Gold

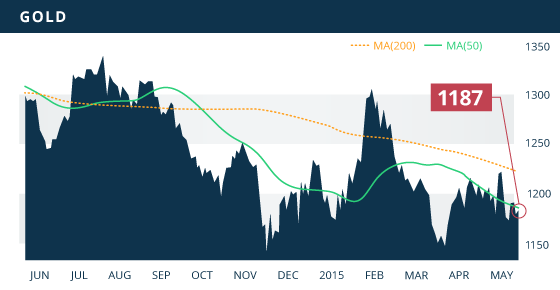

Gold struggled to break back above $1200 last week and was unable to clear this psychological hurdle. The soft NFP numbers of Friday gave gold a small boost, helping the metal gain $10 on the week and close the session at $1187.20. Mixed signals given by recent economic data out of the U.S. has kept gold oscillating over the past few weeks in a narrow trading range between $1175 and $1215. However, so long as the prospect of the Fed raising rates remains on the horizon, the U.S. dollar will continue to be strong. Therefore, there will need to be a significant deterioration of the economic recovery in the U.S., or some other geopolitical or gold related catalyst to propel the metal back up towards $1300.

Resistance remains at $1215, which is further reinforced by a declining 200 day MA. Near-term support comes in around the $1175 area, however if that level is broken, solid support comes in around the $1150 area; reinforced by an ascending trend line from the November low. As mentioned last week, if tested, the $1150 area needs to hold.

Technicals:

- Support: $1176.71

- Resistance: $1215.00

- 50 day moving average: $1,187.20

- 200 day moving average: $1,222.28

- HUI/Gold Ratio: 0.148 (Last week 0.153)

Silver

Silver was up for the second consecutive week, gaining 1.86% to close at $16.42. The metal still faces strong overhead resistance with two separate multi-year trend lines providing downward pressure to the silver price. In this case, a break though above $17 would be a very encouraging sign for the metal. Near-term support comes in around the $15.60, with solid support provided by an ascending trend line from the November low, currently at $15.40. The support and resistance trend lines form a pinch point that extends to the end of June. At some point between now and then, the metal will look to break out of this range in one direction or another. This imminent breakout will have the metal looking to $17.40 and $18.50 on an upside move, and to $15.04 on a downside move.

Technicals:

- Support: $15.59

- Resistance: $16.71

- 50 day moving average: $16.29

- 200 day moving average: $17.20

- Gold/Silver Ratio: 72.30

- XAU/Gold Ratio: 0.0610 (Last Week: 0.0622)

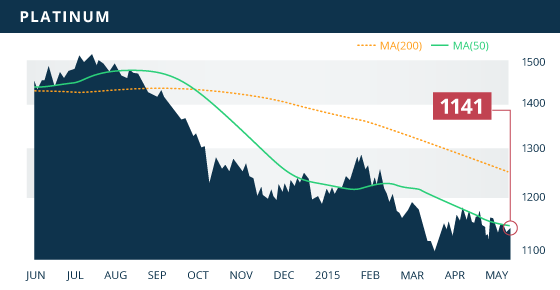

Platinum

Platinum was also up for the second consecutive week, gaining $10.20 to close the weekly session at $1141. The 9-month trend line continues to provide resistance around the $1160 area. Near-term support is provided by an ascending trend line from the mid-March low, which currently sits around the $1128 area. This support line held on Friday, with the metal bouncing off the $1128.10 level and then pushing to end the session at $1141. As with silver, the two support and resistance trend lines form a pinch point, in this case extending to the end of May. Between now and then, the price will break out in one direction or the other. A breakout to the downside will have the metal looking to test $1113 level, which will need to hold, or else the mid-March low of $1086 will be the next target. On a breakout to the upside, the $1186 area would be an important hurdle for the metal to overcome, but would confirm platinum’s upward trend off of the mid-March low.

Technicals:

- Support: $1128.10

- Resistance: $1156.10

- 50 day moving average: $1,147.61

- 200 day moving average: $1,251.92

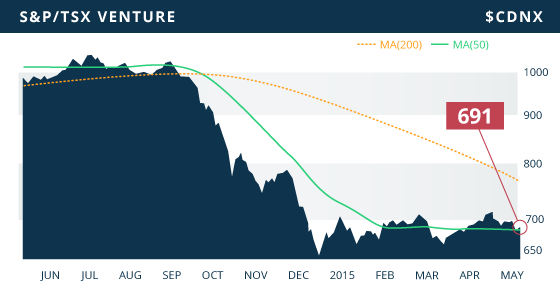

Both the TSX and the TSXV were down on the week roughly 1.1%, although the rally back into equities to end the week helped minimize earlier losses. The late week rally back into equities was a result of the soft NFP numbers indicating the prospect of a Fed rate-hike has been pushed back to later in the year and possibly early 2016.

