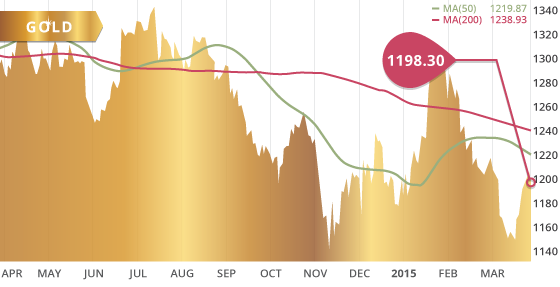

Gold

Gold was up 1.4% on the week to close the session at $1198.30 for the second straight week of gains. During early morning trading on Thursday gold broke above $1200 and pushed to a 3-week high of just under $1220 where it met the 50-day MA and bounced off the trend line. The metal was pushed down the rest of Thursday’s session and ended the day at $1203.60. This was followed on Friday with its first negative day after 7 straight days of gains. This mini trend may be in jeopardy of reversing next week so short-term investors should remain cautious, and be paying close attention to the economic data out of the U.S. this week, most notably the jobs numbers.

The HUI/Gold ratio fell back to a 3-month low, which shows that the gold sector is not participating in the recent gains of the metal. Gold is up $40 over the past two weeks, yet the ratio remains at the 3-month low put in two weeks ago. The fact that the gold miners are not joining the mini rally may indicate that the recent bounce in the gold price will not last.

Technicals:

- Support: $1,183.50

- Resistance: $1,219.16

- 50 day moving average: $1,219.87

- 200 day moving average: $1,238.93

- HUI/Gold Ratio: 0.139 (Last week 0.144)

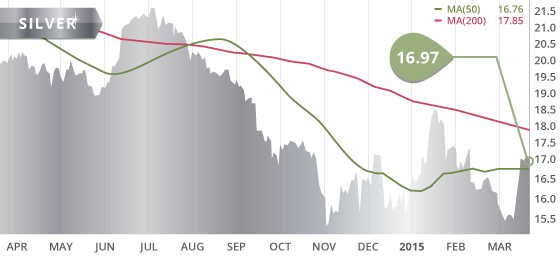

Silver

Silver ended another week in positive territory, up 1.4% to close at $16.97, with the metal spending the majority of the week oscillating along the $17 mark. Silver was able to break through the 50-day MA and clear the $16.89 level, yet met stiff resistance within the $17.30 area. The metal bounced off the underside of an 8-½ month descending trend line, in place from the $21.55 high of July 10th. This was the third touch of the trend line, and will provide significant overhead resistance. Coinciding with this level is a 61.80% retracement mark of the move down from the January high of $18.51 to the March low. Also to keep in mind is the declining 200-day MA that currently resides at $17.85, which may provide further resistance.

Technicals:

- Support: $16.76

- Resistance: $17.85

- 50 day moving average: $16.73

- 200 day moving average: $17.90

- Gold/Silver Ratio: 70.61

- XAU/Gold Ratio: 0.0565 (Last Week: 0.0586)

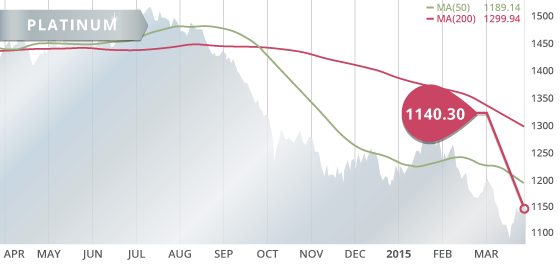

Platinum

Platinum was flat on the week despite being up over $25 at one point during the weekly session. The metal closed Friday at $1140.30, down $7.90. The metal bounced off the underside of a 2-month descending trend line in place from the high of January 22nd. Thursday’s intraday high was the third touch of this trend line, and the bounce off indicates the metal is obeying this trend within a controlled descent. Palladium on the other hand had a dreadful Friday session, closing the day down $32.15, or 4.2%. This helped push the metal to a fresh 5-month low, and within arms reach of the 13-month low of $729.95 put in October 16th. The metal is now down close to 20% from it’s multi-year high of $910.30 put in on October 1st of 2014.

