Gold

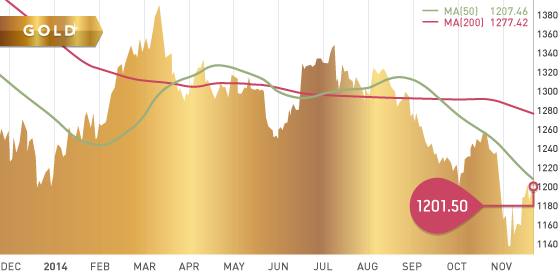

Gold continued its recovery this week from the $1130.40 low of November 7th to Friday’s close of $1201.50. Gold is now up 6.3% from the low, and bulls are looking to build off that momentum. The higher close on the week was not without its battles. For those of you that had the stomach to watch the volatile gold battle on Wednesday, it was quite the show. A shocking $20 drop in price occurred after Swiss referendum polls indicated a 6% decline in those favouring a yes vote. Shortly after though, gold regained its strength and shot back up to $1200, removing the idea that the referendum is currently supporting gold. However, with the release of the October FOMC minutes later in the day, gold was again beaten down $20 to end the day at $1182.50, despite there being little in the FOMC minutes to support the onslaught. It seems that much of the move Wednesday was in fact a result of a stronger USD as the USD/JPY hit a fresh 7-year high. This helped push the dollar index higher, and incidentally gold suffered.

On Friday, gold bounced off the 50 day moving average in early morning trading, but managed to claw back from a midday down spike to close the day above $1200 for the first time in over 3 weeks. This is a good sign for gold, despite not able to close above the 50 day moving average for the second time in the past month. A break above that level would also be a break above 2 retracement marks of potential resistance around the $1210 level.

A strong breakout this week above a well-established trend line would also be very positive for gold, since we have been in this down trend for 4 months. The downward trend line, established since the mid-July high, currently sits at around the $1230 level. However, a bounce off the trend line would indicate the bears are still in control.

There was a big announcement Monday of another merger in the gold space. Osisko Gold Royalties (OR.TO) and Virginia Mines (VGQ.TO) announced their planned merger to create a leading intermediate gold royalty company valued at $1.3 billion. Another display of the strong getting stronger, while the weak get weaker.

Technicals:

- Support: $1,173.90

- Resistance: $1,225.00

- 50 day moving average: $1,207.46

- 200 day moving average: $1,277.42

- HUI/Gold Ratio: 0.146

Silver

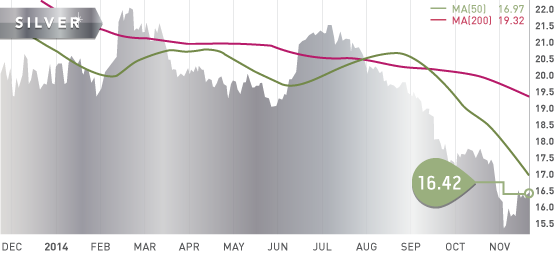

Silver basically traded sideways all week, closing up slightly at $16.42. Like gold, a strong breakout this week above a well-established trend line would be very positive for silver, since we have been in this down trend for 4 months. The downward trend line, established since the mid-July high, currently sits at around $16.50, basically at Fridays close. This level will be an important test for silver this week, and one to watch. However, a bounce off the trend line would indicate the bears are still in control. Much of the economic data due out this week, especially from Japan on Monday and from the US Tuesday and Wednesday, has the potential to significantly aid in a breakout, or contribute to the agenda of precious metal bears. Japan’s comments Monday evening should be closely watched.

Technicals:

- Support: $15.50

- Resistance: $16.64

- 50 day moving average: $16.97

- 200 day moving average: $19.32

- Silver/Gold Ratio: 73.17

- XAU/Gold Ratio: 0.0614

Platinum

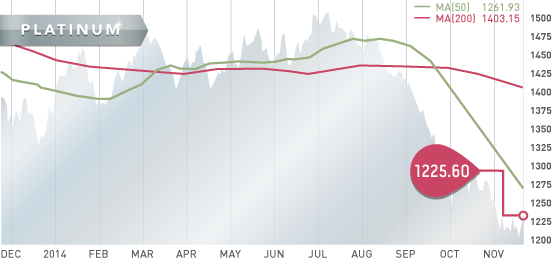

In response to pressure on the USD, platinum was also a mover Thursday and Friday, closing the week at $1225.60. With Fridays close, platinum was up $10 after being down $35 earlier in the week. Platinum closed above a 4 month down trend on Friday which, if further confirmed this week, will be quite bullish for the metal.

The World Platinum Investment Council was launched November 18th and is aimed at promoting platinum as a global investment tool. The council is backed by Anglo Platinum, Aquarius Impala, Lonmin, Royal Bafokeng, and Northham. The council will be much like the World Gold Council in that it will provide statistics relating to the metal. Also of note, Anglo American is investing $100 million in companies that use PGMs, in attempts to generate more demand for the metals.

