Another wild week for the precious metals as headlines across the globe and technical selling hurt the charts. The main driver for initiating the selling in precious metals came from the ECB interest rate announcement, when the ECB unexpectedly cut rates. This caused the US dollar to appreciate and the inverse relationship that we haven’t seen a lot of lately took over and propelled gold lower. Technical selling below the $1310 level pushed gold down to $1280. This interest rate decision by the ECB really throws a wrench into the ever-depreciating US dollar argument to move gold higher. Additionally, the positive news regarding the US GDP numbers provided additional leverage to the QE tapering argument.

Gold support levels: $1285, $1270, $1250

Gold Resistance levels: $1305, $1320, $1327

Gold Chart

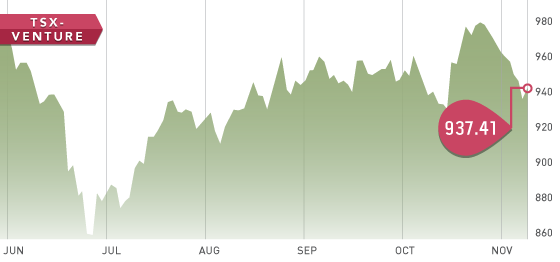

The broader markets closed the week up near record highs as retail buying in defensive sectors in the US propelled equities higher. Closer to home the TSX-V had a less than stellar week closing near the 937 level. The gold miners index (GDX) powered higher late in the day on Friday to close positive on the day and in a Hammer candlestick formation, which is normally a short-term bullish signal. Earnings season is upon us, Q3 gold prices should show a slight recovery, which may add some value to smaller, nimble producers that mined higher grade over the quarter.

Symbol: (SSL.T)

Symbol: (SSL.T)

Share Price: $5.69

Shares Outstanding: 99,877,433

Market Cap: $533,346,000

This week we feature Sandstorm Gold as our Stock of the Week. Sandstorm is a gold royalty company with nine gold streams and 25 gold royalties. Sandstorm currently has $94 million in cash and is debt free. Led by CEO Nolan Watson, Sandstorm is looking to grow into next Franco Nevada (FNV.T). Watson owns 930,000 common shares so he is well vested with current shareholders.

Sandstorm bought out our previous stock of the week, Premier Royalty, in Q3. We feel they got excellent value on this transaction and it was an accretive move for shareholders. The growth of Sandstorm is excellent – it’s forecasted to grow 80% in the next two years while reducing G/A expenses by 35% in 2014.

NOV