Technicals:

- Support: $1,086.20

- Resistance: $1,149.70

- 50 day moving average: $1,198.14

- 200 day moving average: $1,307.93

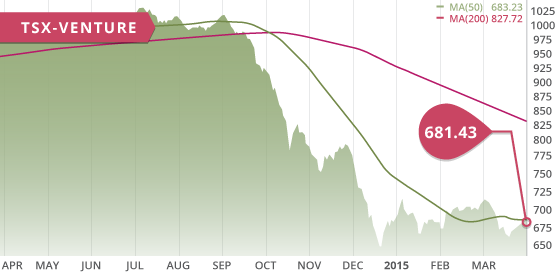

The TSX was down on the week, weighed down by the mining sector, which was down 2.44%, as well as the financial sector. However, in a rare occurrence the TSX VENTURE was actually in positive territory despite its bigger brother being down on the week. This was largely a result of the energy sector gaining 2.5%. The gold sector was down 2.6% and the base metals were down 2%.

The US dollar index regained some of the lost ground this week, which helped to put pressure on commodities. The strength in the dollar this week was in large part a result of multiple Fed members, including Yellen of Friday, indicating rate-hikes are nearing.

A Look Ahead

As we keep an eye on economies around the world, particularly on the recovery of the US, the condition of the Euro Area, and the growth in China, the key economic items on the calendar this upcoming week are:

Monday March 30

- Personal Income, Spending (US) – Consensus: 0.3%, 0.2%

- Pending Home Sales MoM (US) – Consensus: 0.5%

- Core PCE MoM-Feb. (US) – Consensus: 0.1%

Tuesday March 31

- CPI YoY-March (EA) – Consensus: (-0.1%)

- GDP MoM-Jan. (CAN) – Prior: 0.3%

- Chicago PMI (US) – Consensus: 51.5

- CB Consumer Confidence (US) – Consensus: 96.0

Wednesday April 1

- NBS Manufacturing PMI (CHN) – Prior: 49.9

- ADP Employment Change (US) – Consensus: 240K

- ISM Manufacturing PMI (US) – Consensus: 52.5

Thursday April 2

- Balance of Trade (US) – Consensus: ($-41.20B)

- Initial Jobless Claims (US) – Prior: 282K

- Factory Orders MoM-Feb. (US) – Consensus: (-0.5%)

- Balance of Trade (CAN) – Consensus: ($-2.00B)

Friday April 3

- Non-Farm Payrolls (US) – Consensus: 242K

- ISM Non-Manufacturing PMI (US) – Prior: 56.9

The main areas to watch this week will be the multiple pieces of jobs data, most notably the Non-Farm Payrolls. However, with the Non-Farm Payrolls being released on Good Friday, a day on which markets will be closed, investors will most likely focus their attention on the ADP numbers out on Wednesday more then usual. However, there is no question the Non-Farms will be not go ignored, and will undoubtedly impact trading the following Monday and the weeks ahead. The Fed has clearly signalled that they are looking for further improvement in the labour market as well as with inflation before they decide to raise rates. The key areas of the labour market investors should be watching are the wage growth and participation rate. Any hiccup in the strength displayed by the labour market will translate into delays in rate-hike expectations. This will weigh on the U.S. dollar, and inversely lend support to the gold price. We should get some clues from the ADP numbers out of Wednesday, as well as the initial jobless claims and challenger job cuts on Thursday.

Wednesday will also see the release of manufacturing numbers out of both the U.S. and China. Manufacturing PMI has been an area of weakness in both countries, with business confidence in the U.S. dropping for the fourth straight month in February, and looking to continue that trend in March. Similarly, Factory Orders have declined for six straight months, and look for that trend to continue when data is released on Thursday for the month of February.

Home Sales will be an area to watch after some stronger housing data was released last week and offered some optimism in an otherwise sluggish area of the economic recovery. Since the collapse in the housing market during 2007-2010, new home sales have not been at this level since the early 1990’s.

Last Week: As this was the first full week of economic data post-FOMC meeting, there was plenty of data to sift through for the market. The data was somewhat mixed, with new and existing home sales showing better then expected numbers. Home sales rose to their highest level since the 2008 recession. However, these home sales could be explained by the fact buyers expect rates to increase soon and are therefore trying to get in before that point. Core CPI showed slightly better numbers then expected. However, the Durable Goods report was dismal, and again underscores the impact of a stronger dollar as well as a lack of spending by the U.S. consumer.

