Gold

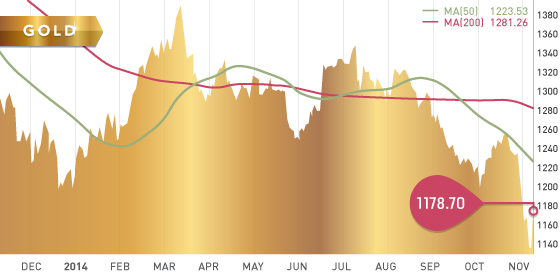

Gold spent most of the week under pressure, breaking through short term support and putting in a new floor at $1130.40 early Friday morning. However, with the release of lower then expected jobs report out of the US on Friday, coupled with Ukraine tensions flaring up, gold surged $37, up 3% on the day. Thanks to the gains made on Friday, gold was able to make back the losses incurred during the week, to close basically flat at $1178.70.

Gold miners reported Q3 earnings this week, and as expected the results were poor. For instance, Yamana lost $1 billion in Q3, and Goldcorp and Primero posted $44 million and $106 million losses respectively due to write-downs. These disappointing earnings continue to document the challenges the miners are having with the current price environment. Many have taken significant cost cutting measures, yet it does not appear to be enough to stop the bleeding. In this next phase of price collapse, after all the cost-cutting band-aids have been employed, we will start seeing the suspension of operations.

When we look at gold miners now valued at levels not seen since early-mid 2000s, it should really make an investor take notice and ask whether this makes sense or not. The HUI/Gold ratio hit an all time low of 0.128 on Wednesday since the inauguration of the HUI back in 1996. Despite hitting the low Wednesday, the ratio managed to gain some ground back with Fridays strong move by gold miners. The last time it was ever this low was in the year 2000 when the average price of gold that year was $279. The HUI/Gold ratio is currently at 0.14.

Although the market sentiment for precious metals continues to deteriorate, buying of the metals remains strong in the east. Russia for instance, continued to add to their gold holdings this week which are now at their largest since 1998. In contrast, GLD continued to trim their holdings, now at a 6 year low of 727.14 tonnes

Technicals:

- Support: $1,130.40

- Resistance: $1,183.30

- 50 day moving average: $1,223.53

- 200 day moving average: $1,281.26

Silver

Silver broke through short-term support this week to put in a new low at $15.00 early Friday morning. However shortly after putting in the low, silver followed gold’s strong move, closing up 2.7% on the day. As with gold, silver will need to build on Friday’s gains to demonstrate that Friday was not merely a short-covering rally based on a minor hiccup in the job numbers. With tensions in Ukraine flaring up once again, we may well see a strong move into gold and silver this week.

The gold:silver ratio is now at a remarkable 74.5, with the 5 year average at 1:57. Many believe this ratio cannot be maintained, and therefore silver is a better bet than gold with the ratio as high as it is.

Technicals:

- Support: $15.00

- Resistance: $16.22

- 50 day moving average: $17.59

- 200 day moving average: $19.50

Platinum

Platinum came just shy of hitting long-term support, before making strong gains similar to its precious metals cousins on Friday.

Shares of Eastern Platinum Ltd. (ELR.TO) were up close to 150% at one point Friday before settling in at $1.78, up 102% to close the day. ELR announced Friday that they have reached an agreement with Hebei Zhongbo Platinum Co Ltd., whereby Habei will acquire ELRs’ entire South African PGM business for $225 million.

Technicals:

- Support: $1,186.50

- Resistance: $1,250

- 50 day moving average: $1,300.51

- 200 day moving average: $1,412.36

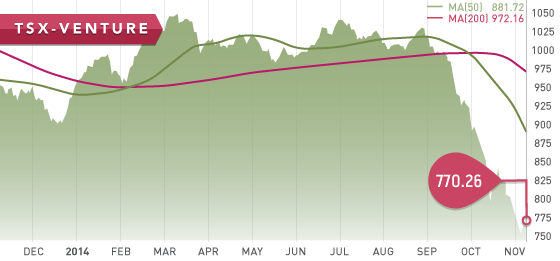

Both the TSX and Venture were up on Friday. The TSX was largely moved by gains in gold majors as they responded to the surge in the price of gold on Friday. The Venture battled back on Friday from what started off as a continuation of downward pressure, initially resembling another tough week. Despite the strong 2.5% move up on Friday, the Venture barely managed to gain back the losses experienced earlier in the week. The Venture closed the week basically flat at 770.26.

