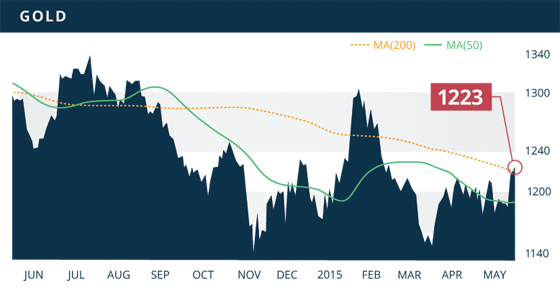

Gold

Gold gained $35.80 last week to close at $1,223, up 3%. The catalyst was the further weakness in economic data out of the U.S. last week, which has begun to raise important questions about the true health of the U.S. economy. If the weakness continues it will start to cast serious doubt about the possibility of near-term rate-hikes, as well as on the effectiveness of the Fed’s policy tools. This would be extremely positive for the gold price, and we are starting to see the initial impact that this weak data can have on the gold price.

The metal broke through key resistance while putting in a 3-month high last week, with the metal now in a strong upward trend. Near-term resistance for the metal is at the $1,246 area, followed by solid resistance around the $1,270 level. A break above these two levels should signal the metal is on its way back to retest the $1,307 mark. Near-term support is at the $1,208-$1,212 area, with solid support at the $1,175 level.

Technicals:

- Support: $1,208.51

- Resistance: $1,246.19

- 50 day moving average: $1,189.30

- 200 day moving average: $1,219.94

- HUI/Gold Ratio: 0.148 (Last week 0.148)

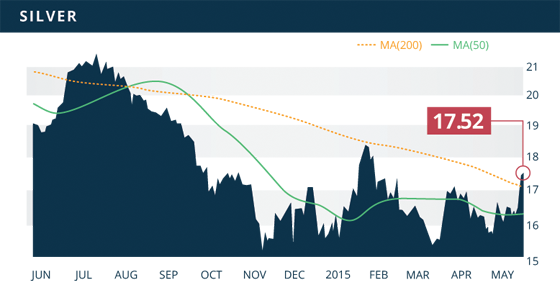

Silver

Silver gained $1.10 or 6.7% on the week to close at $17.52, its highest close since late January. This was an important surge by the metal as it is now out of a strong downward trend and on track to retest the January highs around the $18.50 area. We got the encouraging break-out that we were looking for along the descending 10-month down trend, which was further fortified by a 2-year trend line. This was a very important breakout that will need to be confirmed this week with further gains. Initially though, it looks to be the start of a rally towards the $18.50 level. A break above $18.50 will have the metal targeting the July high of $21.55, with little resistance in the way. It is this promising signal by the silver price that motivated our “stock of the week” selection this week (Fortuna Silver).

Technicals:

- Support: $16.85

- Resistance: $18.48

- 50 day moving average: $16.36

- 200 day moving average: $17.11

- Gold/Silver Ratio: 69.81

- XAU/Gold Ratio: 0.0614 (Last Week: 0.0610)

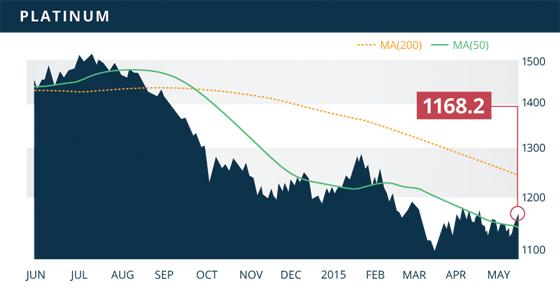

Platinum

Platinum gained $27.20 to close the weekly session at $1,168.20, up 2.4% on the week. The metal will be targeting the early-April high of $1,186.00, which will provide initial resistance. A break above that mark would have the metal looking towards the $1,225 area where the descending 200 day MA will provide possible resistance.