The final GDP numbers for Q4 showed the country expanding at 2.2% in 2014. Preliminary data showed corporate profits in the U.S. fell 1.6% vs. an expected 1% gain. This will most likely become a more prominent issue moving forward as the strength of the dollar will significantly impact the earnings of corporations with operations abroad. In other news, China’s manufacturing activity fell to an 11-month low in March, which does not bode well for the resource sector, namely the base metals.

Ontario Developers update is nearing completion, with Rubicon Minerals and new addition Premier Gold Mines looking to claim the top spots.

Top 10 Updates:

Pretium Resources (PVG.TO) announced that they have received the British Coumbia environmental assessment approval. This is an important step in the development of Brucejack and brings the project one step closer to construction. The project will still need to obtain environmental approval from the federal environmental agency, which the company stated is nearing completion.

Silvercrest Mines (SVL.TO) announced their Q4 and full year 2014 financial results, which showed the company losing 2 cents per share on an adjusted basis in the fourth quarter. The loss was largely attributed to 55% higher cash costs realized as a result of the transition process from open-pit to underground mining at Santa Elena. These costs should start to come down somewhat as underground production ramps up. Silver ounces sold in the Q4 increased to a record high.

Dalradian Resources (DNA.TO) announced that they have commenced drilling at the Curraghinalt Project. The 20,000-meter program will consist of 6 drill rigs, with 15,000 meters of underground drilling and 5,000 meters of surface drilling. This program will help support the ongoing prefeasibility study, and drill results will be released as they are received. This will provide steady news flow over the next few months.

Red Eagle Mining (RD.V) announced this week that they have arranged a $65 million (U.S.) construction financing with Orion Mine Finance, and stated that the company is on track to commence construction by mid-2015 with production in 2016. The financing includes a secured $60 million (U.S.) credit facility. The $5 million equity portion is priced at $0.33 cents per share ($1 million already closed Feb 3rd). As part of the loan facility agreement, the company will need to complete another $15 million (U.S.) equity financing. At these prices this $15 million raise roughly would add another 60 million shares to the issued share count. In addition to the current share count, as well as the approximately 15 million shares as part of the $4 million equity financing, the total shares outstanding would therefore grow to approximately 150 million shares. At $0.30 cents per share, and considering a share count of 150 million, the company is currently trading at 0.5X their (after-tax) NPV5% at $1200 gold.

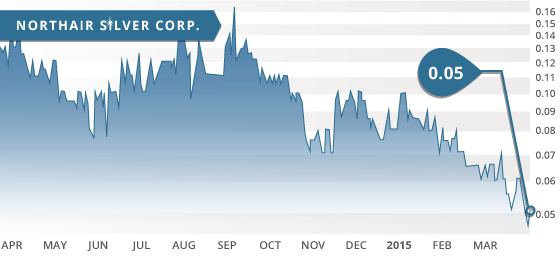

- Symbol: INM.V

- Price: $0.05

- Shares Outstanding: 150,137,105

- Market Cap: $7.5 Million

- Cash: $4.4 million in treasury (as of January 31st)

- Significant Shareholders: Condire Group (15.2%), Coeur Mining (13.5%), Sprott/Associates (11.1%), Management and Directors. (7.1%)

Northair Silver Corp. (TSX VENTURE:INM) (OTCQB Listing: INNHF) is a Canadian mining company exploring for silver in the state of Chihuahua in northern Mexico. The company is focused on advancing their flagship La Cigarra Project located in southern Chihuahua, within the historic Parral Silver District. This district is home to several past producing and current silver mines, including Santa Barbara, San Francisco del Oro, and Veta Colorada. The Parral Silver District is home to over 2 billion ounces of historical silver production and contained silver resources.

The area is clearly a prolific silver district, and companies such as Northair are showing that there is still more silver to be discovered in the area. Notable companies such as Silver Standard and Endeavour Silver also hold land positions in close proximity to the La Cigarra property. Endeavour Silver, who purchased a 100% interest in the old Parral mine in 2011 for $1 million stated, “We’re seeking other properties in the district with silver resources, to create critical mass for developing a new mine”. This helps demonstrate the attractiveness of this district, and also shows that the development of La Cigarra will not go unnoticed, and could potentially lead to an acquisition.

