Gold

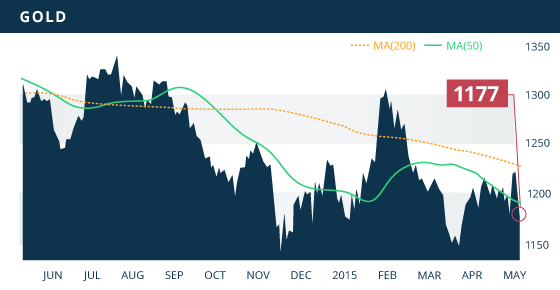

Gold initially found strength early in the week leading up to the FOMC statement, reaching a high of $1215 during intraday trading on Tuesday. However, in reaction to the less dovish than expected FOMC statement on Wednesday, the market quickly sold off gold. The following day gold was beaten down further as data showed that the Initial Jobless claims had reached a 15-year low. Gold will have a hard time making ground now that the market expects the NFP numbers to also be strong this week.

Gold initially broke through a 3-month trend line descending from the January high, although this was quickly reversed once the FOMC statement was released, and compounded by the subsequent strong jobless claims. Gold encountered selling pressure once again along the 100 day MA while struggling to advance past the $1215 area, and the metal was once again pushed back below $1200. This is a significant sign of weakness for the metal considering its lack of strength even though the weak economic data in April should have been supporting the metal.

As a result of the selloff of the metal this past week, gold broke through a key support area around $1175-$1180. However, the metal recovered to end the week back above $1175. The $1175 level continues to be an important area of support despite being breached on Friday. This area marks a line in the sand, which if broken with confirmation, will have the metal looking for support around the $1150 level. As mentioned last week, there is a bullish trend line established from the November low, which is currently ascending around the $1150 level. This line provides solid support, and needs to hold if gold wishes to remain in an upward trend off of the November low.

Near-term resistances comes in at $1215, which is reinforced above by a declining 200 day MA at the $1220-$1222 area. Gold will require a significant push to get through $1220, but at this point it appears range bound between $1280 and $1215.

Technicals:

- Support: $1176.71

- Resistance: $1215.00

- 50 day moving average: $1,190.57

- 200 day moving average: $1,225.35

- HUI/Gold Ratio: 0.153 (Last week 0.147)

Silver

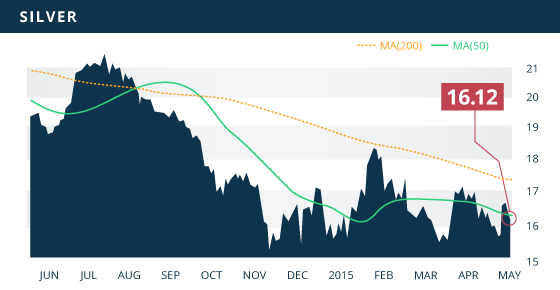

Silver bounced off of the 1-month low after a strong performance to start the week. Despite a strong sell-off on Thursday, silver was still up 2.5% on the week, while closing at $16.12 an ounce. Solid support for the metal is at the March 11th low of $15.27, although look for near-term support around $15.59 along a broken trend line ascending from the November low. There remains a solid 2-year declining trend line that continues to provide significant resistance below the $17 level. Until this trend line is broken the metal remains in a strong down trend. Near term resistance is at last week’s high of $16.71, which is reinforced by the solid 2-year resistance line, currently descending around the $16.80-$16.70 level.

As with last week, the improving XAU/Gold ratio continues to be an encouraging sign for the gold and silver miners, increasing for the fourth consecutive week and up 10% during that period.

