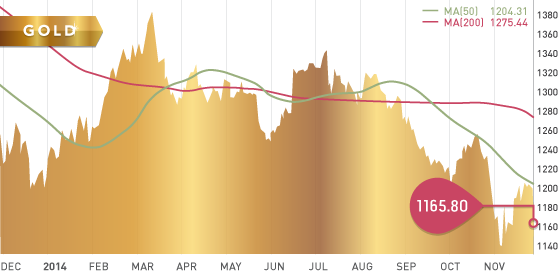

Gold

Gold was unable to build off of last week’s momentum and was generally stagnant for most of the week. Then, it finally succumbed to the pressures of a stronger dollar and a collapsing oil price.

It was a tentative battle at the $1200 level this week, as neither the bears nor the bulls wanted to give up much ground, until Friday when gold finally buckled to the substantial selling. Gold finally settled at $1165.80, down over $30 on the day. During its descent on Friday, gold broke a supporting trend line from the November low as well as important support at $1173.90, leaving the short term direction to the downside.

Surprisingly, gold was intently sold off on Friday, despite the Swiss gold referendum and a surprise announcement by India stating that they are scrapping the 80/20 rule immediately. The 80/20 rule stipulated that 20% of imported gold must be exported, this was typically in the form of jewellery. This rule was created with the goal of improving their trade deficit by reducing imports into the country. However, as a result it stifled gold demand.

News update: As of this morning, it is confirmed that 78% of Swiss voters overwhelmingly chose “No” in the Swiss gold referendum. View articles on Business Insider and Zero Hedge on it.

Technicals:

- Support: $1,146

- Resistance: $1,208

- 50 day moving average: $1,204.31

- 200 day moving average: $1,275.44

- HUI/Gold Ratio: 0.140 (Last week 0.146)

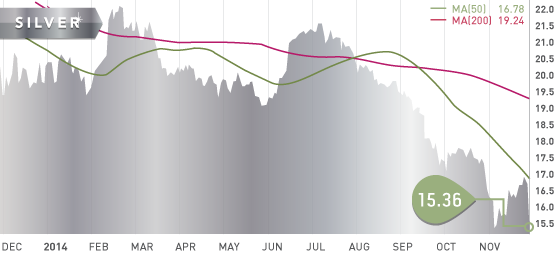

Silver

Silver got crushed Friday and was down $1.10, or 6.7%. On Friday alone, silver managed to wipe away 70% of the gains made over the past two weeks. It closed the week at $15.36, precariously close to the 4 ½ year low of $15.04 established in early November. That level also happens to be silver’s last line of defence before we are in new bear territory, unseen since 2008.

Silver miner Hochschild, announced this week that they will be cutting spending and production at two of their mines in Peru. The company still plans to increase overall production by 15% during 2015, however the cuts announced this week is further evidence of miners having to scale back production and take measures to cope with the declines in metal prices.

Technicals:

- Support: $15.04

- Resistance: $16.65

- 50 day moving average: $16.78

- 200 day moving average: $19.24

- Silver/Gold Ratio: 75.89

- XAU/Gold Ratio: 0.0587 (Last Week: 0.0614)

Platinum

Platinum closed the week at $1200.00, down 2% from the previous week. This renounced last week’s test of the 4 month downtrend. A break below this current level of support next week would have the metal looking to test the $1177.50 low established November 14th.

A recent presentation by Johnson Matthey Plc, a global leader in sustainable technologies, and supplier of 1/3 of the worlds catalytic converters, indicated that platinum and palladium supply shortages will persist in 2015 for the fourth year in a row. Despite the sell-off of the metals during the past 4 months, the company expects the market to remain in a deficit during 2015. It also expects strengthening auto sales from China and North America, and more demand for the metals due to stricter legislation worldwide regarding vehicle emissions.

Technicals:

- Support: $1,200.00

- Resistance: $1,234.70

- 50 day moving average: $1,261.93

- 200 day moving average: $1,403.15

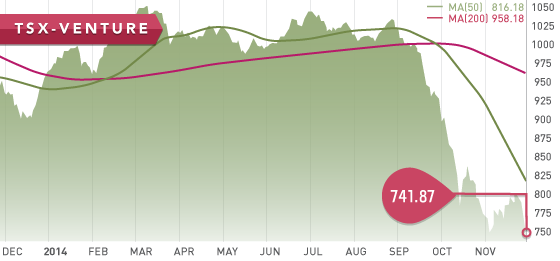

The main theme this week was US dollar strength as a result of the collapsing oil price, better than expected GDP data out of the US, and weakness with many of the major currencies. The TSX-V spent the week removing all of the gains made during the past two and a half week bounce off of the November 5th low. The Venture ended the week at 741.87, down 6%, and closing at a new historical low. The only other time the Venture was remotely close to this low was during the peak of the 2008 financial crisis.