The La Cigarra Project consists of a number of concessions totalling 32,000 hectares, and is situated 26 km from the historic silver mining city of Parral. The deposit is an intermediate sulphidation epithermal silver deposit with notable lead, zinc and gold values. There is numerous historical surface workings on the property, however there has been no known modern exploration or previous drilling conducted on the property.

Northair began drilling the La Cigarra in 2010 and after 3 rounds of drilling the company released an initial resource estimate in 2013. In 2014, the company drilled 17 holes for 4,817 meters to follow up on the initial resource estimate. Following the completion of the 2014 drill program, an updated resource estimate was released in January of 2015. The updated resource used a higher cut-off grade as well as a lower silver price then those used in their initial resource estimate. Despite these increased constraints, the results of the updated resource estimate showed an improvement on the size and grade of the initial resource estimate by 17% and 14% respectively.

The updated resource includes 156 holes totalling 27,617 meters of drilling. The resource was calculated using a cut-off grade of 35 g/t and a $22 silver price. The company also conducted a sensitivity analysis of the resources using $29 silver (price used in 2013 resource estimate) and $17 silver. The resource estimated at todays current silver price of $17 silver, contains a measured and indicated resource (M&I) of 15 million tonnes grading 92.5 g/t of silver for 44.7 million ounces of silver. The resource also includes 35,000 ounces of gold, 44.4 million pounds of lead, and 59.3 million pounds of zinc. The inferred resource adds roughly another 20% to these numbers, although at slightly lower grades.

