extend that zone up-dip towards the Russet South deposit. The Russet South deposit contains an historical resource that Pure Gold would like to eventually update with further drilling.

Phase 1 drilling is currently underway and will test targets along the unconformity contact. Phase 2 will test the ultramafic contact that hosts the 8 Zone deposit and Russet South deposit. This phase could be exciting if Pure Gold is able to prove their concept and connect the 1.6 km gap between 8 Zone deposit and the Russet-South deposit with gold mineralization.

The plan is to expand the current resource as well as identify and drill-test new targets. Pure Gold predicts that if they vector the unconformity contact hosted gold deposition with the ultramafic contact gold deposition, they think they will locate the feeder zone at the intersect of the two vectors. Conceptually, through trend projection, this zone would appear to be located at a similar depth as the high-grade zone of the Red Lake mine situated 15 km on trend to the northeast.

In the business of mining, it is all too important to have a strong, experienced and competent management team. This is even more important in this current market environment. Pure Gold has a proven management team with a strong technical background. This team also has experience working in the Red Lake District. It is very important for any management team to be familiar with the area they are exploring as this will increase their chance of success. CEO Darin Labrenz was the Chief Geologist at Placer Dome’s Campbell Mine located 15 km away from the Madsen mine.

Pure Gold is also in strong hands with AngloGold and Rob McEwen holding a little over 12% each. These two combined with Management holdings (7%), Sabina, Claude, and Institutional ownership, all account for 56.3% of the float. This indicates that there is strong belief in this management team and their concept at Madsen.

Bottom line: Pure Gold has the third largest land package in the Red Lake District, with over 2.5 million ounces having been extracted from the Madsen Property. In addition to mine infrastructure, the property hosts a high-grade resource of close to 1 million ounces of gold. With new geological understanding of the area, there is potential to unlock new resources to add to the current resource contained at Madsen. Nothing is for certain in the mining industry, but it sure increases the chance of success when the company has a strong and knowledgeable management team with experience in the area.

Potential Catalysts and Events to Monitor:

- Pure Gold will be busy with the drill going forward. They will drill numerous targets on the Madsen Property in attempts to grow the current resource and unlock new deposits on the property.

- Phase 1 drilling (underway) will look to expand Madsen resource and discover new deposits along the 12 km unconformity contact.

- Phase 2 drilling (winter) will test targets within the ultramafic contact. If Pure Gold’s concept is correct, this second phase could open up a new resources area within the ultramafic zone.

OCT