Technicals:

- Support: $15.59

- Resistance: $16.71

- 50 day moving average: $16.29

- 200 day moving average: $17.32

- Gold/Silver Ratio: 75.03

- XAU/Gold Ratio: 0.0622 (Last Week: 0.0593)

Platinum

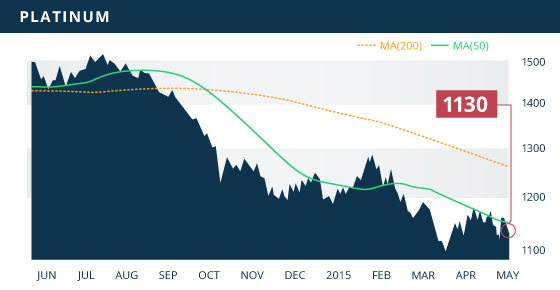

Platinum was up slightly on the week, closing at $1130.80 an ounce, although the metal looks to have lost the steam it had in March. The 9-month down-trend is still the dominant trend, and the metal will need to push above $1160 in the near-term to break out from this trend. Short-term support remains around the $1123 level, which if breached, will have the metal looking for solid support at the March lows in the $1086 area. Short-term resistance is in place at the $1154 level, which is reinforced above by two separate declining trend lines currently at the $1155 level and the $1165 level, with the latter a 10-month trend line and the stronger of the two.

Technicals:

- Support: $1124.32

- Resistance: $1154.20

- 50 day moving average: $1,150.06

- 200 day moving average: $1,260.66

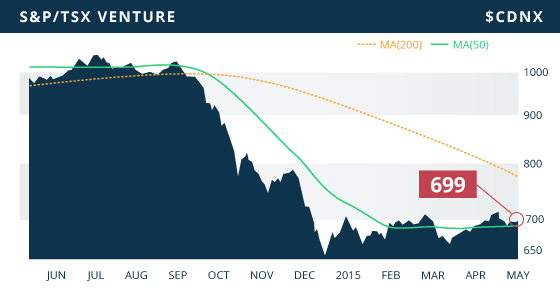

The TSX was down 0.44% on the week, while the TSX Venture closed the week essentially flat at 699.43. The mining sector was up 3.83% with the gold miners up close to 4% and the base metal sector up 5.73%. Contributing to these gains was the performance of copper, which was up 7% on the week, reaching a 4-1/2 month high on Friday. This capped 7 consecutive days of gains with the metal up close to 11% over that period.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday May 4

- HSBC Manufacturing PMI (CHY) – Consensus: 49.4

Tuesday May 5

- Interest Rate Decision (AUS) – Consensus: 2.00%

- ISM Non-Manufacturing PMI (US) – Consensus: 56.5

Wednesday May 6

- ADP Employment Change (US) – Consensus: 198K

Thursday May 7

- Initial Jobless Claims (US) – Consensus: 275K

Friday May 8

- Trade Balance (CHN) – Consensus: $34.25B

- Non-Farm Payrolls (US) – Consensus: 213K

- Employment Change (CAN) – Consensus: (-2.5K)

After the hawkish FOMC statement last week, followed by the strong Initial Jobless Claims, the market will be looking for confirmation of a stronger labour market in the ADP jobs data on Wednesday, but more importantly in the NFP numbers out of Friday. Strong jobs data this week would surely add another blow to the gold price. The market is also anticipating a rate-cut by the Reserve Bank of Australia, which if so, would add strength to the U.S. dollar this week.

Last Week: The Services PMI, Consumer Confidence, and Preliminary GDP numbers out of the U.S. were all below estimates, which increased expectations of a more dovish FOMC leading up to Wednesday’s statement, and in turn gave a boost to gold to start the week. However, the FOMC statement showed that the committee was staying the course with their belief in the recovery of the economy, and their desire of a near-term rate-hike. The following day, the Initial Jobless claims showed the number of those seeking employment insurance was at a 15 year low, and thus giving the market reason to believe this week’s NFP numbers will be strong. These factors have the market putting further confidence in a September rate-hike, and possibly even earlier. This has put a lot of pressure back on gold, which was sold off for the remainder of the week.

With Quebec Developers complete, we will begin working on an update of BC Developers this week. We have also begun working on our Top 10 Spring Report, which we anticipate will be out at the end of MAY.

Top 10 Updates:

Galane Gold (GG.V) announced an agreement to acquire 100% of South African gold miner Galaxy Gold Mining Ltd.

Kootenay Silver (KTN.V) announced the results from 7 more holes from their phase II drill program at the La Negra discovery.

Montan Mining (MNY.V) announced a binding agreement to acquire a 150 TPD capacity gold ore processing facility in Peru.

