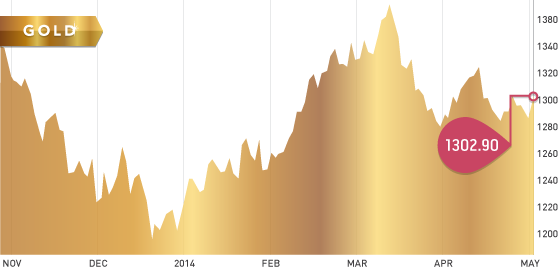

It was an interesting week for gold with plenty of economic data being released. Gold finished the week at $1302.90, up $0.10 from last week’s close at $1302.80. The gold price shot up on Friday as action was sparked by a weak US dollar and short covering. April job numbers were also released Friday morning and traders picked up on the drop in the labour participation rate from 63.2% to 62.8%. In Ukraine tensions continue to rise which could also help drive the yellow metal higher.

Gold support: $1280 level

Gold 200-day moving average: $1300.76

Silver

Silver also had a bounce on Friday, but continues to be under selling pressure. The downtrend continues since early March when silver touched $22/ounce.

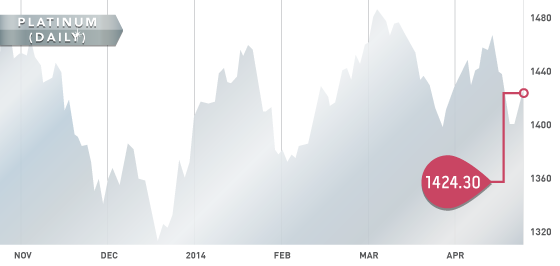

Platinum

Thomson Reuters GFMS came out with a report this week that the platinum price in 2014 is to average $1,457 per ounce through the course of the year. Platinum producer Impala Platinum is claiming that two-thirds of its workers want to end the strike and accept the company’s latest wage offer. The AMCU is expected to hold a press conference on Monday in Johannesburg so more details will be known then. Another producer, Lonmin, has set a deadline of Thursday next week for employees to accept the latest offer.

A Look Ahead

The key items on the calendar next week are:

- Monday May 5th – ISM services

- Wednesday May 7th – Consumer Credit

- Thursday May 8th – Initial Unemployment Claims

Latin American producers (Q4) were sent out on Wednesday. Ontario and Nevada Producers (Q4) are in the queue. Many producers were not profitable in Q4, so this is important to keep in mind as you look at the reports.

Investors looking for value should do some due diligence on Luna Gold (LGC.T) which looks attractive at these levels ($1.02).

Symbol: DGC.T

Symbol: DGC.T

Price: $11.86

Shares Outstanding: 157,421,791

Market Cap: $1,873,319,000

This week we take a look at Detour Gold, a gold producer ramping up production in Ontario. Detour is one of the best performing stocks on the TSX year to date up 183%.Detour owns a world-class asset with 15.5 million ounces in reserves with excellent growth potential. 2014 production is expected to be between 450,000-500,000 ounces as the ramp up process continues. The project would be considered lower grade with the average head grade in Q1 2014 being .90 g/t. Detour is still losing money with an adjusted net loss of $28.1 million in the first quarter of 2014 but all signs show everything heading in the right direction.

Investors could look at Detour as an excellent long-term play on the gold sector with a potential for a takeover. Osisko received a few takeover offers and Detour would be the next logical candidate in Ontario. The Osisko takeover was valued at $3.9 billion which makes Detour look cheap with a $1.8 billion dollar market cap.

MAY