The big market mover this past week was the OPEC decision to maintain its current production rate of 30 million bpd of oil. As a result of the decision, the price of oil collapsed to a 4 ½-year low of $69.05. The energy sector of the TSX was down 7% Thursday, helping to push the TSX down 116 points on the day. The Venture was also down 2% on the day. Friday continued the blood bath in oil and further pushed the commodity down to a fresh 5 year low of $66.15 a barrel. This sent the TSX energy sector down another 2.5%, as well as the TSX down 178 points, or 2.4%.

The plunge in oil weighed heavily on the Canadian dollar, despite consistently good third quarter data coming out of Canada. The Canadian dollar lost 1.80 cents since the OPEC announcement on Thursday.

Despite China’s recent announcement of growth promoting measures, March copper was down 11 cents on Friday, closing at a 4-year low of $2.85. The metal dropped partially as a result of Antamina, the worlds 6th largest copper mine, announcing an end to strikes and a return to normal operating levels next week. In effect, this raised concerns about a global oversupply of copper. In addition to those concerns, the metal was also weighed down, like other commodities, by a stronger US dollar, lower oil prices, and a general concern over slowing global growth.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Sunday Nov. 29

– Swiss Gold Vote – Consensus: A ‘No” vote

Monday Dec. 1

– Balance of Trade (CHN) – Forecast: $44.6B

– Manufacturing PMI (CHN) – Consensus: 50.6

– Manufacturing PMI (EA) – Consensus: 50.4

– ISM Manufacturing PMI (US) – Consensus: 58

Tuesday Dec. 2

– Inflation Rate MoM,YoY (CHN) – Forecast: 0.1%, 1.47%

Wednesday Dec. 3

– ADP Employment Change (US) – Consensus: 228K

– ISM Non-Manufacturing PMI (US) – Consensus: 57.5

– BoC Interest Rate Decision (CA) – Consensus: 1%

Thursday Dec. 4

– Interest Rate Decision (EA) – Forecast: 0.5%

– ECB Press Conference (EA) – GMT

– Inintial Jobless Claims (US) – Consensus: 290K

Friday Dec. 5

– Industrial Production (CHN) – Forecast: 7.9%

– GDP Growth QoQ, YoY (EA) – Consensus: 0.2%, 0.8%

– Employment Change (CA) – Consensus: 5K

– Unemployment Rate (CA) – Consensus: 6.6%

– Balance of Trade (US) – Consensus: -$41.5B

– Non-Farm Payrolls (US) – Consensus: 232K

– Unemployment Rate (US) – Consensus: 5.8%

– Consumer Credit Change (US) – Consensus: $16.5B

With the Thanksgiving holiday behind us, it is a busy week ahead for US data, especially on Friday. The focus this week in the US, is the employment numbers out Wednesday and Friday, as well as the balance of trade, and change in consumer credit. These are all items that the FOMC will use to help guide their decisions in mid-December. This week we also draw our attention to the trade and production numbers out of China, any QE clues in the ECB press conference, as well as the employment numbers and interest rate decision out of Canada. As a result of declining oil prices, the US dollar has mostly ignored the strong data reoccurring out of Canada in Q3. With all the sensitive data out of the US and Canada on Friday, we are likely to see the markets move.

Last Week: The data out of the US this past week was somewhat neutral, which didn’t help the markets in predicting the potential rate hike decision of the FOMC. The big market mover this week was the OPEC meeting, which saw the members decide to maintain production and abstain from any cuts. This had oil plunging to end the week, and also sending the Canadian dollar down 1.80 cents. Both outcomes that inversely strengthened the US dollar. Also aiding in a stronger dollar on Friday was the release of lacklustre data out of Japan on Thursday evening. The Euro Area released weaker inflation numbers also on Friday, as well as an unemployment rate that remained unchanged at a concerning 11.5%.

Mexico Gold Producers update is up next, with Mexico Silver Producers following shortly thereafter. As we work away at the Gold and Silver Producers in Mexico, it is evident by the recent financials the challenges that even these lower-cost miners are having in the current metals price environment. Some of these miners injected capital into their projects during the peak years to expand and develop their operations. Now that the expansions are complete or near complete, the miners find themselves in a price environment far below when these expansions were initiated. The IRR of these expansion projects are due to suffer as a result, and unless we start seeing higher prices, so too will the companies balance sheets.