Many of you have heard some of the experts speak of “capitulation” in the mining industry. This is described as a point where a large volume of exhaustion selling, by even faithful investors, signals the beginning of a new period within the sector. At that moment, the large volume of shares that were previously held by investors with substantial and surmounting losses, are now in the hands of fresh investors starting from a new base. Most experts await this bellwether signal that indicates the end of the current market collapse and the start of a new investment climate within the mining industry.

We are seeing initial signs of capitulation around the industry. There are funds selling their entire position in the mining sector, both out of frustration and necessity. Perhaps this is just the start and we have further to go, but judging by the various factors it sure seems like we are at, or approaching the bottom of this precious metals bear market.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the economic items on the calendar for this upcoming week are:

Saturday Nov. 8

– Balance of Trade (CHN) – Consensus: $42B

Monday Nov. 10

– Inflation Rate (CHN) – Consensus: 1.6%

Wednesday Nov. 12

– Unemployment Rate (UK): Consensus: 5.9%

Thursday Nov. 13

– Retail Sales (CHN) – Consensus: 11.6%

– Industrial Production (CHN) – Consensus: 8%

– ECB Monthly Report (EA)

– Initial Jobless Claims (US) – Forecast: 274K

Friday Nov. 14 –

– GDP Growth QoverQ (EA) – Consensus: 0.1%

– Inflation Rate MoverM (EA) – Consensus: 0.0%

– Retail Sales (US) – Consensus: 0.2%

China will release their Balance of Trade for October this weekend which previously showed weakness in September. With economist predicting a weakening Chinese economy, the Balance of Trade along with Industrial Production data, will surely support commodities if they indicate any signs of a strengthening Chinese economy. The inflation rate in China is fairly low, causing some concern from economists.

US initial jobless claims will be a closely watched item after the lower then expected jobs numbers on Friday. Also, retail sales will be closely monitored after experiencing the first drop in 8 months in September. Increased spending indicates a more optimistic consumer, and therefore a strong economy. With exports on the decline due to a strong US dollar, the country will be relying more heavily on sales from within.

Last Week: On Tuesday the US Balance of Trade showed an increased in their trade deficit for the first time in 4 months. This is expected to adjust the Q3 GDP released last Friday from 3.5% to 3%. Imports into the US from Canada were the highest since 2008. Non-Farm payroll numbers came in below market expectations. This sparked a selloff of the dollar which was positive for gold, as evident by the near $40 rise in price on Friday. Canadian job numbers on the other hand beat expectations, helping to push the Canadian dollar higher.

It was an interesting week for stocks chosen in our Top 10 Report for the Autumn, released in the first week of September 2014.

Ivanhoe Mines (IVN.TO), was up 16.5% on the week after announcing they had received final approval for their Platreef mine in South Africa. We choose our companies on the Top 10 lists based on these types of catalysts that can cause these types of surges in stock price.

On Friday, US Silver & Gold (USA.TO) also announced a merger with Scorpio Mining (SPM.TO). It should be noted that Scorpio is a company that has scored fairly well in Tickerscores over the last year as well. US Silver & Gold shares were up 6.8% on Friday, partially because of this news as well as the silver price increase.

From the database side, to cap off the recent updates of the Colombia Explorers and Developers, we decided to make Red Eagle Mining (RD.V) the pick of the week in today’s e-mail.

Next to be updated are the Nevada Producers. Klondex Mines (KDX.TO ) joins the list after acquiring the Midas mine and mill complex earlier in the year. Veris Gold Corp. (VG.TO) has been halted since June 10 as they have received notice from the TSX that they will be delisted. Since Veris will attempt to list on the Venture (and potentially on the TSX once again in the future once they exit the CCAA process), we have decided to include Veris until they have been officially delisted from the TSX and/or prohibited from the Venture.

