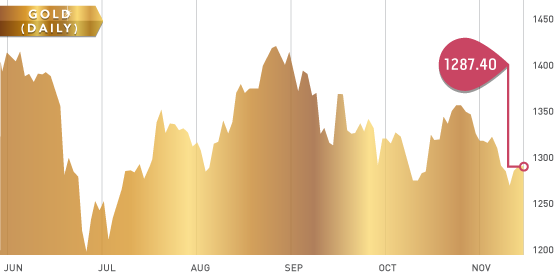

It was another yo-yo week for the precious metals as they were hit hard Monday through Wednesday on further technical selling. The breakdown from our $1310 area triggered stops and pushed gold below $1280 and made a spike low of $1260. Yellenomics fortunately came in to save the day as Janet Yellen (the next Fed Chair) said in a testimony that she is in no hurry to stop spending programs anytime soon. This ultra-loose stance is a positive for precious metals on several levels.

Gold Support levels: $1280, $1260, $1251

Gold Resistance levels: $1290, $1310, $1325

A quick note: Silver has pulled into the $20.50 area; this is where silver broke out from earlier this summer and these types of breakout levels are usually excellent areas of support.

Gold Chart

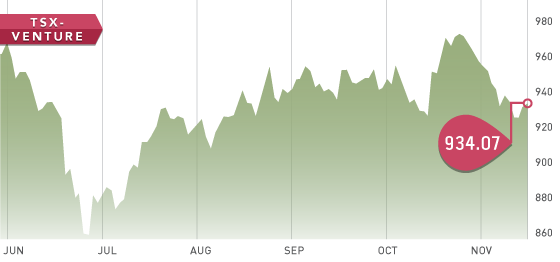

American markets continued the trek to record highs, as earnings from S&P 500 companies have been fairly positive. The Fed’s monetary policy stance continues to be a positive and really has put a floor in for the markets. Unfortunately, there has been little rotation away from the US large caps into the junior space; the TSX-V closed up the week relatively unchanged.

TSX-V Chart

It was too difficult to choose just one headline this week so here are two good ones:

Alix Resources: “Alix to pay Ridge for Windy work in bitcoins.” For those of you that do not know, Bitcoin is a digital currency that has become quite popular in the online world. Apparently, Ridge Resources sees more value in digital currency than in Alix Resources’ shares.

Dolly Varden Resources: “Burns sued over roadside CFO firing.” Apparently, after a cocktail party that was probably thrown using shareholder money, the chairman of DV fired the CFO on a street corner. She claimed to be ill and unable to drive home. It is still up in the air if that was because of the firing or due to a few too many wobbly pops.

Symbol: NGD.T

Symbol: NGD.T

Share Price: $5.81

Shares Outstanding: 503,180,000

Market Cap: $2.92 Billion

New Gold Inc. is in an intermediate gold producer with four producing assets worldwide. Third quarter results out of New Gold were excellent with net earnings of $12 million when many gold companies were in the red. One of the keys to New Gold is they have one of the lowest all-in sustaining cash costs in the gold industry at ~$900/oz. With low all-in sustaining cash costs, this offers shareholders tremendous leverage to the gold price.

Management and the board of directors are heavily invested in the stock, cumulatively investing ~$80 million. The team at New Gold is also taking advantage of the ‘weak’ gold market by acquiring assets like Rainy River and Blackwater. The ‘Rainy River’ and ‘Blackwater’ projects are both located in Canada, which is rated one of the safest political jurisdictions for mining. Acquiring world-class assets now at bargain prices will give New Gold a peer-leading pipeline of growth for the future.

NOV