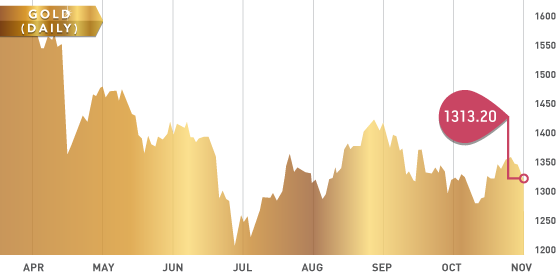

Even the promise of $85 billion per month in treasury purchases wasn’t enough to push the metals markets higher. Gold fell to a three-week low on Friday after rather hawkish comments came in from the FOMC meeting on Wednesday. Weakness in Europe caused the US dollar to appreciate adding fuel to the fire and pushing the precious metals lower. Both the GLD and SLV recorded significant monthly outflows for the first time since the summer. If the European economy continues to slow and the ECB decides to lower interest rates in Europe then the US dollar will appreciate and push the precious metals markets significantly lower.

Gold support levels: $1290, $1270, $1250

Gold resistance levels: $1320, $1330, $1360

Gold Chart

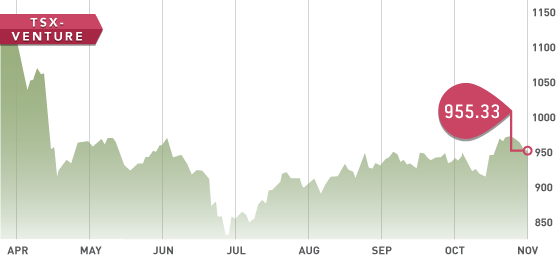

American stocks pushed higher throughout the week as a combination of QE and strength out of the manufacturing sector led the indexes higher. The precious metals stocks were hammered Thursday and Friday as metal prices slipped further. The news release out from Barrick Gold stating that they are trying to raise $3 billion over the next several weeks really exemplifies how tough times are for many of the miners.

Headline of the Week:

Mexican government OKs royalty hike. Not what the Mexican producers were looking for on this one. The increased royalty of 7.5% will cut into the bottom line even more, making it harder for producers to turn a profit.

TSX-V Chart

Symbol: THO.T

Symbol: THO.T

Share Price: $18.81

Shares Outstanding: 146,004,481

Market Cap: $2,923,010,000

This week we’re featuring Tahoe Resources, a brand new major silver producer in Southeast Guatemala. Tahoe has just started shipping silver concentrates (Oct 16th) and expects to ramp up to full production before the end of 2013. The mine is expected to produce 20 million ounces of silver in 2014. The ‘Escobal’ mine is high-grade with wide veins, which results in robust economics. Cash costs are expected to be under $5/ounce. Even at $18 silver the project has an IRR of 46.8%, which is terrific.

Note: This mine is the only asset Tahoe owns so if any issues occur shareholders will not be pleased.

The company’s stated goal is to lead the industry in cash flow per share, earnings per share, and dividend yield. If they can accomplish this, which in our opinion they are well on the way to achieving, shareholders will see a very healthy return.

NOV