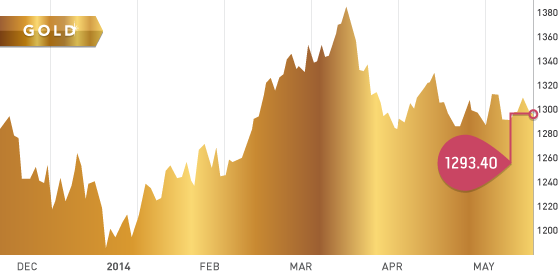

It was another fairly quiet week for the gold price which closed at $1293.40 Gold has been in a tight trading range since the end of March. No major catalysts have occurred to move gold one way or the other. Investors will be closely watching the FOMC minutes for April this week.

India, the world’s second biggest gold consumer, held its elections on Friday. It is expected that import restrictions on gold may be reduced later in 2014. Government officials need to make sure the current account deficit does not widen. Gold is very important in the Indian culture and pent up demand could be very bullish if/when the restrictions are reduced.

Silver

Still nothing exciting going on in the silver market. A report was out recently that physical demand for silver was at record levels in 2013. Despite this, it is interesting to note that silver is down ~15% in the last year.

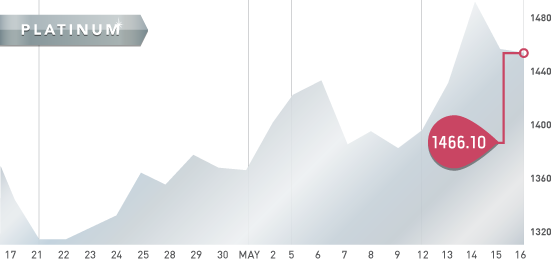

Platinum

The strike continues into week 17 as the AMCU holds strong in its wage demands. The platinum producers were hoping to lure employees back to work by going around the union but have been unsuccessful. Platinum producer Impala stated in its Q3 production report:

“The resumption of normalized production levels at Impala Rustenburg, once the strike ends and operations resume, are expected to take at least three months to achieve.”

The platinum price has started to move up in the past couple weeks and we expect this to continue.

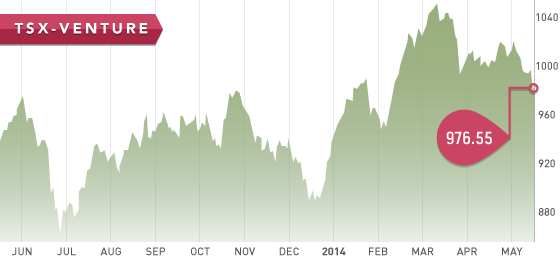

The TSX Venture continued to sell off as investors exit positions ahead of the summer. A major catalyst is needed to put significant upwards pressure on the TSX Venture such as a major discovery or a significant move in metal prices. We have been warning about the possibility of a slow summer for a few months now and continue to do so. We still need a hefty amount of companies to delist before we have fully hit bottom.

A Look Ahead

The key items on the calendar next week are:

- Monday May 19th – Canadian markets closed, US markets open

- Wednesday May 21st – FOMC minutes

- Thursday May 22nd – Unemployment claims

- Friday May 23rd – New home sales

Nevada Q4 producers were sent out last week.

Mexico producers (Q4) are in the queue. All producers for Q4 are now done.

Notice: As far as updates go, due to the quick turnaround between annual financials and Q1 statements we will be doing the following schedule:

1. Next updates will be Q1 2014 updates for all producers.

2. All development and exploration companies will have Q1 statements out by the end of May. We will then start these companies with the focus on the bigger regions first such as BC and Mexico.

3. If a subscriber would like an update on a particular company please let us know at info@tickerscores.com and we will get it back to you immediately.

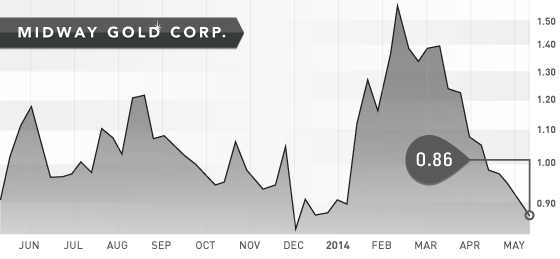

Symbol: MDW.T

Shares Outstanding: 134,103,006

Market Cap: $120,693,000

Cash: $43,500,000 (March 31)

Midway’s second project, the ‘Gold Rock’ project, is a similar project to the PAN project and is located 8km away. The plan is to follow along a similar path with defining 1 million ounces and production in 2016. A third asset is the ‘Spring Valley’ joint venture with Barrick. This is an attractive asset which Midway is fully carried to production with a 25% interest. The ‘Spring Valley’ project is already over 4 million ounces of gold in all categories.

The bottom line with one asset going into production and a pipeline of growth, Midway is well set up for future share price growth.

MAY