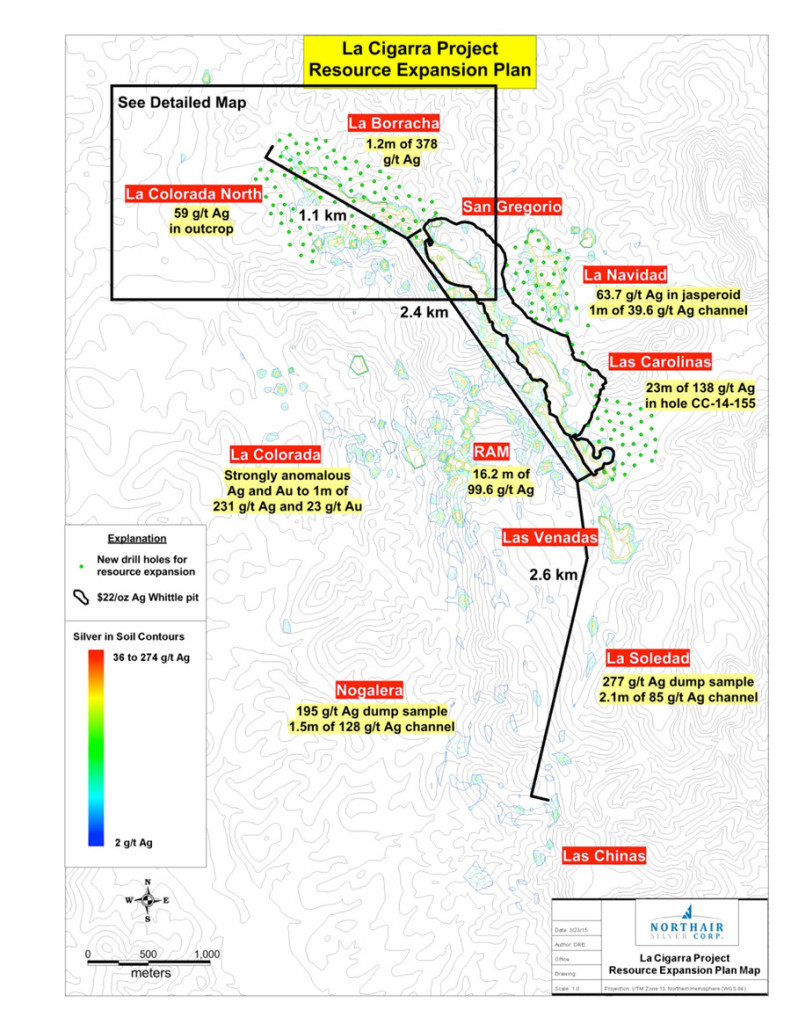

The main area of the project contains over 6km of mineralized strike length, with the La Cigarra resource accounting for 2.4km of the trend (See map below). The fully funded 2015 drill program will consist of 8,000 meters of drilling and will largely concentrate on extending the deposit to the north and to the south. The drilling will be allocated between the La Borracha Zone 500 meters to the northwest of the deposit, the southern extension of the Las Carolinas Zone, as well as the La Navidad Zone immediately to the east of the deposit. See map below for the areas of focus and proposed drill holes. The company is currently working through permitting the 2015 drill program and expects to commence drilling in late spring or early summer.

The La Cigarra deposit hosts an attractive shallow resource that is open-pittable, though is also showing signs that mineralization continues at depth. Hole 155 helped to support this theory. The deposit is open in all directions and there are multiple areas adjacent to the deposit that are generating encouraging exploration results, indicating that these areas could become potential drill targets. To the west of the deposit the RAM Zone returned promising trench results and La Colorada Zone returned encouraging soil and rock samples.

The company has conducted two phases of metallurgical test work, which have displayed favourable silver recoveries of 82% using a combination of floatation and carbon-in-leach (C.I.L). The deposit contains a mix of oxide and sulphide material as well as refractory silver mineralization that complicates the processing somewhat. The phase III metallurgical program recently announced will be sufficient to support a preliminary economic assessment (PEA), and should help to optimize the processing flow sheet as well as clarify any issues presented in the first two phases of test work. The company will also be looking to evaluate zinc recovery options, with the phase two met-test generating zinc recoveries around 55%.

The project is well positioned close to a paved highway and local infrastructure, including power and rail. The company also maintains positive community relations, and has a 20-year lease agreement with the local Eljido. Coeur Mining holds 13.5% of the shares of the company, and also recently purchased a 2.5% Net Smelter Royalty (NSR) on future production from the La Cigarra Silver Project. This relationship and NSR interest further validates the potential of the La Cigarra Project.

The company recently brought in new personnel at both the management and board level, and along with the new personnel also came new money. The management team currently holds 7% on the shares, and in addition, director Ryan Schedler through indirect ownership, holds 15% of the shares through his Condire Group.

We do like how the deposit is shaping up at this early stage, however there are some areas of concern we have at this point with the company. The high number of shares is a bit of an issue, as that number is sure to grow with future financings. With $4.4 million in working capital, the company should be good for 2015, but will most likely need to raise cash again in 2016. If the share price does not start to appreciate, future financings will be quite dilutive for current shareholders.

On the project level, we see the possible high strip ratio of the open-pit being an area of potential concern. The company currently estimates a rough, back of the napkin strip ratio of 4.5 to 1. The PEA will help clarify this, but a high strip ratio could significantly impact the economics of the deposit, and although it is still too early to know the actual ratio, it is an area that should be monitored. The metallurgy still needs some work, but the phase III tests underway should help to improve the processing model and add some confidence in the economic feasibility of the deposit. Both the metallurgy and strip ratio should be closely considered, as these two factors will largely determine the level of operating costs. As mentioned though, it is still early, and so far we like the potential that is contained within the La Cigarra Project.

Bottom line

We feel that the company is undervalued at these prices considering the value of the resource, the quality of the Parral District, the property wide exploration and resource expansion potential, and lastly the infrastructure available. Coeur Mining would not throw $4 million in exchange for a 2.5% NSR of a deposit that has little promise. The company has undergone a restructuring in the past year with a new management team and new money. With this new team we feel there is new life into the company to help advance the quality La Cigarra asset.

A conservative Tickerscore value of the La Cigarra resource would value the company at $0.15/share not including the monetary value of the treasury, or any exploration potential. The 2015 drill program will undoubtedly add ounces to the resource and potentially improve on the grade. The third phase of metallurgical testing will also be an important step for the company in improving the metal recoveries as well as help support a PEA.

Potential Catalysts and Events to Monitor:

- Phase III Metallurgical Test work (Q2 2015)

- 2015 Drill Program (H2 2015)

- Possible PEA (Late 2015)

- Take-over Target?

MAR