Gold

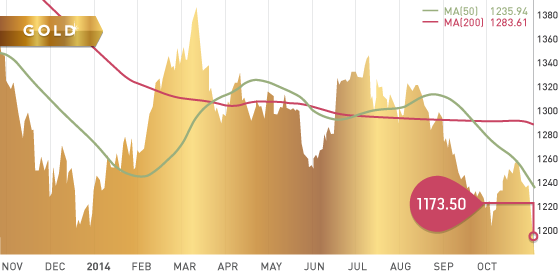

We are now officially in new bear territory for gold, which is an area that we have not been in since 2010. Gold broke key technical resistance at $1,180 on Friday, falling to a four and a half year low, while finally settling in at $1,173.50. The next level of major support now appears to be between $1,052 and $1,100, with short term support at $1,150. It looks as though Goldman Sachs may turn out to be right after all about a $1,050 gold price by year-end, but we shall see.

The selloff in gold on Friday was partially continuance of the selling after the FOMC meeting on Wednesday where the end of QE was announced. However, it was mostly driven by the increased strength of the US dollar resulting from the surprise stimulus announcement by Japan overnight Thursday. It’s a bit of a twilight zone for gold investors. More currency printing in other non-US countries leads to a strengthened US dollar, which hurts gold further. Gold in now down 4% on the year and down 13% since this time last year.

Around the gold sector: In Burkina Faso president Blaise Compaore announced his resignation following a military coup. Gold miners in the area were down sharply such as True Gold and Roxgold mining, down as low as 40% and 33% respectively at one point Friday. Both companies recovered somewhat by the end of the day, but were still down 32% and 28% respectively on the week. This serves as a reminder of the importance of geopolitical risk for precious metals investors.

Technicals:

- Support: $1,150.

- Resistance: $1,183.30

- 50 day moving average: $1,235.94

- 200 day moving average: $1,283.61

Silver

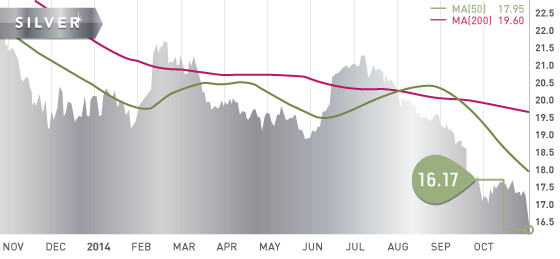

The price of silver was also under pressure this week as a result of USD strength. Despite these low silver prices, we are still seeing strong demand out of China, as well as strong silver coin and bar demand. US Silver Eagle demand reached a record high of 5.79 million ounces in October, up 8% from the previous high set in March. The gold:silver ratio is now at 72.5, with the 5 year average at 1:57.

Technicals:

- Support: $15.50

- Resistance: $16.64

- 50 day moving average: $17.95

- 200 day moving average: $19.60

Platinum

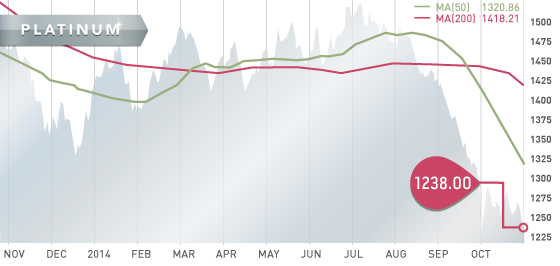

With platinum breaking through support at $1,240 on Friday, the new level of support is now at the low of $1186.50 put in on October 6th. We have not seen platinum at these levels since mid-2009. The platinum price remains soft despite the 1.3 million ounces of production lost to the 5-month strike. A healthy supply of above ground stockpiles have cushioned the blow of the strike, and therefore has kept platinum prices rather subdued in a supply disrupted environment.

Technicals:

- Support: $1,186.50

- Resistance: $1,280

- 50 day moving average: $1,320.86

- 200 day moving average: $1,418.21

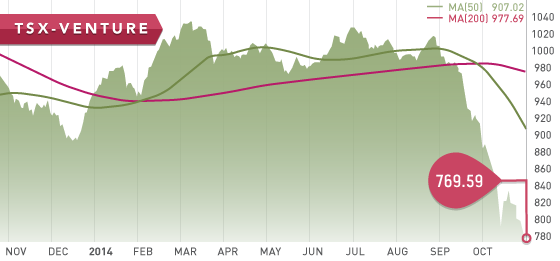

The passing of the QE baton was accomplished Friday as the Bank of Japan took hold and announced an increase to their current stimulus measures by upwards of 60%. Japan, the world’s third largest economy, has been trying to stimulate their country out of deflation. The US dollar and markets worldwide reacted positively to the announcement of another punch bowl arriving to the party. The TSX was up 154.63 points Friday to close the week at 14613.32, further reinforcing the bounce off from the mid-October sell-off. The resource heavy TSX-V however, put in five straight days of losses to close the week at 769.59, down 4.5%. This is the lowest level since December of 2008, which saw the Venture at 678.62. The Venture has not been below that level since its inception.

