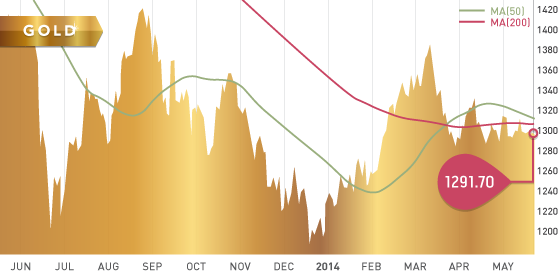

Gold continues to be stuck in the $1290-$1305 range which is up about 7% year to date. Gold bulls are looking at the Ukraine elections this weekend as a possible catalyst. Meanwhile, gold bears continue to argue that the slowly improving US economy is bearish for the yellow metal. Sales of US homes increased 6.4%, which is the highest since October, resulting in only a $2 drop in gold prices Friday. Also noteworthy: the US dollar index has been trading in a fairly tight range as well between 79 and 81 in 2014.

Technicals:

50-day moving average: $1303.77

200-day moving average: $1299.31

Support: $1277

Resistance: $1315

Silver

Silver continues to be range-bound as well, with support at $19.20/ounce and resistance at the $20 level.

Platinum

The strike continues and is starting to hit the entire South African economy. AMCU and the platinum producers had three days of mediated talks this week and the feedback was “luke warm”. In the past two weeks the stoppage has turned violent with five deaths occurring. Implats CEO Terrence Goodlace had this to say in an interview following the mediated talks:

“It’s almost like how long is a piece of string. I suppose the proper answer to it is that it could go for much longer because we are so far apart between the two parties… My expectation is they will probably go on for longer.”

Our go to name in the platinum industry continues to be Stillwater Mining (SWC).

A Look Ahead

The key items on the calendar this week are:

- Sunday May 25th – Ukraine elections

- Monday May 26th – US markets closed (Memorial day)

- Tuesday May 27th – Consumer Confidence

- Thursday May 29th – Initial unemployment claims/ GDP 2nd quarter estimate/ Pending home sales

- Friday May 30th – Chicago PMI/ Personal income and spending data

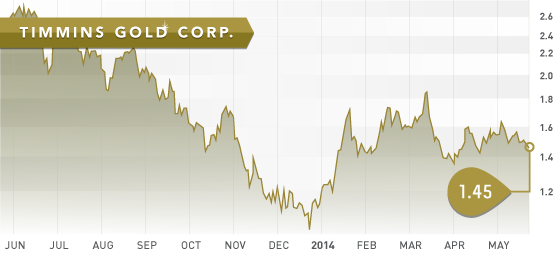

All producers for Q4 (audited annual financials) are now complete and updates will be hitting your inbox frequently. Work has been started on Q1 2014 financials with a few jurisdictions complete already. Initial analysis shows companies working to bring down costs with some success. Quite a few companies still lost money in Q1. Companies like Timmins gold (TMM.T) and Luna Gold (LGC.T) both are coming off excellent, profitable quarters.

Price: $1.45

Shares Outstanding: 163,379,045

Market Cap: $240,167,000

With strong cash flow coming in look for Timmins to possibly initiate a dividend or make an acquisition later in the year. We are making an aggressive call here and would not be surprised if Timmins is looking at taking over Marlin Gold (MLN.T) later in 2014 or 2015. Management is looking at all possible scenarios to add value to the company. The bottom line with Timmins is you get a strong company generating strong cash flow.

MAY