Gold

Gold continued its descent from the January highs as it ended the week plunging from a stronger U.S. dollar. Gold closed Friday’s session at $1168.20, down $45.50 or 3.75% on the week. Up until this week, the metal hadn’t closed below $1200 since January 2nd.

With the market-perceived strong jobs report out on Friday, investors poured into the U.S. dollar as the prospect of a mid-year rate-hike is back on the table. All of this weighed heavily on gold as it was swiftly sold off Friday morning, breaking through support levels along the way with ease. An ascending support line in place from the November low was broken on Friday leaving little support markers in place below these levels. A bearish tone now dominates the gold space, and any optimism generated during the January rally has now been erased.

Despite the continuous soft U.S data that have been undershooting estimates, and even the fact the NFP weren’t particularly strong, the market clearly has one objective, and that is buying the $USD. As a result gold has fallen victim to the herd mentality. Looking closer at the jobs numbers though, the participation rate fell lower and continues to be at a near 40 year low, while wage growth was lower than expected.

The technicals broke down this week following Friday’s jobs numbers, and now leave the metal with little in terms of support levels. A confirmation of a mid-year rate-hike during the upcoming FOMC meeting in March 17-18th could potentially send gold lower than the November low.

Technicals:

- Support: $1,142.65

- Resistance: $1,219.92

- 50 day moving average: $1,229.39

- 200 day moving average: $1,245.56

- HUI/Gold Ratio: 0.143 (Last week 0.158)

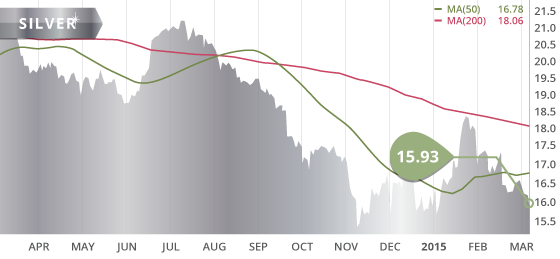

Silver

Silver was down close to 4% on the week with a close of $15.93 an ounce. During the sell-off on Friday, buyers stepped in at $15.65 and in turn had the $15.51 level continuing to hold up as a level of solid support. A sell-off in gold and silver miners on Friday had the XAU/Gold ratio dipping to a two-month low.

Technicals:

- Support: $15.51

- Resistance: $16.45

- 50 day moving average: $16.78

- 200 day moving average: $18.06

- Gold/Silver Ratio: 73.33

- XAU/Gold Ratio: 0.0579 (Last Week: 0.0634)

Platinum

While putting in a fresh new multi-year low on Friday, Platinum was down $29.20 to close at $1158.80. The metal looks like it has further to fall, as there does not seem to be much support between these levels and the July 2009 low of $1100. Palladium on the other hand, climbed above the 200 day MA this past week and closed above the trend line for the first time since late September. Palladium also put in a fresh 5½-month high on Monday before giving back some of the gains the rest of the week.

Technicals:

- Support: $1,100.00

- Resistance: $1,194.40

- 50 day moving average: $1,215.76

- 200 day moving average: $1,324.86

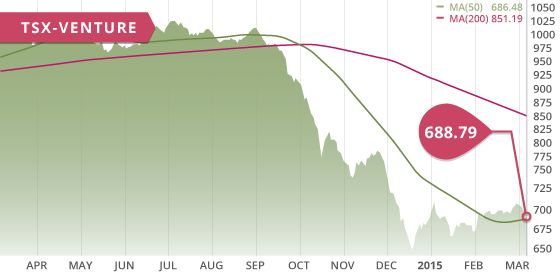

The TSX was down 1.85% on the week, and dropped below the 15000 mark while closing at a one-month low. The TSX-V closed at 688.79, down 2.54% on the week after putting in 5 straight days of losses. The TSX Materials Index was down 7.7% on the week, and similarly, the TSX Global Mining Index was down 7.8% after hitting a five-month high the week prior. The gold sector was a heavy contributor to these declines as it was down close to 12% to end the week.

Copper shed 8 cents to close the week at $2.61 per pound. The materials-friendly measures recently taken by China have not supported base metals as we have expected. This is clearly evident by the decline in the base metal sector, which was off over 5% this week.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Sunday March 8