The Canadian resource sectors were in the red last week, with the mining sector down 1.74% and the energy sector shedding 4.52%. The energy sector plunged 3% on Wednesday alone, with the NDP party winning a majority victory in Alberta, taking power from the Conservatives after close to 45 years in charge of the province. The NDP majority victory has the market concerned over potential hikes in royalty tax for the oil rich province of Canada. The gold sector shed 1.73% on the week, while the base metal sector lost 2.18% after two consecutive weeks of strong gains.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Tuesday May 12

- JOLTs Job Openings (US) – Consensus: 5.085M

- Federal Budget Balance (US) – Consensus: $146.5B

Wednesday May 13

- Industrial Production YoY (CHN) – Consensus: 6%

- German GDP QoQ (EA) – Consensus: 0.5%

- Core Retail Sales MoM (US) – Consensus: 0.5%

Thursday May 14

- PPI MoM (US) – Consensus: 0.2%

- Initial Jobless Claims (US) – Consensus: 271K

Friday May 15

- May NY Empire State Manufacturing (US) – Consensus: 4.50

- Industrial Production MoM (US) – Consensus: 0.1%

- Consumer Expectations & Sentiment (US) – C: 88.6 & 96.0

The main theme this month will be the market looking for better data out of the U.S. to show that the weakness in the first quarter can be attributed to harsh weather and not in fact to a weakening economy. With moderation in labour market data out last week, the market will be looking to the JOLTs Job Openings and the Initial Jobless Claims this week for further clues into the health of the labour market. Inflation watchers will be looking to the PPI for a 0.2% increase in the price of manufactured goods month over month. The market will also be looking for a bounce back of the NY Empire State Manufacturing index which had a reading of (-1.19), a figure showing worsening conditions. A bounce back is also expected for Industrial Production month-over-month, which had a prior reading of (-0.6%). Of great significance to the U.S. economy is consumer spending, and therefore Retail Sales and Consumer Expectations & Sentiment will be watched closely this week.

Last Week: The jobs data out of the U.S. was on the weaker side of things, with soft ADP and NFP numbers, although slightly stronger initial jobless claims. NFP data was a bit soft, although the market was happy to see an increase of jobs above 200K once again, considering the dismal numbers released last month. Those numbers were in fact further revised downward with the latest report, from 126K to 85K. However, with job gains back above 200K, it essentially signified that the March data (85K) was a one off and not an indication of a deteriorating labour market.

A stronger than expected ISM non-manufacturing PMI showed that the U.S. economy is potentially improving after a poor first quarter. In China, the balance of trade imports and exports both fell year over year by 16.1% and 6.2% respectively. China’s Manufacturing PMI came in below estimates, and showed the country’s manufacturing industry contracting. After these two readings it was not surprising to see China cut its benchmark interest rate on Sunday.

We are currently working on an update for British Columbia Developers, as well as the TOP 10 Spring report.

- Symbol: AR.TO

- Price: $1.89

- Shares Outstanding: 154,158,938

- Market Cap: $291.4 Million

- Treasury: $64 million USD (as of March 31st)

- Significant Shareholders: Management and Directors (3.5%), Institutional Ownership (77%)

Argonaut Gold Ltd. (TSX:AR) is a Canadian-based miner with 2 producing mines in Mexico and 3 high-quality low-risk development projects in Canada and Mexico. The company is in a strong financial position with US$64 million in cash and a manageable US$4 million in debt. The company has displayed strong production results over the past two quarters, recording record production in Q4 followed by another strong quarter in Q1. In the past 2 quarters, the company has grown their cash position by US$20 million or 45%.

The company is led by Chairman Brian Kennedy and CEO Peter Dougherty, both coming from Meridian Gold, which was acquired by Yamana for $3.5 billion in 2007. Mr. Kennedy served as President and CEO for Meridian and subsequently became Chairman, while Mr. Dougherty was the CFO. The company also has a strong COO in Richard Rhoades, prior General Manager for copper giant Asarco. In addition, Argonaut also boasts a strong supporting cast of directors, with numerous M&A experience in the resumes.