Technicals:

- Support: $1,136.10

- Resistance: $1,186.00

- 50 day moving average: $1,143.80

- 200 day moving average: $1,243.54

The TSX was down slightly last week, helped in part by a 2.3% decline in the energy sector. The TSXV put in small gains yet was unable to return back above 700. The mining sector was only up slightly despite the gold miners gaining 3% on the week. However, weighing on the mining sector was a 1.4% decline in the base metal sector, largely as a result of the declines in the price of lead, zinc, nickel, and copper.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Tuesday May 19

- CPI YoY (EA) – Consensus: 0.0%

- April Building Permits (US) – Consensus: 1.042M

- April Housing Starts (US) – Consensus: 1.019M

Wednesday May 20

- FOMC April Meeting Minutes (US)

Thursday May 21

- HSBC May Manufacturing PMI (CHN) – Consensus: 49.4

- German May Manufacturing PMI (EA) – Consensus: 52.3

- Initial Jobless Claims (US) – Consensus: 271K

- Existing Home Sales April (US) – Consensus: 5.24M

- Philly Fed Manufacturing Index May (US) – Consensus: 8.2

Friday May 22

- German GDP Q1 QoQ (EA) – Consensus: 0.3%

- Core CPI April MoM (US) – Consensus: 0.2%

- Core CPI April MoM (CAN) – Consensus: 0.2%

- Core Retail Sales March MoM (CAN) – Consensus: 0.4%

As mentioned last week, the main theme at the moment is the market looking to gauge if the Q1 economic weakness in U.S. is related to weather and not in fact to a weakening economy. However, with the weak data out last week, especially the consumer sentiment and retail sales numbers, it has changed perceptions and has many starting to ask questions about the true health of the economy. These data points are becoming increasingly important and persuasive, and could result in an abrupt reality check for the market and its optimism in the health of the U.S. economic recovery. We have long held the view that the recovery is not strong and intact, and precious metals will ultimately benefit when this fact emerges. The home sales this week, core CPI, and the Philly Fed data will all need to be strong in order to derail the recent rally in precious metals. Otherwise, any continuous weakness will add further fuel to this initial price rally.

We are currently working on an update for British Columbia Developers, as well as the TOP 10 Spring report.

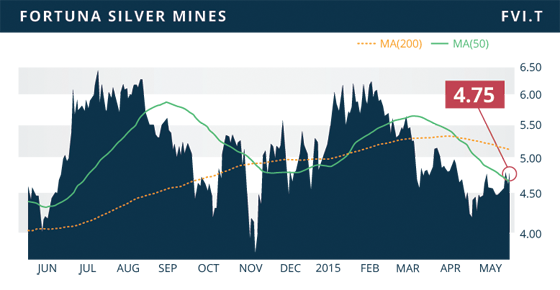

- Symbol: FVI.TO

- Price: $4.75

- Shares Outstanding: 128,845,842

- Market Cap: $612 Million

- Treasury: $77 million USD (as of March 31st)

- Significant Shareholders: Institutional Ownership (48.5%)

Fortuna Silver Mines (TSX:FVI, NYSE:FSM, Frankfurt:F4S, BVL:FVI) is a Canadian-based silver miner operating two low-cost mines in Mexico and Peru. The company is in a strong financial position with US$77 million in treasury and no long-term debt or hedging programs. The company also has a US$60 million credit facility, leaving Fortuna with a total liquidity position of close to US$140 million.

Fortuna operates the 2,000 tpd high-grade San Jose silver mine in Oaxaca, Mexico, which has a reserve life of 5.4 years. Their second operation is the 1,300 tpd silver-base metal rich Caylloma mine in Arequipa, Peru, which has a reserve life of 6.5 years. The San Jose mine is responsible for approximately 60% of revenue generation, with Caylloma contributing the other 40%. The underground San Jose mine contains proven and probable reserves of 3.8 million tonnes grading 233 g/t Ag and 1.81 g/t Au for 28.3 million ounces of silver and 219,500 ounces of gold. In the measured and indicated (M&I) and inferred categories combined, the mine contains an additional 60.5 million ounces of silver and 424 million ounces of gold. Continued conversion of these ounces into reserves will be the key to maintaining a solid production profile. The silver and gold reserves at the underground Caylloma mine grade 134 g/t and 0.33 g/t respectively, for 13 million ounces of silver and 32,300 ounces of gold. In the (M&I) and inferred categories combined, the mine contains an additional 22.7 million ounces of silver and 115,400 ounces of gold.