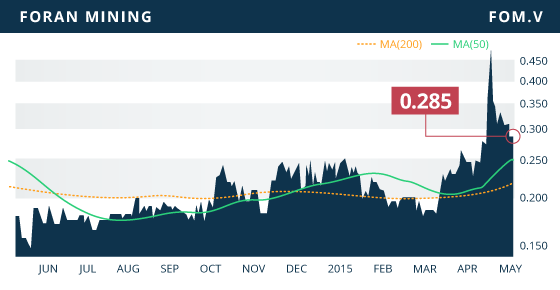

- Symbol: FOM.V

- Price: $0.285

- Shares Outstanding: 90,773,992

- Market Cap: $28.9 Million

- Treasury: $4 million (as of December 31st)

- Significant Shareholders: Management and Directors (18%), Pierre Lassonde (11%), Institutional (25%)

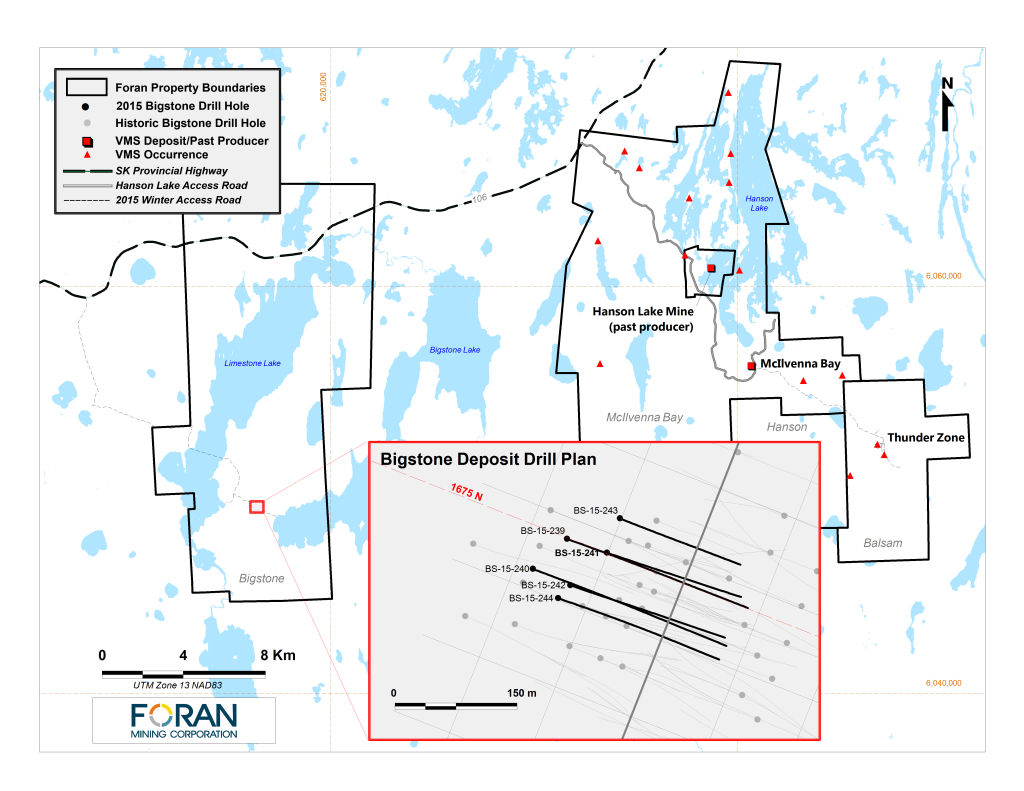

Foran Mining Corp. (TSX VENTURE:FOM) is a Canadian-based junior exploration and development company focused on their 100%-owned McIlvenna Bay Project in east central Saskatchewan, Canada. The 204 km2 property is located on the western flank of the Flin Flon Greenstone Belt (“FFGB”), a prolific geological belt hosting VMS mineralization. The FFBG extends from central Manitoba into northeastern Saskatchewan, and has sustained 75 years of mining, particularly at the hands of Hudbay Minerals (TSX:HBM).

Foran is led by an impressive management team with past success in the development and sale of projects. CEO Patrick Soares served as the President and CEO of Brett Resources which was acquired by Osisko Mining in 2010. On the exploration side, VP’s Roger March and Dave Fleming were responsible for the development of Agnico Eagle’s (TSX:AEM) Meadowbank Gold Project located in Nunavut, Canada.