Argonaut operates two heap-leach mines in Mexico, El Castillo in the state of Durango, and La Colorada in the state of Sonora. These are both low-cost open pit heap-leach mines, with a cash cost of the combined production coming in at $735 per ounce sold in Q1. These two mines produced over 130,000 ounces of gold in 2014, and are expected to produce closer to 150,000 in 2015. During the full year of 2015, the company expects these two mines to generate US$75 million in cash flow. This US$75 million is expected to be eaten up by US$37 million in expansion and exploration expenditures, US$4 million in debt repayment, US$7 million in taxes, US$8 million in G&A, and lastly US$20 million for the final instalment owed to Silver Standard Resources (TSX:SSO; NASDAQ:SSRI) for 100% interest in the San Agustin property. This payment was evidently made last week.

These expenditures will leave the company at essentially the same cash position as it did to start the year. However, US$7.4 million of the expenditures are for pad development for future ore stacking at their two operating mines. The US$20 million payment to Silver Standard, and the US$4 million debt repayment, will slash the company’s current liabilities in half to just over US$20 million. This will help to strengthen their balance sheet even further going forward.

Argonaut also holds 3 high-quality development projects; two of which are in Mexico and one in Ontario Canada. The combined NPV of all three projects at a discount of 5%-8% is $474.5 million. These three projects also use a gold price of between $1200 and $1300, which is in line with today’s gold price environment. In fact, gold is trading at approximately $1400 in relative terms in the Canadian and Mexican currencies. This essentially displays that all three of these projects are feasible in the current environment and ready to go ahead, subject to permitting. The addition of production from one or all three of these projects will significantly boost the companies revenue and earnings.

At the San Agustin Project in Durango Mexico, located 10 km west of their El Castillo mine, the company is close to submitting their final permits, which are expected to take 6-9 months for the Mexican authorities to process. The company expects to receive all necessary permits required, and be in the position to make a construction decision by the end of the year. The initial CapEx for the project is approximately US$67 million, which could potentially be funded in part from the current operations. At $1200 gold and $17 silver, the project generates an (after-tax) NPV5% of US$70.2 million, with an IRR of 22% and a payback of 4.1 years over the 10.5 year mine life.

At the San Antonio Project in Baja Sur Mexico, the company is patiently pursuing necessary permits as the project is hung up at the permitting stage. With the area set to undergo local elections in June, the company will have a better understanding of the project’s direction once a new mayor is chosen and in power. With the project requiring US$85 million in initial CapEx, yet generating and an (after-tax) NPV8% of US$205.6 million, any positive moves towards a construction decision, and out of permit purgatory, would certainly have a positive impact on the share price.

At the Magino Project in Ontario Canada, the company continues to expand the resource, with drill results from the current program expected over the next couple of months. These results will be used in an updated PEA expected by the end of the year. Using $1250 gold, the current PEA shows the project generating an (after-tax) NPV5% of US$199 million, with an IRR of 31% and a payback of 2.7 years. The initial CapEx of the project has a price tag of US$356 million, with a mine life of 13.2 years. With additional drilling and further mine design optimization, the updated PEA should improve on the already impressive economics.

Bottom line

The company is in a clean and stable financial position with US$64 million in the treasury, and is relatively debt free with approximately $4 million in debt. The cash position, in Canadian dollars, represents 25% of Argonaut’s market cap. The company is currently producing roughly 140,000 gold equivalent ounces (GEO), and with the continued progress at their development projects, the company hopes to increase that production to 300,000-500,000 GEO of annual production.

Clearly the development projects are feasible in today’s price environment, and the company will look to advance these project to become fully permitted and further optimized, so that they are ready to be given the green light when the right opportunity arises. The company has a strong and capable management team in place, whom have shown in the past their ability to generate shareholder value.

With a market cap of $290 million, Argonaut seems prime for the picking as a merger or take out candidate, even more so if they are able to address San Antonio permitting issues. One plausible scenario that makes sense would have Primero Mining acquiring or merging with Argonaut Gold. Both companies are mid-tier gold producers with operations in Mexico and Ontario, and both with a strong pipeline of project in these two jurisdictions as well. The combination of these two companies makes sense for various reasons, although it likely does for other companies on the hunt as well

Potential Catalysts and Events to Monitor:

- San Agustin Drill Results (Q2 2015)

- San Agustin Construction Decision (Q4 2015)

- Magino Drill Results (Q2 2015)

- Magino Updated PEA (Q4 2015)

- San Antonio Project Update (Q3 2015)

- Merger or Acquisition Target.

MAY