On a positive note, the TSX accepted its 600th Venture graduate since 2001, with the graduation in October of Fission Uranium (FCU.TO) from the Venture to the TSX.

Side note: Despite being in a higher commodity price environment, the venture is now below the levels seen in 2001, when commodities prices were substantially lower. So its begs the question: Has the TSX-V 600 graduates removed much of the positive stories from the Venture that contributed to its valuation in those years, or is the current valuation on the Venture extremely undervalued? There seems to be a severe disconnect between the valuation of the Venture and the higher commodity price environment we are in, compared to 2001. We welcome thoughts in the Ask an Analyst section of the site.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, key economic items on the calendar this upcoming week are:

Monday Nov. 3

– Manufacturing PMI (US) – Consensus: 56.7

Tuesday Nov. 4

– Balance of Trade (US) – Consensus: -$40.0B

Wednesday Nov. 5

– ADP Employment Change (US): Consensus: 220K

– Non-Manufacturing PMI (US) – Consensus: 58.0

– Retail Sales MoM (EA) – Consensus: -0.8%

Thursday Nov. 6

– ECB Interest Rate Decision (EA) – Consensus: 0.05%

– BOE QE and Interest Rate Decisions (UK) – Consensus: £375B, 0.5%

Friday Nov. 7 –

– Unemployment Rate (CAN) – Consensus: 6.8%

– Non-Farm Payrolls (US) – Consensus: 233K

– Unemployment Rate (US) – Consensus: 5.9%

Weekend Nov.8-9

– Balance of Trade (CHN) – Forecast: $40.1B

– Inflation Rate (CHN) – Forecast: 2.1%

It may be a volatile week ahead for the markets with key US October data coming out, such as the non-farm payrolls and unemployment rate. Both are key reports that the Fed is watching closely to guide their potential rate hikes, which are expected to occur by Q2 2015.

Last Week: As expected, the FOMC officially ended QE3 on Wednesday. The committee was more hawkish then expected concerning the anticipated interest rate hike. Both items pushed markets higher and sparked a selloff in precious metals. A surprise stimulus announcement by the Bank of Japan elevated the strength of the dollar, and as a result continued the dogpile on precious metals. Bank stress tests out of the EU came out positive, easing concerns about the condition of the Euro Area.

This past week the Tickerscores team was interviewed by Wall Street for Main Street. We discussed the current precious metals environment, our attendance at the Silver Summit, as well as the state of the mining industry.

Colombia Development companies will be updated this week. The area seems to be suffering more than most, as the jurisdiction average is down 37% since the year to date. In fact, Red Eagle Mining is the only Colombian development company in positive territory.

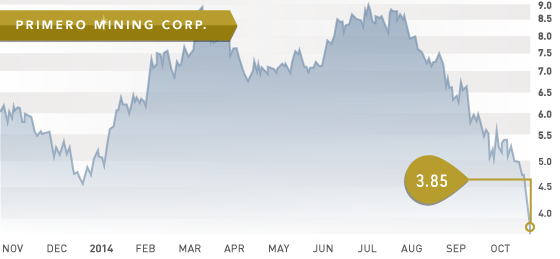

- Symbol: P.TO

- Price: $3.85

- Shares Outstanding: 159,884,712

- Market Cap: $615.5 million

- Cash: $44 million

- Significant shareholders: Multiple Funds and Institutions (87% of shares)

Note: Although Primero was listed in last place (5th) in our Tickerscores Mexican Gold Producers category, the Tickerscores team feels that there is good potential for that score to change to the upside over the next 6-12 months.

This week we showcase Primero Mining (P.TO), a stock that has been under severe pressure over the past 3 months, due in part to the falling precious metals price, but largely as a result of disappointing earnings and underperformance at their newly acquired Black Fox mine. At Tickerscores we try to showcase companies that we feel have the ability to generate shareholder value, and appreciate in price from current levels. We feel Primero has the management team and portfolio of assets to do just that. Despite the fact that Primero has basically fallen off a cliff in the past 3 months, shedding 55%, and most notably in this past week falling 20% on the week, we feel that this level provides a lot of upside potential when looking forward 1-2 years down the road . The stock bounced off the $3.80 level on Friday which could provide a level support. This level was a previous resistance mark established in early 2012 that was later broken 6 months later and had never looked back until now. The $2.40 level is the ultimate low since Primero’s inception in 2010, and should gold and silver prices continue their descent, it would not be out of the question for Primero to reach that level again.

The company will be releasing Q3 earnings this week which is a very pivotal quarter for the company since the Brigus acquisition earlier this year. This Q3 report should shed some light on how well Primero is adjusting to a lower price environment and how well the turnaround at Black Fox is going.