– Balance of Trade (CHN) – Consensus: $10.8B

– GDP QoQ, YoY (JPN) – Consensus: 0.6%, 2.2%

Tuesday March 10

– Inflation Rate MoM, YoY (CHN) – Consensus: 0.7%, 0.9%

– Balance of Trade (RUS) – Consensus: $14.5B

Wednesday March 11

– Industrial Production (CHN) – Prior: 7.9%

– Federal Budget Balance (US) – Consensus: $-190.5B

Thursday March 12

– Industrial Production MoM (EA) – Consensus: 0.2%

– Retail Sales MoM (US) – Consensus: 0.3%

– Initial Jobless Claims (US) – Consensus: 309K

Friday March 13

– Interest Rate Decision (RUS) – Consensus: 15%

– Employment Change (CAN) – Consensus: -5.0K

– Mic. Consumer Sentiment (US) – Consensus: 95.0

– PPI MoM (US) – Consensus: 0.3%

This week the markets will focus on the key economic data points out of China to help gauge the growth profile of the country. The mining sector will be particularly interested in these numbers. The market will also be focused on the Consumer Sentiment and Retail Sales data out of the U.S., since the weak consumer data continues to be a concern. The PPI, as well as the Federal Budget Balance, will also be items that may be market movers.

Last Week:

The non-farm payroll data out of the U.S. was the big market mover this past week. The data showed the country adding 295K jobs, which was well above the expected 240K. However, the participation rate declined and continues to be at a near 40 year low. Also, wage growth grew less than expected, which is a data point the FOMC is closely monitoring before their next policy meeting on March 17-18.

Also in the U.S. last week, the ISM Manufacturing data came in weaker than expected, showing employment nearing contraction and exports continuing to contract. With weak construction spending numbers out on Monday, the first quarter GDP estimates were lowered this week. Personal spending improved month over month but was still below estimates. Despite these improvements, this was the second consecutive month of declining personal spending. ADP employment change came in lower than expected.

Meanwhile, initial jobless claims were higher than expected, increasing for the second straight week and having the highest reading since May of last year. Factory orders were below estimates and marked the sixth straight month of negative readings. Balance of Trade was in line with expectations showing a drop in exports as well as imports. Finally to end the week, Consumer Credit in the US was the smallest gain since November of 2013; a number that may foreshadow this week’s consumer confidence and retail sales data.

The strong GDP numbers out of Canada, combined with no rate cut by the BoC, initially led to a stronger Canadian dollar. However, with poor building permit numbers and weak balance of trade data out on Friday, the gains made earlier in the week were quickly erased. As with Canada, there were also no rate cuts from Australia or the ECB.

Mexico Developers update is being finalized and will be released this week. We now look towards our next update, which will be Ontario Developers, a jurisdiction that has had some exciting developments over the past few months, including the announced acquisition of Probe Mines by Goldcorp.

Top 10 Updates:

Montan Capital Corp. (MO.P) announced this week that the amalgamation of Montan and Strait Minerals is complete and the newly amalgamated company Montan Mining Corp. will begin trading on Monday March 9th under the symbol MNY.V.

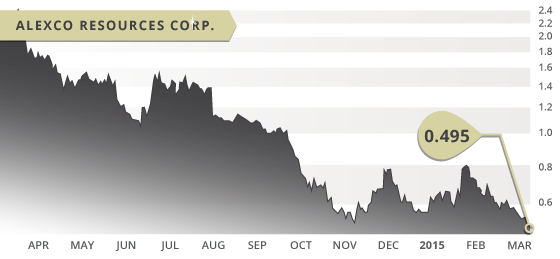

- Symbol: AXR.TO

- Price: $0.495

- Shares Outstanding: 69,588,898

- Market Cap: $34.4 Million

- Cash: $10.5 million (As of Sept. 30th)

- Significant shareholders: Sprott Asset Management (8%), Columbia Wanger Asset Management (4%), Directors & Officers (4%)

Note: Alexco is not currently covered in the Tickerscores database.

Alexco Resources (AXR.TO) is a silver company developing the prolific Keno Hill Silver District (KHSD) in the Yukon Territory of Canada. The 100% owned KHSD covers 233.5 km2,which includes more than 35 historical mine sites. Historical production from the aggregate of these mines is well over 200 million ounces, with the district containing some of the highest-grade silver resources in the world.

After years of production, the Canadian Government eventually inherited the district, after environmental liabilities forced the former operator into bankruptcy. Alexco acquired the district after being appointed the preferred purchaser by the court-appointed interim receiver and receiver manager. In 2006 the company’s purchase of the district was approved, after lengthy negotiations with the governments of Canada and the Yukon, as well as the courts.

Since acquiring the district in 2006, Alexco focused on developing the Bellekeno resource, and with the help of a $50 million silver purchase agreement with Silver Wheaton Corp. (SLW.TO), Alexcoeventually put the mine into production in 2011. This silver purchase agreement gave Silver Wheaton the right to buy 25% of the silver produced from the KHSD for a fixed price of $3.90 per ounce. After only 3 years in production, Alexco made the decision to suspend operations at Bellekeno as a result of the collapsing silver price. This decision was made to allow the company to reorganize the district and reposition the company for sustained long-term operations. The company needed to get its production costs under control as the costs were rising in tandem with a falling silver price. During the final year of production (2013), the company was producing silver at a cost of $14 per ounce, although the all in costs combined with the effect of the silver stream, equated to approximately $20 per ounce. Therefore, as the silver price dropped, underlying fixed costs consumed the entire margin. At a silver price of $20 or less, the company was essentially losing money.