- Symbol: RD.V

- Price: $0.20

- Shares Outstanding: 74,166,475

- Market Cap: $14.8 million

- Cash: $4 million

- Significant shareholders: Management (11.6%), Liberty Metals and Mining (19.9%), Appian Natural Resource Fund LP (13.5%)

Note: Red Eagle Mining was ranked #1 in our most recent Colombia Developers update.

This week we showcase Red Eagle Mining (RD.V), a company that has a very promising project in Colombia. The current downside risk to the project is that it is located in a country that is in the process of trying to establish a stable mining industry. Although the he San Ramon deposit will be a smaller-scale operation, the economics are some of the best we have seen in the industry. There is potential for the deposit to expand, and there are also multiple targets on the property that could potentially generate future mill feed. However, the story at this point is the current 8 year mine plan that Red Eagle has produced in their recently released Definitive Feasibility Study (DFS). The after-tax NPV5% generated from this mine plan, would value Red Eagle at approximately $0.70 cents a share using an industry standard 0.5xP/NPV multiple. If and when Red Eagle receive their final permit, financing for the project should not be an issue considering two of the largest shareholders, Liberty and Appian, are very experienced private equity funds investing in mining companies. So the real hurdle is on the much anticipated environmental permit. So long as there is a permit pending, the share price is bound to remain depressed.

Santa Rosa

Red Eagles flagship Santa Rosa Project is a large land package hosted within the prolific Antioquia Batholith. The Project is an intrusive hosted structurally-controlled quartz stockwork system. The project contains the high-grade San Ramon deposit, which is awaiting final permitting before construction can begin. The deposit contains (P&P) reserves of 405,000 ounces of gold at 5.20 g/t, and a resource of 446,100 (M&I) ounces of gold at 5.10 g/t. The defined reserves are contained within 200 meters below surface, a scenario that results in an enviably low CAPEX of around $75 million. The operations will be an underground mine producing an average of 50,000 ounces a year over 8 years, at a cash cost of $600/ounce including royalties, and an all in sustaining cost (AISC) of $736/oz.

Economics

The economics of the Santa Rosa Project are very encouraging, and have been completed at a (DFS) level. This is the highest level of accuracy from an evaluation standpoint, within +/-15% accuracy. This mean investors can place a fair amount of confidence in the numbers. Using a base case of $1300 gold, the post-tax NPV5% of the project is $108 million with a 52% IRR and a payback of just 1.5 years. These are exceptional numbers. However, if we stress test the economics using $1,100 gold, the project still boasts a positive post-tax NPV5% of $56 million with a 32% IRR and a 1.9 year payback. Investors would be hard pressed to find a project with economics as good as Santa Rosa.

The long-term plan for Red Eagle, is to have multiple mines within their Santa Rosa land package and a central processing facility. The cash flow generated from the San Ramon deposit therefore could potentially fund the exploration and development of other deposits in the area. This model of starting small to fund expansion along the way has shown to be a good model, especially in a volatile price environment such as the one we have experienced over the past few years. A project with low CAPEX and quick payback removes a lot of the risk that large, high CAPEX projects have.

Since Santa Rosa will be excavating less than 2 million tonnes per year, the Environmental Impact Assessment (EIA) will be assessed by the Local Environmental Authority as opposed to both the National Environmental Agency and Local Environmental Authority. This should reduce the complexity of the process that larger operations would face. With the operations being underground as opposed to open-pit, this should be more favourable to obtain environmental permits and social licence, since Colombia has a long history of underground mine workings.

Bottom line:

Despite the fantastic economics of San Ramon, there is a chance that Red Eagle will end up in permit purgatory, as the Colombian Government attempts to establish a reliable regulatory framework for their mining industry, while also trying to appease the concerns of environmentalists and local stakeholders. Since this is a possibility, investors must be prepared to put this one away until a permit is either rewarded or denied. An investment in Red Eagle is a bet on them obtaining the final permit. The economics are solid, and can support the project even at $1000 gold. The stock is held by strong hands (45%) including 11.6% by management. Financing is not expected to be an issue as both major shareholder would most likely step up to the plate to finance the project.

Potential Catalysts and Events to Monitor:

- Rewarding of Final Permit

- Project Financing

NOV