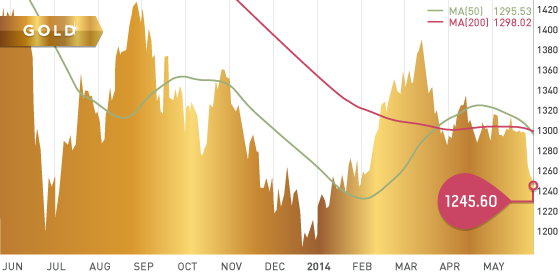

Gold dropped significantly this week, down to $1,249.60 per ounce – a four month low. Gold slipped on upbeat economic data coming out of the US this week. Technical selling then took control as gold breached support levels. We mentioned the importance of watching the US dollar, which also strengthened this week. Geopolitical risk has lowered a little bit with Russia pulling troops out of Ukraine.

Technicals:

50-day moving average: $1,295.53

200-day moving average: $1,298.02

Support: $1,220

Resistance: $1,268

Silver

This week, silver hit a year to date low and closed at $18.83 per ounce, down 4.25% now on the year.

Platinum

The stalemate continues between the AMCU and the platinum companies. South Africa’s new mine minister, Ngoako Ramatlhodi, has gotten involved and hopes to bring both parties to an agreement soon.

Employees earnings lost now are over 9 billion R (rand) while the companies have lost 20 billion R (rand) in revenue.

The price of platinum continues to have very little reaction to the strike. The market is showing that demand for platinum remains weak and ample stockpiles are available. Analysts estimate if the strike continues for another 6-8 weeks, we will see producers stockpiles run thin. If this happens, a potentially large spike in the platinum price could occur.

A Look Ahead

The key items on the calendar this week are:

- Tuesday June 3rd – Auto sales

- Wednesday June 2nd- Bank of Canada interest rate

- Thursday June 5th – European Central bank monetary policy announcement

- Friday June 6th – US Employment data

Q1 producers are being completed and should be arriving in your inbox every few days. Many companies are continuing to generate a net loss at current gold prices. Once all Q1 producers are finished, it will be time to start with exploration and development companies.

It’s tough to find a precious metals company to feature this week due to the drop in commodity prices. We feel the metals could have some more downside, which would then provide an excellent buying opportunity. Be patient and wait, as it appears stocks will get cheaper this summer. A few of our favourites at that these levels are low cost producers like Timmins Gold (TMM.T – $1.38), Luna Gold (LGC.T – $0.97), and Lake Shore Gold (LSG.T- $0.77). These three smaller producers are all generating free cash flow. Investors need to take the mindset of a buying opportunity coming and we will be searching for stocks with 2-10 bagger potential in the next 6-12 months.

MAY