Technicals:

- Support: $1,200.00

- Resistance: $1,261.50

- 50 day moving average: $1,261.93

- 200 day moving average: $1,403.15

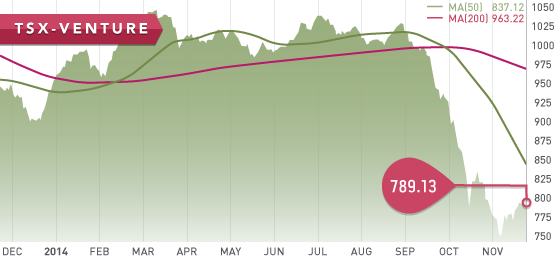

The TSX and the TSX-V were both up on the week due to higher commodity prices, as well as signs of stimulus efforts from central banks around the globe. With central banks concerned about deflation and slowing growth, they are attempting to bolster their struggling economies and promote growth with rate cuts and credit injections. China, Japan, and the Euro Area have all recently announced stimulus measures in attempts to reignite their economies. The TSX was up 268 (1.84%) on the week, and the Venture was up 12.5 (1.6%).

Commodities should get a boost this week following the somewhat surprise rate cut by the PBOC, and the promise of extra credit injections if needed. China is concerned about deflation and is taking these measures to stimulate growth, which in turn should be positive for commodities, especially the base metals and coal. The base metals group was up 5.75% on the announcement, with companies such as Teck Resources (TCK.B.TO) making strong gains as a result. Teck was up $1.72, or 9.44% on Friday.

A stronger Canadian dollar weighed on the USD Friday, after higher than expected inflation for the month of October was released out of Canada. The Canadian Dollar and the Yen both put pressure on the USD Friday, which helped gold and silver to further regain some of the losses experienced over the past 3 weeks.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday Nov. 24

– Services PMI (US) – Consensus: 56.8

– BoJ Monetary Policy Minutes (JPN)

– BoJ Gov Kuroda Speech (JPN)

Tuesday Nov. 25

– GDP Growth Rate (US) – Consensus: 3.3%

– Consumer Confidence (US) – Consensus: 96.0

Wednesday Nov. 26

– Initial Jobless Claims (US) – Consensus: 288K

– Personal Income/Spending (US) – Consensus: 0.4%/0.3%

– Chicago PMI (US) – Consensus: 63.0

– New Home Sales (US) – Consensus: 470K

Thursday Nov. 27

– Inflation Rate YoY, MoM (JPN) – Forecast: 3.1%, 0.03%

– Industrial Production MoM (JPN) – Consensus: -0.6%

Friday Nov. 28 –

– Inflation Rate YoY (EA) – Consensus: 0.3%

– Unemployment Rate (EA) – Consensus: 11.5%

– GDP Growth Rate QoQ/YoY (CA) – Consensus: 0.6%/2.1%

The Bank of Japan Policy Minutes and Governor Kuroda on Monday evening will be closely watched, especially after the concerns raised by Japans Finance Minister last week. The US will be releasing a string of reports Tuesday and Wednesday ahead of the Thanksgiving Holiday on Thursday. These reports will be scrutinized by the market in attempts to gauge the outcomes of the much anticipated FOMC meeting December 16-17th.

Last Week: The big economic news last week included the surprise rate cut by the PBOC, the ECB Draghi speech indicating more stimulus is on the horizon for the Eurozone, and finally a statement the Finance Minister of Japan voicing concerns about the Yen has declined against the dollar too quickly. The weakening of the Yen has provided fuel for a strengthening USD. As a stronger dollar is bad for gold, Japan’s policy decisions should be monitored by any gold investor. The FOMC minutes did not provide much detail or clarity about the timing of any rate hikes. It was a fairly non-event. A stronger Canadian dollar also weighed on the US dollar Friday as higher than expected inflation was reported out of Canada.

With Nevada Producers completed and going out Monday afternoon, we are now focusing on the Gold and Silver Producers in Mexico. Subsequent to the completion of the Mexico Producers update, we are planning to update the Nevada and Mexico Explorers and Developers.

As we approach year-end, the Tickerscores team is beginning to compile our Top 10 report, which we anticipate will be out near the end of December. Considering the undervalued state of the mining industry, we feel there are a number of high-quality companies that are trading at unreasonable levels compared to their net asset value and future potential. Our goal with the Top 10 report is to identify these companies, which also have the ability to whether the current storm, and also possess the best leverage to a higher price environment.

- Symbol: SBB.TO

- Price: $0.43

- Shares Outstanding: 194,019,935

- Market Cap: $83.4 million

- Cash and Cash Equivalent: $38 million (As of September 30th)

- Significant shareholders: Van Eck (16%), Dundee Precious Metals (12%), Dundee/Goodman (9%), Silver Wheaton (6%).