The McIlvenna deposit, like the many others hosted in the FFGB, is a zinc-copper-gold-silver Volcanogenic Massive Sulfide (VMS) deposit. The Project contains an indicated and inferred resource of 13.9 million tonnes and 11.3 million tonnes respectively. The indicated resource grades at 1.28% Cu, 2.67% Zn, 0.59 g/t Au, and 17 g/t Ag. The grades of the inferred resource are very similar to that of the indicated category.

A PEA on the McIlvenna Bay Project was recently completed in November of last year, and showed reasonable economics in today’s metal price environment. The project has an (after-tax) NPV7% of $262.6 million, with an IRR of 18.9% and a payback of 4.1 years over a mine life of 13.7 years. These economics are encouraging, although they will need to be optimized further, or would likely require higher metal prices to encourage a construction decision. One developing situation that may increase the attractiveness of McIlvenna, is the depletion of ore at Hudbay Minerals (TSX:HBM) 777 mine, located 65km east of McIlvenna. This scenario may increase the allure of the project to Hudbay should they fail to procure additional mill feed.

In addition to the McIlvenna property, the company holds three other high-quality properties proximal to McIlvenna, which all have the potential to generate additional resources to complement their flagship deposit. These three properties: Bigstone, Balsam, and Hanson, along with McIlvenna, combine to form a dominant 355.7 km2 prospective land package covering the western flank of the FFGB.

Foran initiated a 2015 winter drill program in attempts to delineate additional resources proximal to the McIlvenna deposit. In the winter program Foran drilled 5 holes for 1,914 meters in the Thunder Zone on the Balsam Property, as well as 6 holes for 2,545 meters in six drill holes in the Bigstone deposit. Bigstone contains an historical (non 43-101 compliant) resource of 3.75 million tonnes grading 2.03% copper, and 0.33 g/t gold, and the company hopes to validate this resource with the 2015 drilling. The Thunder Zone is a recent discovery, with 4 of the 5 follow-up holes drilled in the winter program returning wide intercepts of copper-zinc mineralization, with gold and silver credits. This early-stage discovery is 7 km southeast of McIlvenna, and is open along strike.

At Bigstone, 3 of 6 infill holes drilled during the winter program have returned positive results, with the remaining 3 holes expected over the next few weeks. The second hole drilled, hole BS-15-239, returned an impressive intercept of 104.9 meters grading 2.03% Cu, 0.12% Zn, 0.1 g/t Au, and 6.4 g/t Ag. Keep in mind though, that the true width is approximately 60% of the intercept. These infill holes will be used to validate the historic resource, and also be used to conduct metallurgical test work.

Bottom line

The company is in a clean and stable financial position with $4 million in the treasury and no debt. At their current burn rate, the company should have more than enough cash to complete their 2015 exploration program and metallurgical test work. At this point, it is unlikely the company will need to raise cash prior to 2016. The company is led by a strong management team of successful mine developers, who also form a sizeable portion of shares held at 18%. The company is also is strong hands with legendary gold miner Pierre Lassonde holding 11% of the shares. Mr. Lassonde continues to display his confidence in the story by adding to his position as recently as September.

The McIlvenna Bay Project displays encouraging economics, though will likely need a higher metal price environment or further optimization before it would become robust enough to demand a suitors serious attention. However, the addition of the potential resources generated at Bigstone and Balsam could improve the economics in a significant way. In a higher metal price environment, this Project becomes very attractive, but its proximity to the prolific Flin Flon camp also adds to its desirability, especially if Hudbay is unable to locate additional mill feed to replace the depleting 777 mine. In this case, Foran becomes an obvious acquisition candidate for Hudbay. Another possibility in a trade-off study may have McIlvenna ore transported to one of the processing facilities in Flin Flon.

Potential Catalysts and Events to Monitor:

- Further Drill Results (May 2015)

- Metallurgical Test work (mid-2015)

- Maiden Resource Estimates: Bigstone and Balsam (H2 2015)

- Optimized McIlvenna PEA

MAY