The Tickerscores team continues to compile a short list of our Top 10 report, which we anticipate will be out near the end of December.

- Symbol: KAM.V

- Price: $0.73

- Shares Outstanding: 122,788,811

- Market Cap: $89.6 million

- Cash: $16 million (As of November Corporate Presentation)

- Significant shareholders: Ross Beaty (9.98%), Zebra Holdings (Lundin Family Trust) (9.98%), Insiders (2.5%).

Note: Kaminak was ranked number 1 on the most recent Alaska/Canada North Tickerscores update.

This week we have chosen Kaminak Gold Corp (KAM.V) as our pick of the week. Kaminak is developing their multi-million ounce Coffee Gold Project located in the Yukon Territory of northern Canada. The high-grade oxide gold project is a newly indentified deposit type for the Yukon. Kaminak recently initiated a $30 million Feasibility Study (FS), after their maiden PEA released in June revealed robust economics at a $1250 gold price environment. Kaminak has decided to skip the Pre-Feasibility study stage and advance directly into a FS, an indication of their confidence in the project and the robust economics displayed by the PEA.

Coffee Gold Project

The Coffee Gold Project is a high-grade oxide gold district, which is part of a large structurally controlled hydrothermal system. Kaminak has drilled 16 separate and distinct gold discoveries since 2010, with 4 of these discoveries contributing to the resource estimate of the Project. The Project contains an indicated resource of 719,000 ounces at 1.56 g/t, and an inferred resource of 3.4 million ounces of gold at 1.36 g/t. Approximately 2.5 million ounces of the global resource are classified as oxide. With oxide ore being easier and cheaper to extract and process, the oxide scenario at Coffee greatly contributes to the positive economics of this low-cost project. All of the deposits remain open along strike and at depth. The pit shell designs have a maximum depth of 200 meters, fairly shallow in open-pit terms. This is designed to optimize the extraction of low-cost oxidized ore, in attempts to maximize the initial NPV of the project.

Coffee Economics

The mine plan for the project will be an open-pit heap leach operation, processing mostly oxide material. The recent Preliminary Economic Assessment (PEA) has the Coffee Project producing 1.68 million ounces of gold over the 11 year life of mine (LOM). The PEA was completed using $1250 gold, and generated an after-tax NPV5% of $330 million, with an IRR of 26.2% and a 2-year payback. The total cash cost are estimated to be $645/oz for the LOM, with total capital cost coming in at $450 million, including closure costs. The project is still reasonably profitable even in a $1050 gold environment, with the after-tax NPV5% coming in at $159 million. Kaminak estimates the breakeven gold price for the project is $900 an ounce. The metallurgical work being completed as part of the feasibility study should aid in improving the already encouraging gold recoveries used in the PEA, as well as potentially upper-transition zone ounces included into the final feasibility study.

Exploration

Due to the lack of glaciation in the area, Kaminak is able to use gold-in-soil anomalies to effectively identify priority drill targets. During the summer/fall exploration program, Kaminak spent $5.5 million drilling these exploration targets, including a newly identified zone called Kona North. The second hole drilled at Kona North CFD0376, returned 3.55 g/t over 28 meters of near surface oxide mineralization. In the phase 2 drill program recently completed, hole CFR0657, which was drilled 150 meters east of CFD0376, returned 29 meters of 3.12 g/t. Kaminak plans to commence a phase 3 program in early 2015 with the aim of delineating a near surface oxide resource at this new zone to potentially include into the final feasibility study. There are multiple targets including Kona North, that are in the immediate vicinity of the established resource, which Kaminak hope will contribute additional ounces to the project in the future. There is 20 km of untested gold-in-soil anomalies that remain to be evaluated by the company.

Bottom line

The company has approximately $16 million in cash, and has no debt. The feasibility study will require roughly another $20 million over the next year, and so Kaminak will most likely need to raise capital at some point in 2015. However, the project clearly demonstrates positive economics, as well as the potential to expand the resource and to improve the economics displayed so far. Kaminak has the right people working on the project, with industry leading experts in heap leach processing on board. These experts have also acted as consultants to Kinross for the development of their Ft. Knox heap leach mine in Alaska. Kaminak has always been able to raise money when needed, and that shouldn’t change going forward. The project certainly has promise, as indicated by the backing of Ross Beaty and the Lundin family.

Potential Catalysts and Events to Monitor:

- Infill Drilling and subsequent resource upgrade (Ongoing)

- Kona North Drilling (H1 2015)

- Metallurgical Tests (Ongoing)

- Feasibility Study Completion (Q4 2015)

NOV