Note: Sabina was ranked 2nd on our most recent Alaska/Canada North update.

This week we showcase Sabina Gold and Silver Corp. (SBB.TO), a company that possesses two excellent assets, the high-grade Black River deposit, and the Hackett River Royalty. The Hackett River Project was sold by Sabina in 2011 to global miner Glencore PCL (GLEN:LN) for $50 million, including a significant royalty on future silver production. Black River is Sabina’s flagship project, consisting of a high-grade resource with positive economics. The challenge for Sabina is that the project is located in the Canadian Territory of Nunavut, in a remote Low Arctic location with no infrastructure to support mining. What makes Black River compelling however, is the high-grade resource of over 5 million ounces of gold with the vast potential to expand that resource. Nunavut is also a politically stable and pro-mining jurisdiction, with companies such as Agnico Eagle Mines (AEM.TO) having success obtaining permits and social licence to mine in the Arctic region. AEM has been mining from its Meadowbank mine since 2010, and the mine is their largest and best producing asset this year, producing 366,162 ounces of gold at a total cash cost of $561/oz on a by-product basis.

Black River Project

The Black River Project is a Banded Iron Formation (BIF) gold system consisting of structurally controlled high-grade gold mineralization associated with quartz veins, silicification, and shearing. The Project hosts multiple deposits (Umwelt, Llama, Goose, and George), which all contribute to the resource estimate and Pre-Feasibility Study (PFS). The project contains a measured and indicated (M&I) resource of 5.3 million ounces at 5.8 g/t. The project also hosts an inferred (Inf.) resource of 1.9 million ounces of gold at 7.3 g/t.

Black River Economics

The PFS completed at Black River using $1350 gold generated an after-tax NPV5% of $290 million with an IRR of 16.5% and a 3.3 year payback. The total cash costs are estimated to be $685/oz for the life of mine. At an $1150 gold environment, the after-tax NPV5% project would be reduced to approximately $67 million, with an IRR of 7.9% and a payback of 4.8 years. With the recent updated resource estimate and improved metallurgical test work, the economics at Black River are expected to improve significantly in the ongoing Feasibility Study (FS). The recent metallurgical tests have shown an increase in the average gold recovery from 88% (used in PFS) to 93.9%. This is a significant improvement.

The key point that investors should be aware of, is that the PFS uses only 50% of the then current resource, and that none of the 83,000 meters drilled in 2013 was included. Since the PFS was completed, the updated resource estimate increased the measured resource and grade by 464% and 18% respectively. The total contained ounces in the (M&I) resource also increased 735,000 (16%) to 5.3 million ounces. It would not be unreasonable to assume that the inclusion of the resource upgrades into the ongoing FS, will significantly improve the economics of the 2013 PFS.

The other key point is that the PFS was prepared on a standalone basis, therefore not relying on any potential infrastructure development for the Hackett River Project situated 45 km to the west of Black River. The economics of this project should absolutely be valued on that basis, however, any contributions or collaborations to infrastructure by Glencore going forward would greatly improve the NPV of the project. With that in mind, any indications or announcement by Glencore on that front will move the share price of Sabina.

Hackett River Royalty

The Hackett River deposit, owned by Glencore, is one of the world’s largest undeveloped VMS deposits. With the price of lead and zinc rising, and the supply concerns becoming more of an issue, we assume the Hackett River Project will become more of a priority to Glencore. The project has the potential to generate substantial revenue for Sabina in the future, but Sabina may also elect to sell their royalty, or a portion of the royalty, to help fund the development and construction of the Black River mine. This would be an excellent, non-dilutive option for Sabina to fund the construction of the Black River mine.

Bottom line:

The company is expected to have $30 million in treasury by year end, and no debt. We are still a couple years away from a potential construction decision, with some major hurdles to overcome along the way. However, with each milestone reached at Black River, the value of Sabina will continue to appreciate. The strong management team at Sabina is very experienced in developing and monetizing advanced-stage assets, such as the Mount Milligan copper/gold project.

This company is heavily discounted because of the logistical complexity of the project and large CAPEX requirements. Therefore, we feel there is very little speculation built into the share price, and mitigated downside risk at the 40 cent level. We see this level as a good entry point into a company with two fantastic assets, albeit somewhat risky ones at that.

The market is currently pricing the measured and indicated resource at $10-$15 per ounce, depending on how one values the Hackett River Royalty into the mix. This is extremely low considering the industry average is in the neighbourhood of $85 per ounce. With the Arctic being one of the last frontiers hosting excellent deposits such as Black River, it is only a matter of time before these projects go forward.

Potential Catalysts and Events to Monitor:

- Feasibility Study (Q1 2015)

- Environmental Assessment (2H 2015)

NOV