This was unsustainable, and so the company suspended operations to avoid depleting their assets at a loss. The company needed to address the current silver purchase agreement, as well as find ways to bring the operating costs down. The company addressed the first item in mid-2014 when it announced an amended silver purchase agreement. After an extension to this pending agreement was made in November, the company now has until December 31st 2015 to make a $20 million payment to Silver Wheaton to effectuate the amendment. Under the terms of the amended agreement, Alexco will pay $20 million to Silver Wheaton in return for a revised stream on the 25% of silver production from the KHSD. The sliding scale of stream payments allows Alexco to preserve profit margins at lower silver prices.

The second item was to identify ways to bring the operating costs down. They need to achieve mine production volume to ensure that they can reliably increase feed and throughput to the mill and reduce unit costs. One issue is the lack of economies of scale generated by the Bellekeno Mine that reduces the ability to lower the unit costs of the operations. The mine was producing at its 250 tpd design capacity, while the mill has a nameplate capacity of 400 tpd capacity. The discovery and development of the new Flame & Moth (F&M) deposit has reinvigorated the KHSD and provided an opportunity to both alter and improve the mine plan at Keno Hill. As displayed by the recently updated PEA in December, the F&M deposit would contribute 72% of the mill feed in the new mine plan, and would provide some flexibility in controlling the unit costs. The 23 million ounce F&M deposit is emerging as a cornerstone asset of the KHSD and will anchor future production well into 2020s.

The company will continue to optimize the mine plan as it awaits the final mine permits for F&M. Once these permits are in place the company can begin the construction of a decline as well as underground infrastructure and development. These developments will cost around $13 million and would prepare the mine for initial production once the timing is right. The plan is to return to production with a contribution from F&M and Bellekeno, then to later add in production from the high-grade Lucky Queen mine.

Using a silver price of $18.50, the after-tax NPV5% of the updated PEA was $23.3 million, with an IRR of 22% and a payback of 3.75 years. The life of mine (LOM) is a short 5.57 years, however, the exploration success indicates that the company has the potential to extend the LOM as it continues to build up its resource inventory. The NPV is somewhat small at this point, but the upside possibilities evident by the exploration and expansion potential are what make the company compelling at this price.

There are multiple deposits within the district that offer growth potential, such as the Bermingham deposit. It is a complex deposit but the recent drilling success shows the potential for this deposit to be added into the future mine plan. Recently at Bermingham, the company drilled the best hole ever since acquiring the KHSD in 2006 with hole K 14-0537. It intercepted 6.39 meters (true width) with a composite silver grade of 5,667 g/t silver (165.3 ounces per ton). This is a truly remarkable intercept and displays the exceptionally high-grade nature of the district. The 2014 drill program at Bermingham aims to extend the mineralization of the deposit, which at this point contains an indicated resource of 3.8 million ounces of silver as well as 1.2 million inferred ounces. The Bermingham deposit is not included in the PEA, although continued success should elevate the deposit to potentially become future mill feed and extend the LOM at Keno Hill.

An updated resource estimate of the district will be released during the first half of 2015. The total indicated resource currently within the KHSD is 50.2 million ounces of silver, which includes close to 10 million in the Elsa tailings. Approximately 43,000 ounces of gold, 100 million pounds of lead, and 400 million pounds of zinc accompany the 40.7 million ounces of sub-surface silver.

Alexco also operates an environmental unit that is essentially a stand-alone subsidiary of the company. The Alexco Environmental Group (AEG) is a profitable business unit that continues to grow year over year. The gross profit generated from AEG is able to offset Alexco’s burn rate while mining operations are suspended. This scenario will help the company avoid share dilution through unnecessary financings.

Bottom line

At these levels, this company appears to be attractive for a long-term investor. The company is in the process of optimizing their mine plan while potentially restructuring the silver purchase agreement in preparation for a return to production. Once the company obtains the final permits for Flame & Moth, a return to production will become more feasible and more of a reality to the market. This silver district has tremendous upside, and will reward this company if it is able to return to optimized production, and achieve nameplate capacity. With a sizeable land package and rich mineral abundance, the KHSD has the potential for Alexco to significantly increase their already impressive resource inventory.

Potential Catalysts and Events to Monitor:

- Mining Licence for Flame and Moth

- Resource Updates: Flame & Moth, and Bermingham (Early 2015)

- Potential Pre-Feasibility Report (2015)

- Amended Silver Agreement Payment (By end of 2015)

- Possible AEG Revenue Growth

MAR