The company was successful during 2014 in not only replacing the consolidated reserves mined, but also in increasing those silver and gold reserves by 14% and 7% respectively. The company was also successful in expanding the known inferred mineralization, growing those silver and gold ounces by 31% and 30% respectively. With further drilling, these inferred ounces have the potential to become future reserves, and in turn increase the current reserve life of the two mines.

During 2014, Fortuna produced a consolidated 6.6 million ounces of silver and 35,316 ounces of gold, a year over year growth of 42% and 66% respectively, which exceeded their 2014 guidance by approximately 10% in both areas. This increase in production was largely attributed to the two phases of mill expansions at San Jose increasing throughput from 1,150 to 2,000 tpd. Supported by the solid resource expansion over the previous year, the company recently decided to further expand mill throughput at San Jose to 3,000 tpd. The expansion was initiated in Q1 and is slated to be complete by mid-2016 at a cost of US$30 million. This expansion is expected to increase silver and gold production by roughly 40% and 55% respectively, and significantly reduce cash costs at the mine.

During the year the consolidated cash cost (net of by-product credits) per ounce of payable silver was $4.69, with all-in sustaining cash costs (AISCC) coming in at $14.48. The company generated a net income of US$15.6 million in 2014, resulting in earnings per share of $0.12 despite the average price of silver declining 20% to $18.90 an ounce, and the average gold price declining 10% to $1,260 an ounce.

The consolidated AISCC for 2015 is expected to increase to $16.61, as a result of the mill expansion expenditures (US$12.6 million) and the US$28.3 million capital investment in the filter facility and dry stack tailings deposit at San Jose. This does not leave a lot of margin at the current silver price, although it sets the company up for stronger production and lower costs in the future. In addition, the initial breakout of the silver price last week could very well be the beginning of a rally that could propel the metal back above $20. We feel this is a real possibility if the weak economic data out of the U.S. continues. Therefore, a strong silver producer like Fortuna will greatly benefit from a metal price rally, yet would continue to be a solid company even if the metal prices rally is derailed and they retreat back to their depressed levels. Even at the current price of $17.50 silver and $1,225 gold, the 2015 guidance of 6.5 million ounces of silver and 35,300 ounces of gold will likely have the company generating similar revenues as last year, with the help of the weak Mexican Peso and Peruvian Soles; which have devalued roughly 20% and 12% against the U.S. dollar since this time last year.

Fortuna recently released their first quarter financial results, which showed the company generating US$3.9 million in the first quarter of 2015 at an average silver price of $16.65 and a average gold price of $1,215.57 an ounce. The consolidated mine production was in line with 2015 guidance, with the company producing 1.63 million ounces of silver, although producing slightly higher gold at 9,739 ounces. At that pace of gold production, the revenue from gold sales would surpass last years gold revenue at $1260 gold price. In other words, those extra gold ounces are important to this silver producer, so it is something for an investor to keep an eye on, especially if gold is above $1,200 and the local currencies remain weak.

Bottom line

The company is in a stable financial position with US$77 million in the treasury, as well as a $60 million credit facility available. This leaves the company with plenty of available funds to complete the $70 million in capital investments that the company has budgeted for 2015, and still maintain a stable and healthy balance sheet.

The company is one of the rare miners generating profits during this period of depressed metal prices, even though it has not reined in capital expenditures on mine development, expansion, or exploration in response to these lower metal prices. On the contrary, the company has initiated the US$30 million 3,000 tpd mill expansion at San Jose, as well as the $32 million dry stack tailings facility. This is a good example of a company positioning itself for future growth while still maintaining to generate profits despite depressed metal prices.

This company has a solid framework of growth, with the 3,000 tpd mill expansion underway at San Jose, the strengthening silver and gold price, and the resource expansion potential at Trinidad North. We feel that the best is yet to come for Fortuna, and although it is likely still a year away, the recent silver and gold price action of last week may expedite a rerating of the stock. We believe this is a good entry point to partake in the growth of a solid silver producer, with little downside risk at this point yet significant upside considering the growth framework, especially in the event that precious metals continue to rally.

Potential Catalysts and Events to Monitor:

- Expansion and Definition Drilling at Trinidad North Zone (San Jose)

- Increasing Silver and Gold Price

- Currency depreciation: Mexican Peso and Peruvian Soles

- Commissioning of San Jose Mill Expansion to 3,000 tpd (mid-2016)

MAY