Black Fox

The Black Fox mine, acquired in the Brigus acquisition, is located in the prolific Timmins camp of Ontario. The average depth of mines in the area is 1,600 meters, yet the reserves at Black Fox are currently defined down to 500 meters. So, it is safe to assume there is still a lot of potential to expand the deposit to depth. The focus at Black Fox is to increase underground throughput, which was only 20% of total throughput in Q2 2014. The other 80% came from the lower grade open pit. This low contribution of high-grade underground ore not only lowered the ounces produced, but as a result also increased the cash cost per ounce ($998 in Q2). In addition to the higher cash cost, capital was spent on much needed underground development at the mine, which helped push the all in sustaining cost (AISC) to $1771 in Q2. With earning results out next week, the key focus will be on how well the turnaround at Black Fox is going. If Primero was able to increase the underground throughput, it will be positive for the company, and should indicate the beginning of sustainable underground production and a lowering of cash costs.

In Q2 Primero operated Black Fox at a loss, and therefore basically ate away at the profits generated from the lower cost San Dimas mine. Primero is spending $54 million on underground development at Black Fox in 2014, in order to provide high-grade underground ore to feed the mill. Based on previous head grades experienced at the mill in the past couple of years, our calculations at Tickerscores indicate the lack of underground development at Black Fox has essentially stripped $10-12 million from Q2 cash flow, or roughly $0.07/share. We expect Primero will improve on this significantly with current underground development and through optimizing operations.

San Dimas

At San Dimas, a 3,000 TPD mill expansion was announced in August, which will begin construction in Q1 of 2015. This expansion will generate 30% more production over 2014 levels, and decrease cash cost by as much as $50/ounce. The expansion has a $26.4 million price tag with a pay back of just one year. Primero continues to grow their reserves & resources at San Dimas year over year, and lower their AISC, now at an impressive $600-$650 per ounce.

Pipeline

Primero boasts an impressive inventory of assets in their pipeline that will provide future growth for the company.

At the Cerro del Gallo project in Mexico, the company is working on a revised Feasibility Study. A potential construction decision in Q2 2015 could be made if the revised Feasibility Study can demonstrate an IRR of 15% or greater at $1100 gold. The project contains close to 6 million gold equivalent ounces. Contained within this global resource are reserves 1.18 million gold equivalent ounces (710,000 of that is gold). Not inclusive of reserves, the pit constrained measured and indicated resource at Cerro del Gallo is 1.64 million gold equivalent ounces, of which 920,000 are gold ounces.

Primero’s Grey Fox project is located 4 km south east of Black Fox. 45,000 meters of a 76,400 meter program have been drilled year to date in 2014, with positive results continuing to be obtained. The project contains a resource of 558,000 (M&I) ounces, and 219,000 (Inferred) ounces. These numbers are expected to increase with an updated resource estimate in the near future. The deposit at Grey Fox is in a great location next to the Black Fox mine, and has the potential to provide future ore to the Black Fox mill. This scenario would provide strong economics for the Grey Fox project. Grey Fox is not subject to the gold stream royalty that Black Fox has with Sandstorm Gold (SSL.TO).

Bottom line:

The downside risk to mining stocks continues to erode away to the point where the risk:reward ratio is heavily skewed to the reward side. We can only speculate where the gold price is going in the short term. Under the current pressure perhaps gold will hit $1,050. This will obviously hurt miners such as Primero. However, this short term pain presents great opportunities to acquire distressed miners such as Primero, and position oneself to participate in the precious metals bull market that will ensue on the next leg up.

With their two producing mines, and high quality assets in their pipeline, Primero offers a lot of upside at current prices. It may take a couple quarters for Primero to right the ship, but Primero has the right management to do so. The company has always placed a high priority on a strong balance sheet, which will enable them to persevere through these challenging times. We think within a couple of quarters Primero will achieve a successful turnaround at Black Fox, and lower the cash costs at their operations. The Brigus transition has been difficult, as the Black Fox underground mine was underdeveloped when transferred over to Primero, and so as a result the gold production was down. This is expected to change over the next couple quarters as Primero is spending $54 million in 2014 on underground development and other measures to improve the profitability of the mine. With a similar turnaround achieved at San Dimas, we are confident management will make similar impacts at Black Fox.

Note: Primero is most likely going to be a victim of tax-loss selling, due to its extreme depreciation from the highs experienced early in the year. Therefore it may be volatile over the next month. However, this should present a prime opportunity to pickup a miner under strong management, with a strong balance sheet, two core producing assets, and a pipeline of high-quality future growth assets.

Potential Catalysts and Events to Monitor:

- Underground mining improvements at Black Fox Mine

- Cerro del Gallo revised Feasibility and potential development decision (early 2015)

- San Dimas Mill Expansion to 3000t/d (Construction Q1 2015-Q2 2016)

- Resource Updates: San Dimas, Black Fox, and Grey Fox

- Q3 Earnings (November 6th) – Consensus: $0.01/share

NOV