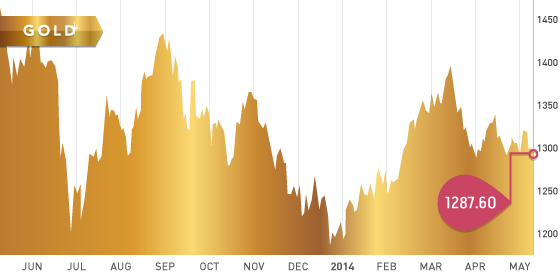

Gold had a fairly quiet week closing at $1287.60, which is down from last week’s close of $1302.90. Weakness was mainly driven by positive economic comments from Fed Chair Janet Yellen.Gold has been trading in a fairly tight range the last several weeks with the average price in April being $1299/per ounce and May so far coming in at $1289.90/ounce. Tensions between Russia and Ukraine continue to support gold as a safe haven investment.Gold investors need to watch the US Dollar Index, as technically it is beginning to weaken which would be bullish for gold.

Silver

Silver continues to be sluggish and closed at $19.13. Silver is now down 2% year to date.

Platinum

The AMCU has declined the latest offer from the platinum producers and continues to hold strong on its position. The platinum producers are going directly to employees asking them to return to work via text messages. Platinum producer Lonmin is apparently preparing to restart production next week (May 14th). Impala will release voting results on May 13th. The strike has been ongoing now for 15 weeks.

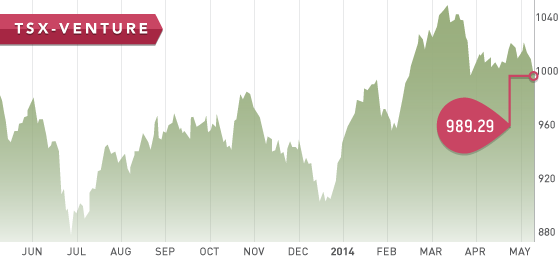

The TSX Venture had five consecutive red days this week dropping a total of 23.63 points to close at 989.29. Investors need to be extremely cautious as we enter the summer months. We can easily see the TSX Venture drop under 900 by the end of August (-10%). Fundamentals remain very weak for the majority of companies on the exchange. Holding some cash and waiting for bargains could be a winning strategy.

A Look Ahead

The key items on the calendar next week are:

- May 12th – Treasury Budget

- May 14th – Producer Price Index

- May 15th – Initial Unemployment Claims, Consumer Price Index

- May 16th – Housing Starts

Ontario producers (Q4) were sent out earlier this week. Lake Shore Gold (LSG.T) took the top spot as they have turned the company around and are now cash flow positive. Keep an eye on Kirkland Gold as the next turnaround story in Ontario.

Nevada and Mexico producers (Q4) are in the queue. All producers will be done shortly and then it is time to get to work on exploration and development companies.

Stock of the Week update: On April 14th we featured Doubleview Capital (DBV.V) at 23.5 cents as a stock to watch.The close on Friday was $0.35 as investors await assays from the HAT project. Investors will be looking for long intercepts (100-200m+) of at least 0.20% copper and 0.2 g/t gold. Another thing to note is DBV will need to raise cash.

Symbol: SLR.T

Price: $1.10

Shares Outstanding: 39,162,127

Market Cap: $43,078,000

Cash: ~$2 million (March 31,2014)

Insider ownership: ~8%

This week we take a look at Solitario Exploration and Royalty Corp. We feel that it has several excellent assets. The flagship project is the Mt. Hamilton gold project in Nevada owned 80% by Solitario and 20% Ely Gold (ELY.V). An updated feasibility study is underway which will increase production to ~60,000 ounces per year. Investors can expect the optimized feasibility study to come out in the next 3-4 months. Project economics are robust down to the $1,000/oz level and at $1,100 gold the resource size is 872,382 Au equivalent ounces. The 2012 feasibility study shows a capital cost of only $72 million. Management expects final permits in August which will be followed by bank financing and construction starting in Q4. If everything goes according to plan initial production is scheduled for 2015.

Another significant asset is the high-grade Bongara Zinc project in Peru joint-ventured with Votorantim Metals. SLR owns 30% of the project and is fully carried until production.Zinc has been forecasted by many analysts to go into a deficit in the next couple years. Drill results from the project have been high grade and the deposit is open in all directions. A major catalyst for this project is a NI 43-101 resource estimate is due out in the next 3-5 weeks.

The bottom line is: with two fantastic projects, strong insider ownership, and a low float, Solitario is an investment to consider.

MAY